Spot And Derivatives Market Dynamics

In today’s Daily Dive, we’re covering some visuals to illustrate bitcoin’s spot and derivatives market dynamics. We can do this by looking at two key metrics compared to price: the futures perpetual funding rate and the long-term holder net position change.

As a refresher, the futures perpetual funding rate was covered more in-depth in The Daily Dive #097 - Derivatives Market Breakdown. It’s a key rate to watch, especially when the market is overleveraged to one side with the derivatives market having more influence over the short-term price.

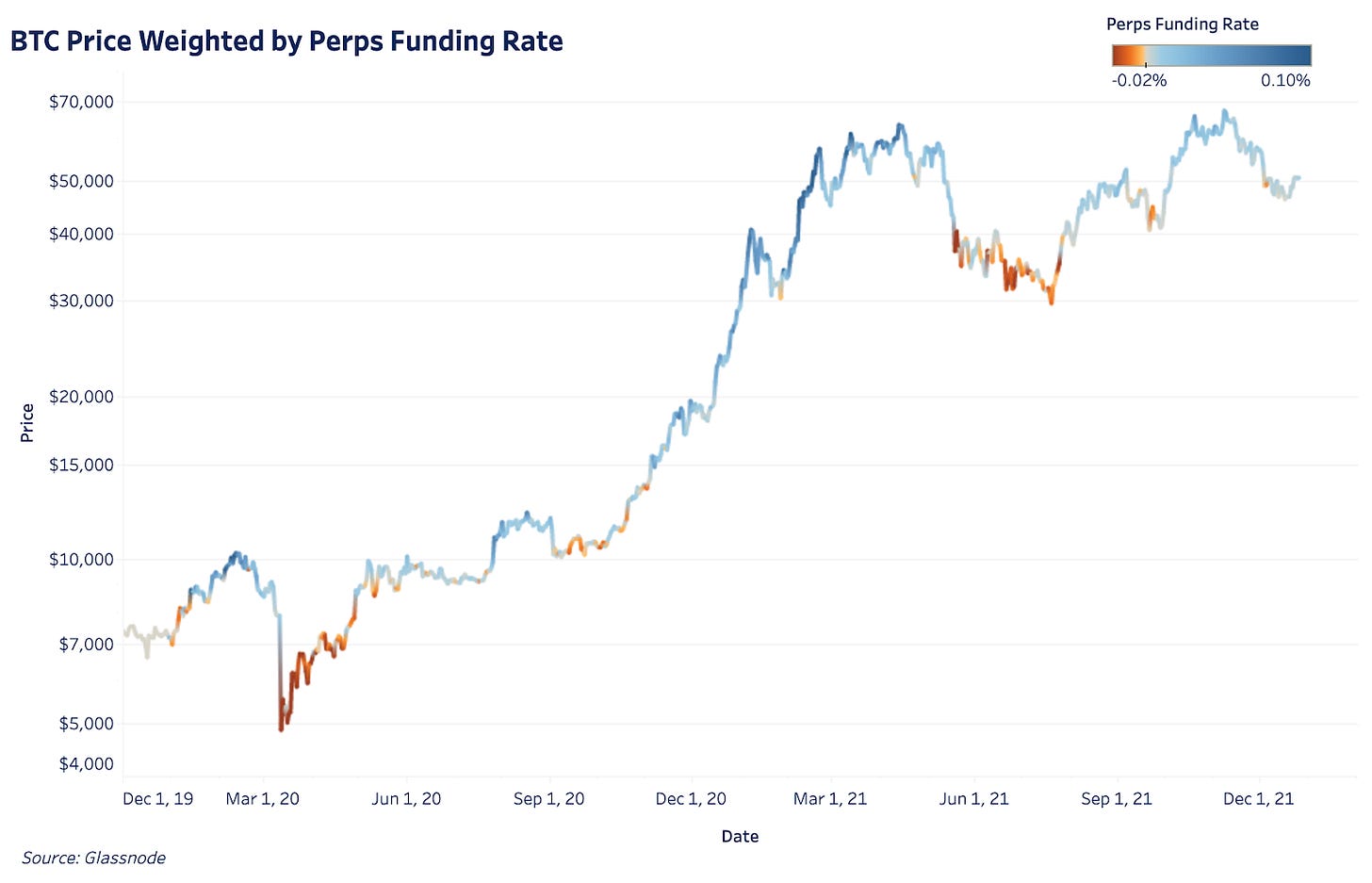

The two charts below show bitcoin price overlaid with the perpetual funding rate. Since the market is historically biased long, the color thresholds are lowered in the second chart to better emphasize periods of any negative funding. Overall, the charts show when the derivatives market is either inflating or suppressing price.

The dark blue areas show when the market was overleveraged to the long side and the dark red areas show the opposite. Each of these extreme periods come with subsequent, explosive moves in price as positions are wiped out.

The derivatives market influences price in the short term but long-term price is driven by adoption, sustained spot demand and the behavior of long-term holders. The long-term holder net position change is one way to view this behavior as it’s the 30-day change in supply held by long-term holders.

As we’ve covered before, every bitcoin price all-time high comes with a significant distribution of coins from long-term holders to new market entrants. Periods of dark red show this in the below chart while periods of dark blue show relatively heavy accumulation periods over bitcoin’s lifetime.

Zooming in and comparing to the same time frame for the perpetual funding rate, long-term holders were selling off coins right before the derivatives market became overleveraged long back in April 2021. When new spot buyers were exhausted, the futures markets were left propping up the price.

When the market was overleveraged short at bitcoin’s bottom in July, long-term holders were heavily accumulating coins, driving up price. That accumulation continued until November, reversed course and now sits in a neutral state.

Final Note

This type of analysis can give us context when the derivatives market is heavily influencing price short term and can’t be sustained. It also illustrates extreme periods of long-term holder behavior which dictate bitcoin’s price long term.

Currently, both are in a neutral state as we continue to range and consolidate into the end of the year.

a bit of a nothingburger for the end of the year. oh well. keep doing your thing ₿!