Tomorrow, we are taking the day off and will not be publishing a Daily Dive. Happy Holidays to all of our subscribers and Merry Christmas to those celebrating!

HODL Trends

Bitcoin liveliness is defined as the ratio of sum of coin days destroyed and the sum of all coin days ever created. In layman's terms, liveliness increases as holders move/liquidate their positions, and decreases as holders accumulate. As a thought experiment, if every bitcoin was moved in the next block, liveliness would temporarily jump to 1.0. Conversely, if there was a block with zero spending activity outside of miner rewards, liveliness would be 0.0.

With that said, bitcoin liveliness is now back in a downtrend that started in midsummer, following sideways action from September to December. Bitcoin on-chain accumulation has started once again.

We can also view the HODLer net position change, which is calculated using a similar method as liveliness. For more information read this introductory article.

Over the last 30 days, approximately 25,000 BTC have been accumulated as measured by the HODLer net position change, as the accumulation trend that persisted throughout the first three quarters of 2020 and the last half of 2021 has once again resumed course.

The green areas in the HODLer net position change metric can be thought of similar to how downtrends in bitcoin liveliness are; the spring that leads to rapid parabolic advances is coiling up.

Bitcoin Exposure Performance

Over the last couple of years, we’ve seen a growing number of ways to acquire bitcoin exposure. The market has supplied investors many creative ways to satisfy demand, manage risk and maneuver around financial regulations. From buying spot and self-custody to buying shares of a bitcoin trust, spot ETFs, futures ETFs, purchasing equity in Bitcoin companies, public companies holding bitcoin and public bitcoin miners - we can only expect the amount of bitcoin exposure vehicles to increase.

Yet, bitcoin is the first asset of its kind: an asset that anyone in the world can directly acquire and secure themselves at almost no cost with zero counterparty risk. So how has it performed versus these other bitcoin exposure options?

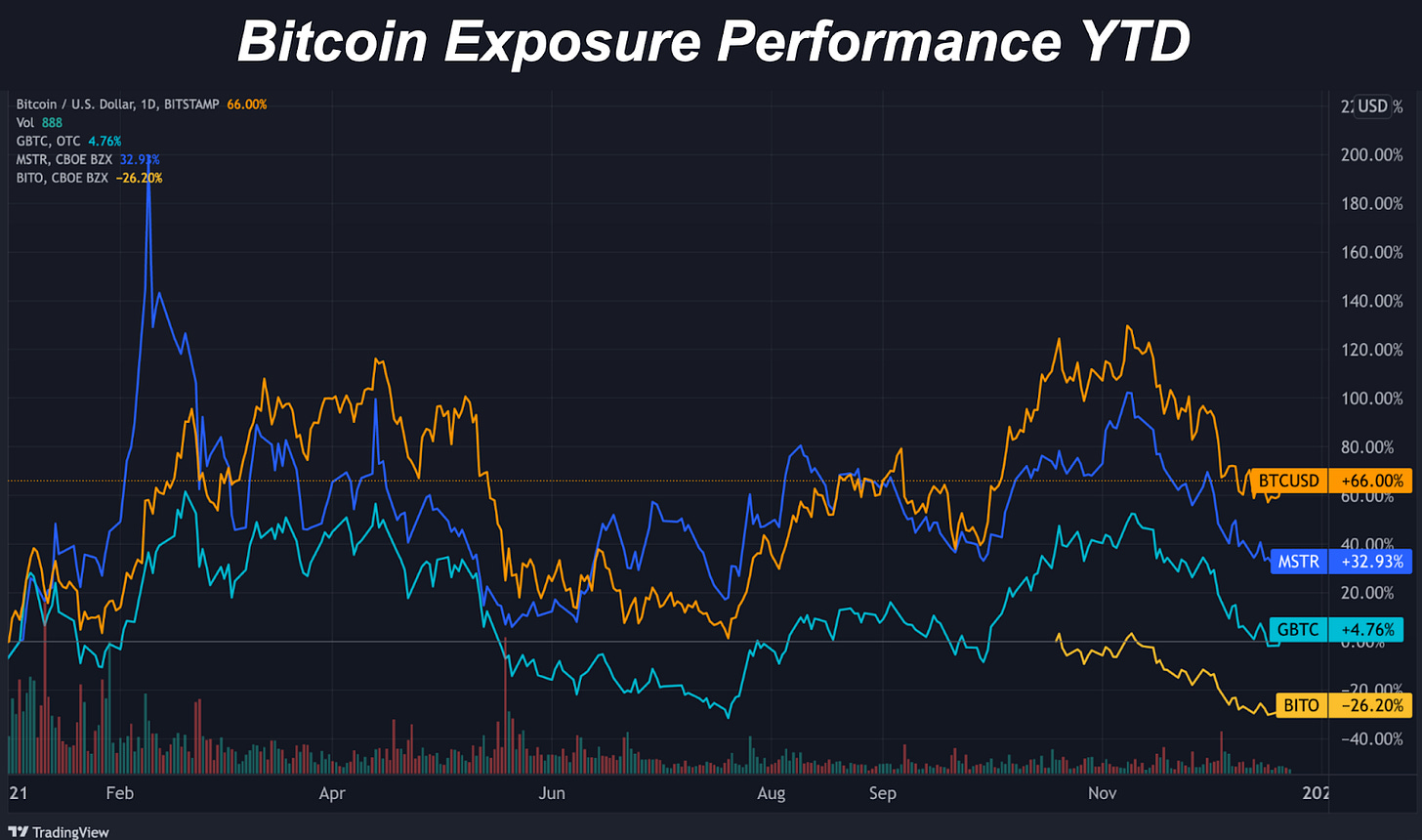

This year, when compared against the popular options of MicroStrategy stock, Grayscale Bitcoin Trust shares and the BITO Futures ETF, bitcoin outperformed by a wide margin returning 66% YTD so far. GBTC shares took a significant hit this year with shares now trading at a 19% discount.

Since BITO entered the market in October, it’s underperformed bitcoin by 2.18%. That gap is expected to widen with management fees and continued rollover costs.

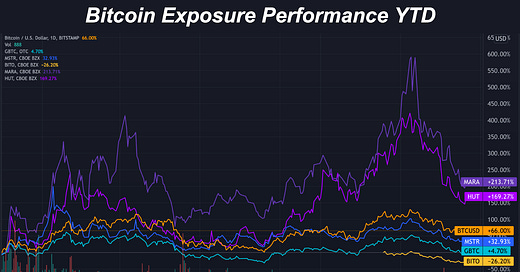

When we compare different public bitcoin miners, a few of the top miners — measured by market capitalization and size of their bitcoin holdings — have outperformed bitcoin this year while others have not. Marathon Digital Holdings, Hut 8 Mining and Bitfarms make up the outperformers.

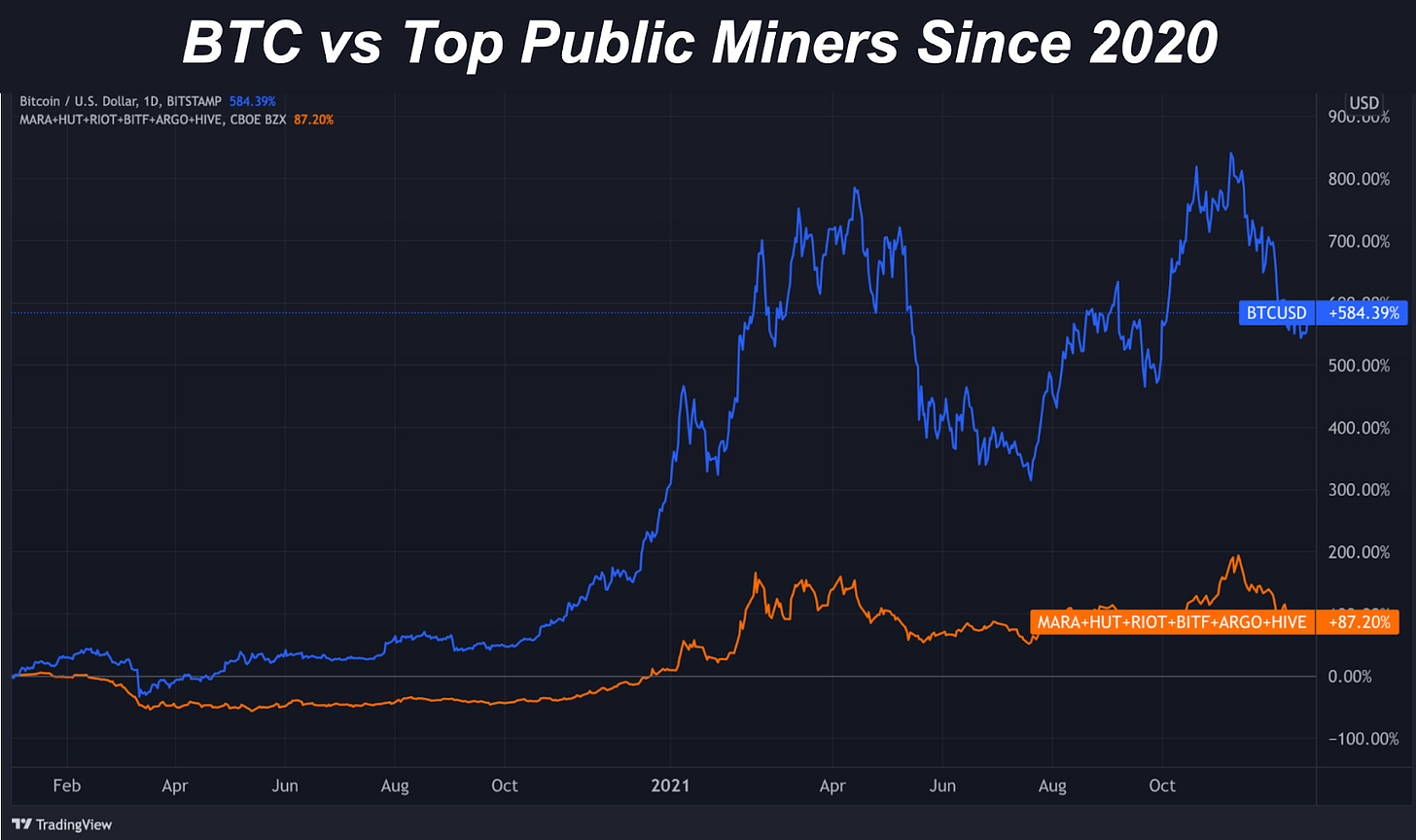

Rather than having all investment exposure to a single bitcoin miner, a simple and equally-weighted index of the top miners would have been right in line with bitcoin performance this year. However, bitcoin has outperformed that simple index on any longer time horizon.

Going further, we can use Luxor’s HI Crypto Mining Stock Index to see how a mix of public companies across bitcoin miners, ASIC or GPU manufacturers and chip manufacturers performed against bitcoin. YTD, the index returned nearly 48%, still below bitcoin’s 2021 66% performance.

Final Note

Going forward, there will be endless ways for investors to acquire different forms of bitcoin exposure all varying around attributes of convenience, regulations, risk, security and potential performance upside.

With the right timing and right decisions, some of these exposures will outperform bitcoin while many will not. Some will be chosen for their ease of use and convenience. But for most, the best strategy is the simplest one, which requires little active management while maintaining direct ownership of the asset: acquire and hold bitcoin yourself during its “once in history” monetization phase.

so many signals, so much noise. choose wisely what you follow.

... and for those that are just hodling... none of this really matters!