Increasing Illiquid Supply

Illiquid supply continues to hit multi-year highs, adding nearly 371,000 bitcoin since the deceleration in May. Even with the recent price drawdowns sparked from long liquidations and market sell-offs, illiquid supply continues to increase signaling that more long-term holders are adding bitcoin over the last few months.

As a percentage of circulating supply, illiquid supply is 76.13% and just below the all-time high of 76.26% also seen back in May. Illiquid supply percentage of circulating supply has been a strongly correlated relationship with price over the last year.

The illiquid supply trends also show that the most recent drawdowns were largely driven by the derivatives market and not so much the spot market. With every major bitcoin correction, there has been a significant deceleration in illiquid supply looking at the illiquid supply 30-day change. Typically this is a 30-day change in illiquid supply at or below -1%.

A 1% change of illiquid supply today would be 143,942 bitcoin worth just over $7 billion at a $49,000 price. We would expect a more significant, spot-driven bitcoin correction to come with a decelerating illiquid supply, which hasn't been seen over the last few months.

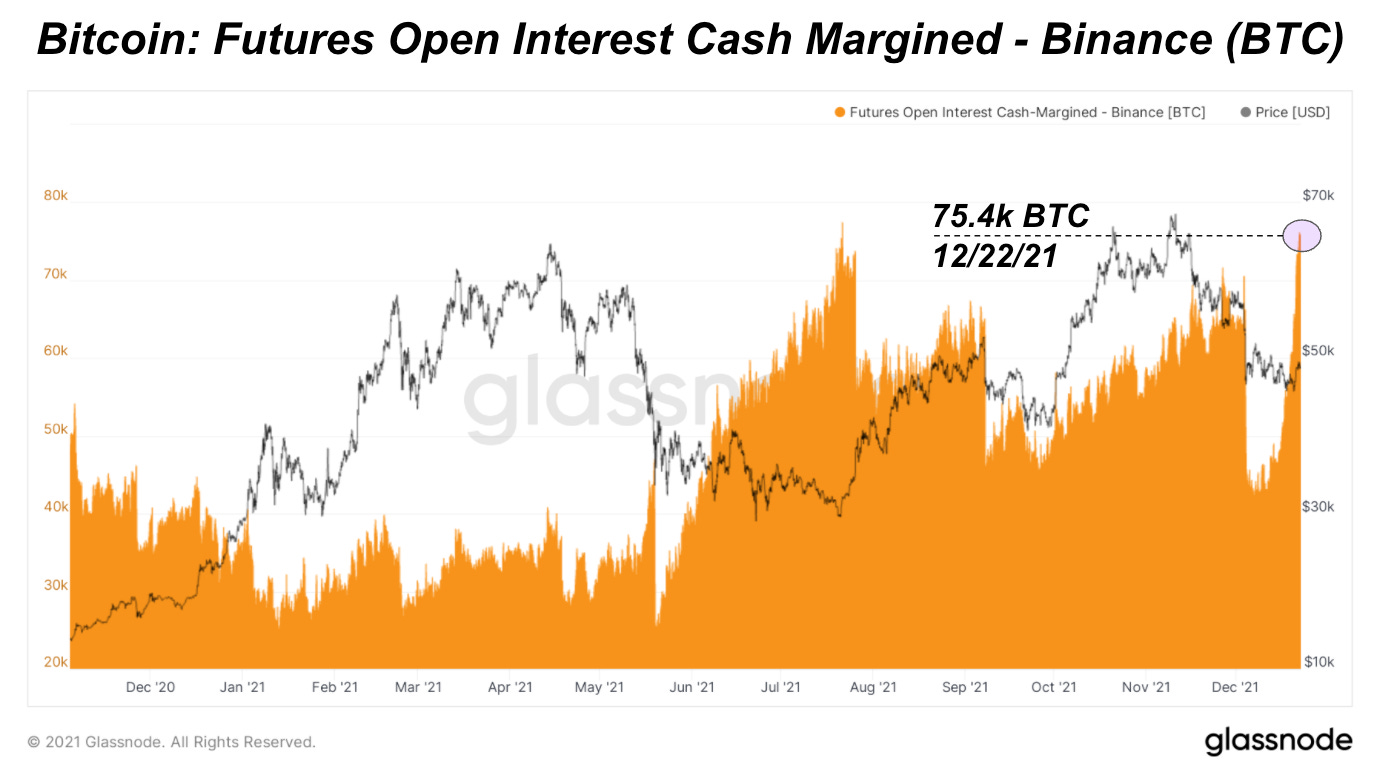

Binance USD-Margined Open Interest On The Rise

The last couple of weeks has brought about a vertical rise in open interest on the cash- (USDT) margined Binance perpetual swap bitcoin futures. Currently there is approximately 75,000 BTC worth of open interest in the stablecoin-collateralized futures product, with approximately 40% of open interest having entered over the last week.

This rapid increase is particularly interesting due to the relationship that collateral types have with bitcoin derivatives. When stablecoin collateral is the dominant form of collateral in the bitcoin derivatives market, and if a large amount of capital gets offside to the downside, a potential large short squeeze can form as a result.

Currently, the collateral type percentage is nearing the low levels it touched in the summer.

Similarly, the open interest on Binance perpetual swaps is nearly 40% of the global open interest on perpetual swaps. This means that any liquidations would have a dramatic impact on the market if/when they are to come.

Although funding on perpetual futures is moderately positive at the moment, a similar scenario this summer on Binance USDT perpetual swaps led to a large short squeeze.

For those looking for an explanation of what happened in July, check out this thread:

The Daily Dive #030 - Massive Short Squeeze also breaks down the dynamics of the summer short squeeze in depth.

The key point to understand is that if you short bitcoin with bitcoin as collateral, your collateral value rises in value to somewhat offset falling PNL. However, when you short with dollars/stablecoins, this dynamic doesn't exist. If price begins to rise rapidly, the dollar-collateralized shorts quickly become forced buyers.

A scenario to watch out for is if more market consolidation led to derivative traders turning bearish, driving perpetual swap funding negative, which would be the perfect setup for a large short squeeze.

The estimated futures leverage ratio on Binance, which measures open interest as a percentage of total bitcoin balance on the exchange, is approaching 2021 high levels.

With an increase in futures open interest this large over the past two weeks, the next move, whether up or down, will surely be a volatile one.

Final Note

An increasingly strong spot accumulation as seen on-chain is notable, and with the steep rise in futures open interest, if derivatives traders turn bearish and/or bitcoin starts to move meaningfully upwards, an explosive short squeeze could result.

This is something we will be following and detailing closely over the coming days/weeks.

muy excelente

****flush