Huobi Drives Lower Exchange Balances

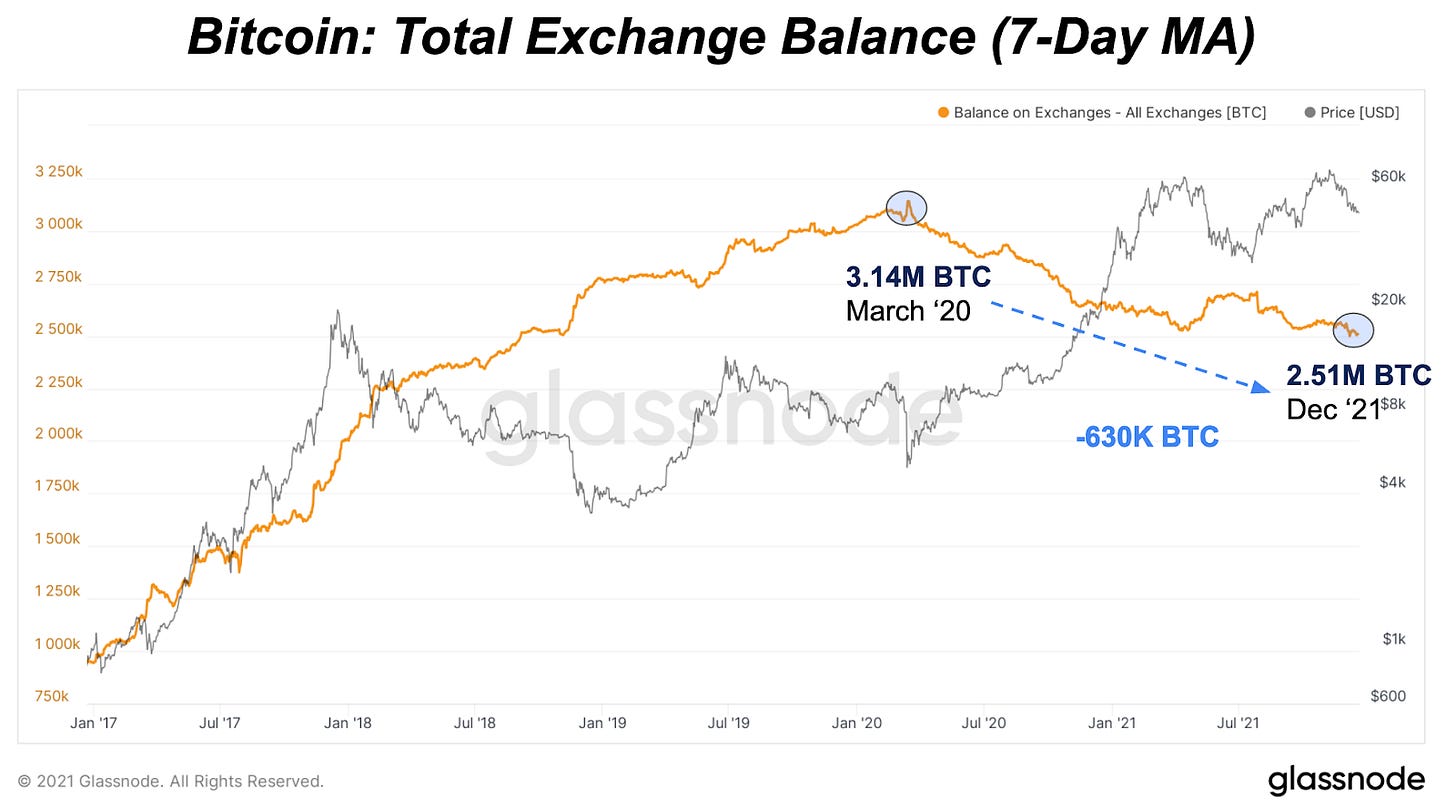

As we’ve noted in previous Daily Dives, one of the most interesting on-chain trends over the last two years is the secular shift in the trend of exchange balances. Since March 2020, total balances on exchanges have fallen by nearly 630,000 BTC, roughly a 20% decline. Typically bitcoin leaving exchanges is a bullish macro indicator for price and adoption, as now that bitcoin can’t be sold or exchanged on the market.

However, this is just a high-level view of all estimated exchange balances with trends differing by exchange and regions. With China’s latest crackdown on cryptocurrency exchanges, exchanges operating in mainland China had to stop offering services to users and remove all accounts.

As a result, a key driver of the falling exchange balance this year has come from Huobi, China’s top exchange. Since March 2020, Huobi’s exchange balance has fallen by 84% with exchange balances in a free fall over the last few months as Huobi shuts down China operations. This forces users to either sell their positions or withdraw their bitcoin and move it elsewhere.

As for quantifying the amount of selling pressure over the last month, there’s been an unprecedented amount when looking at Asia working hours.

As Huobi users move their bitcoin, especially the bitcoin used for derivatives, futures and short-term trading, we can expect some of that bitcoin to likely make its way to other exchanges.

This year, exchanges across Binance, Bitfinex and FTX have seen their exchange balances significantly increase, with Binance and Bitfinex adding nearly 370,000 BTC to their platforms. These exchanges could be new homes for similar speculative short-term trading that has left Huobi.

In response to Chinese regulations, Binance announced in September that it would run checks to ensure mainland China users can only make withdrawals and announced it will discontinue any trading against the Chinese yuan on December 31.

All that said, the key macro narrative of bitcoin leaving exchanges and likely ending up in cold storage has still been consistent since March 2020. Without Huobi, exchange balances are still in a declining trend.

For the behavior of Western investors, we can use Coinbase exchange balance trends as a proxy. Since March 1, 2020, Coinbase exchange balances have fallen 30%, roughly 301,000 BTC.

Here’s a view of the change or delta in bitcoin exchange balances from March 2020 until now. Huobi, Coinbase and Bitmex have been the top outflow forces while FTX, Gemini and Binance have experienced the most inflow.

Reserve Risk Update

In The Daily Dive #94, we broke down the Reserve Risk metric in detail, and explained why it was useful for quantifying the attractiveness of allocating to bitcoin at any particular moment.

A TLDR of the metric is as follows:

Reserve Risk is a cyclical market indicator which aims to quantify the risk-reward of allocating to bitcoin based on the conviction of long-term holders.

Simply, Reserve Risk is a ratio between the current price of bitcoin and the conviction of long-term holders. The current price can be thought of as the incentive to sell, and the conviction of long-term holders/investors can be quantified as the opportunity cost of not selling.

With the recent on-chain accumulation trends coupled with bearish price action, reserve risk has nearly come down to where it was at the market bottom below $30,000.

Historical context shows that bitcoin is in accumulation mode, with a small way to go before entering the green lower bound of the Reserve Risk metric, which signals a massive buy opportunity, due to the asymmetric risk/return profile.

To repeat, Reserve Risk is falling (thus making bitcoin more attractive to allocate capital towards) due to both a falling price of bitcoin as well as increasingly strong hodler trends. Shown below are the components of Reserve Risk visualized:

For those who would like a further in-depth explanation of the Reserve Risk metric, please check out The Daily Dive #94 which explains the metric and all of its components in great detail.

In short, the lower Bitcoin Reserve Risk trends, the more attractive it becomes to allocate to bitcoin.

Despite reading the entirety of your analysis, TLDR summary helps a lot, big up !

just waiting for the ground to clear; engines are already in neutral and warm. ready to fucking go.