MicroStrategy Investor Day

Yesterday, MicroStrategy released their 2021 Investor Day presentation highlighting their long-term bitcoin strategy. The next evolution of the MicroStrategy playbook looks to be finding ways to leverage their 122,478 BTC position as collateral, taking on more long-term debt or lending their bitcoin out to third parties to generate additional yield.

The MicroStrategy position is the long-term view: bitcoin is the competing asset of the future and we’re still early. So it makes sense that they are working to acquire as much as possible while finding opportunities to put their bitcoin holdings to work.

They have taken no formal steps to implement these strategies yet, but CEO Michael Saylor dropped plenty of thoughts on the possibilities. In the meantime, Saylor mentioned that they will continue to look at existing options, more equity or debt issuance, to acquire more bitcoin. Free cash flows from their growing, core analytics business will also be used for bitcoin acquisition.

MicroStrategy’s current bitcoin holdings makeup 0.79% of an adjusted supply estimate of the 15,454,272 btc currently in circulation. Adjusted supply accounts for lost coins, i.e., removing from the total those coins that have not moved in seven years. MicroStrategy acquiring 1% of adjusted supply and even 1% of circulating supply is a likely reality by next year at their acquisition pace. The only known institutions with larger bitcoin holdings are Block.one and the Grayscale Bitcoin Trust.

Profit And Loss Dynamics

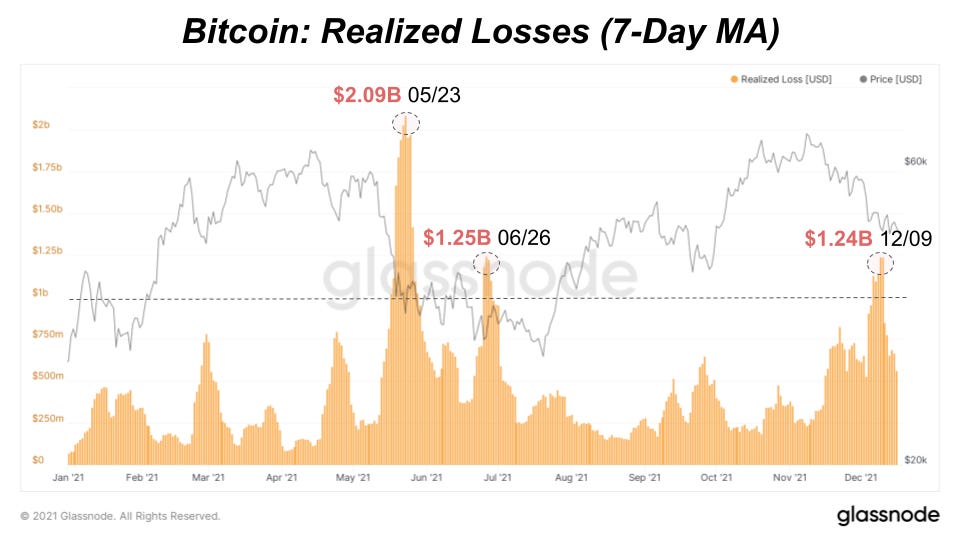

When we look for a local bottom in price, we’re looking for seller exhaustion and the end of a capitulation phase. One way to view that market activity is to look at the trend of net realized profit and loss in the market. On a seven-day moving average, the market is rising back to a neutral state. A market with healthy upside would be realized profit and loss showing a consistent state of profit.

The recent realized losses look to have reached a potential peak when compared to other periods of major realized losses this year. Realized losses reached $1.24 billion, similar to June levels which preceded the end of a capitulation phase.

Those realized losses are driven by short-term holders, so what would be nice to see is the overall reversal of this trend. Looking at the short-term holder Spent Output Profit Ratio (SOPR) on a longer-term 30-day moving average, short-term holders are still realizing losses in aggregate.

But looking at the short-term holder SOPR 7-day moving average, there are momentum signs that those realized losses may be bottoming out over the last week. Overall, there are signs that the recent selling may be close to exhaustion, and seller exhaustion is a positive short-term sign.

Turkish Lira Currency Crises Continues To Worsen

The Turkish lira continued its plunge today, losing as much as 8% against the dollar intraday. The currency has depreciated 37% against the dollar over the last month, which caused the country to implement strict capital controls and to halt trading in domestic equity and debt markets.

The recent developments in Turkey highlight the need for a non-sovereign, apolitical, hard-capped currency in the digital age. In a country with increasing capital controls and runaway inflation, bitcoin offers an alternative.

The reality that bitcoin offers escape for citizens in the country is becoming increasingly understood in mainstream media, with Forbes recently publishing an article titled “Bitcoin Could Fix Turkey’s Currency Crisis.”

let’s hope folks continue to hold and buy! lfggghgggghhgg