The Daily Dive #117 - STH & LTH Dynamics

Short-Term & Long-Term Holders

In today’s Daily Dive, we’re covering the latest long-term and short-term holder trends across cost-basis, profit status and market value to realized value (MVRV) ratios. We last covered short-term holder dynamics in depth in The Daily Dive #103 and in the November Monthly Report.

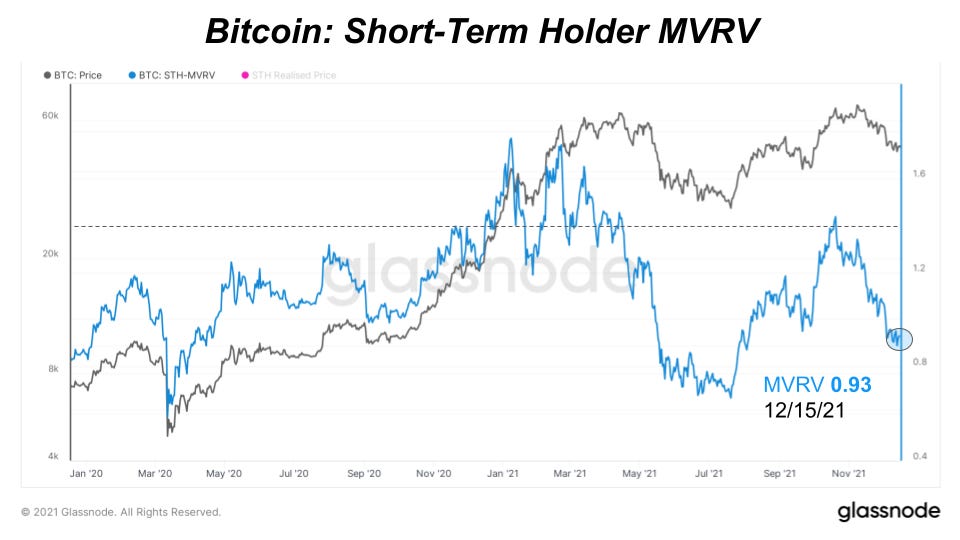

Since the last coverage, bitcoin price has fallen and remained below the short-term holder cost basis, now $52,495. In bull markets, the short-term holder cost basis is typically a key support level. Reclaiming that level, which puts short-term holders back into a neutral-to-positive PNL state, is a good signal that price hasn’t topped short-term.

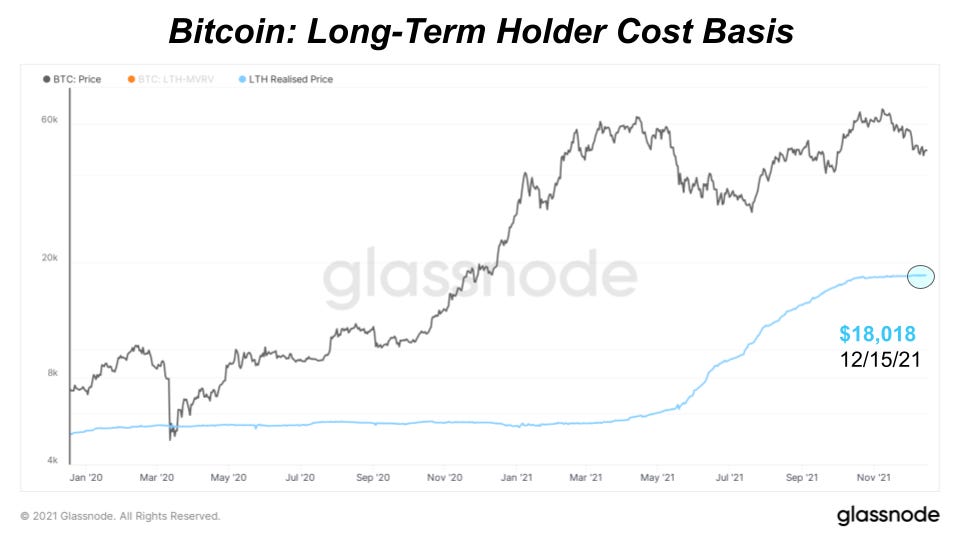

The long-term holder cost basis remains well below current price at $18,018 and in a fairly neutral trend signaling long-term holder coins are not that moving much. Times when price goes below the long-term holder cost basis have historically marked generational buying opportunities.

The current dynamics show fairly cooled-off MVRV metrics across both groups that look to be bottoming out compared to the last two years.

With long-term holder supply still over 70% of circulating supply, we’ve yet to see an accelerated distribution phase into a catalyst of new demand buying. As for now, most long-term holder supply seems comfortable holding their position with supply falling 1.39% or 187,100 BTC since its November 1 peak. For long-term holder supply to significantly change, we would expect a new wave of demand buying and bidding up the price or a serious risk-off liquidity event forcing holders to sell.

Of the non-exchange balance bitcoin supply, 73.08% and in loss 8.12% are long-term holders in profit and loss respectively.

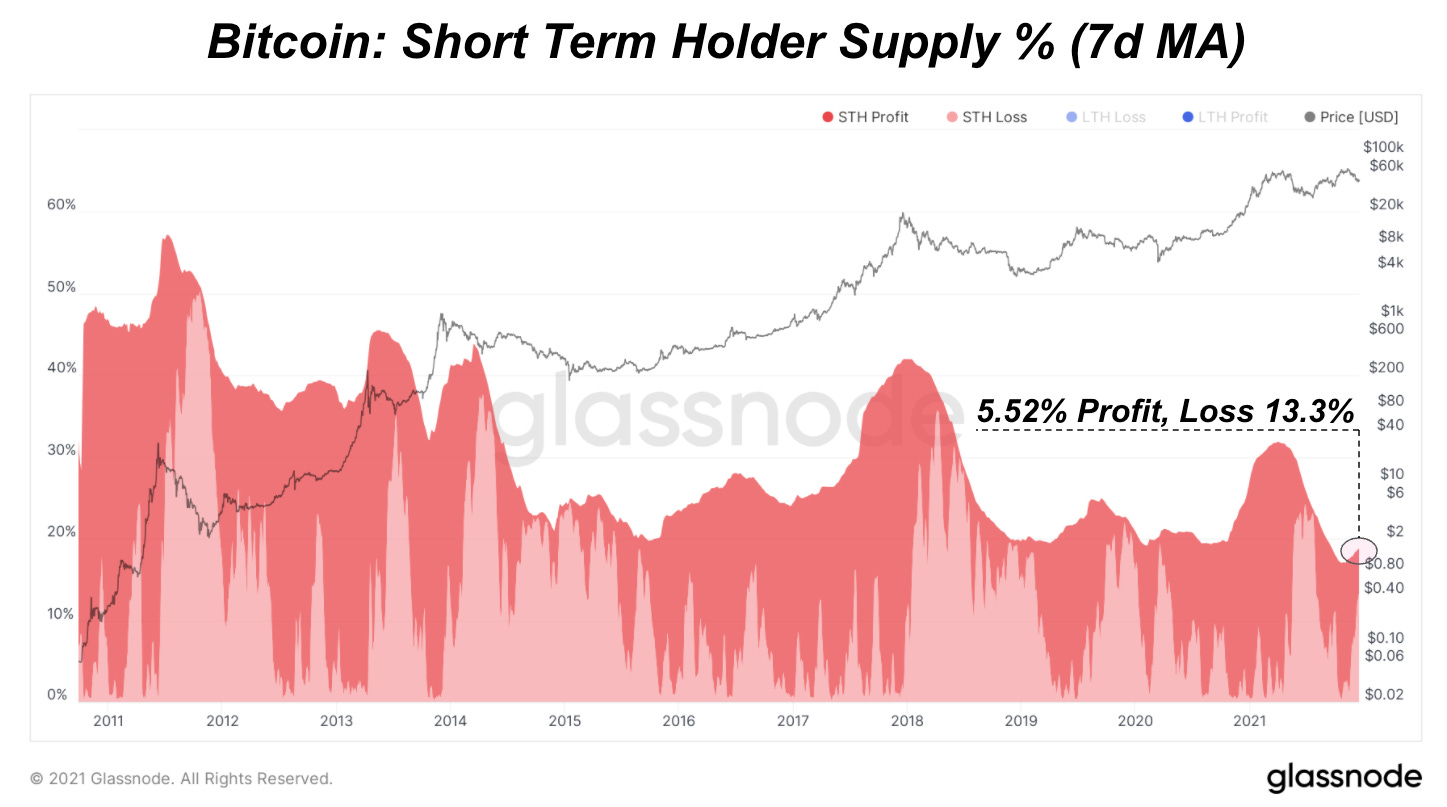

Short-term holders account for 18.82% of circulating supply (excluding balances on exchanges), with profit and loss sitting at 5.52% and 13.3% respectively.

LTH:STH Cost Basis Ratio

We have mentioned the cost basis ratio of long-term and short-term holders a numerous amount of times in our previous analysis.

For an introduction to the metric, read The Daily Dive #070 - Short-Term:Long-Term Cost Basis Ratio.

A TLDR:

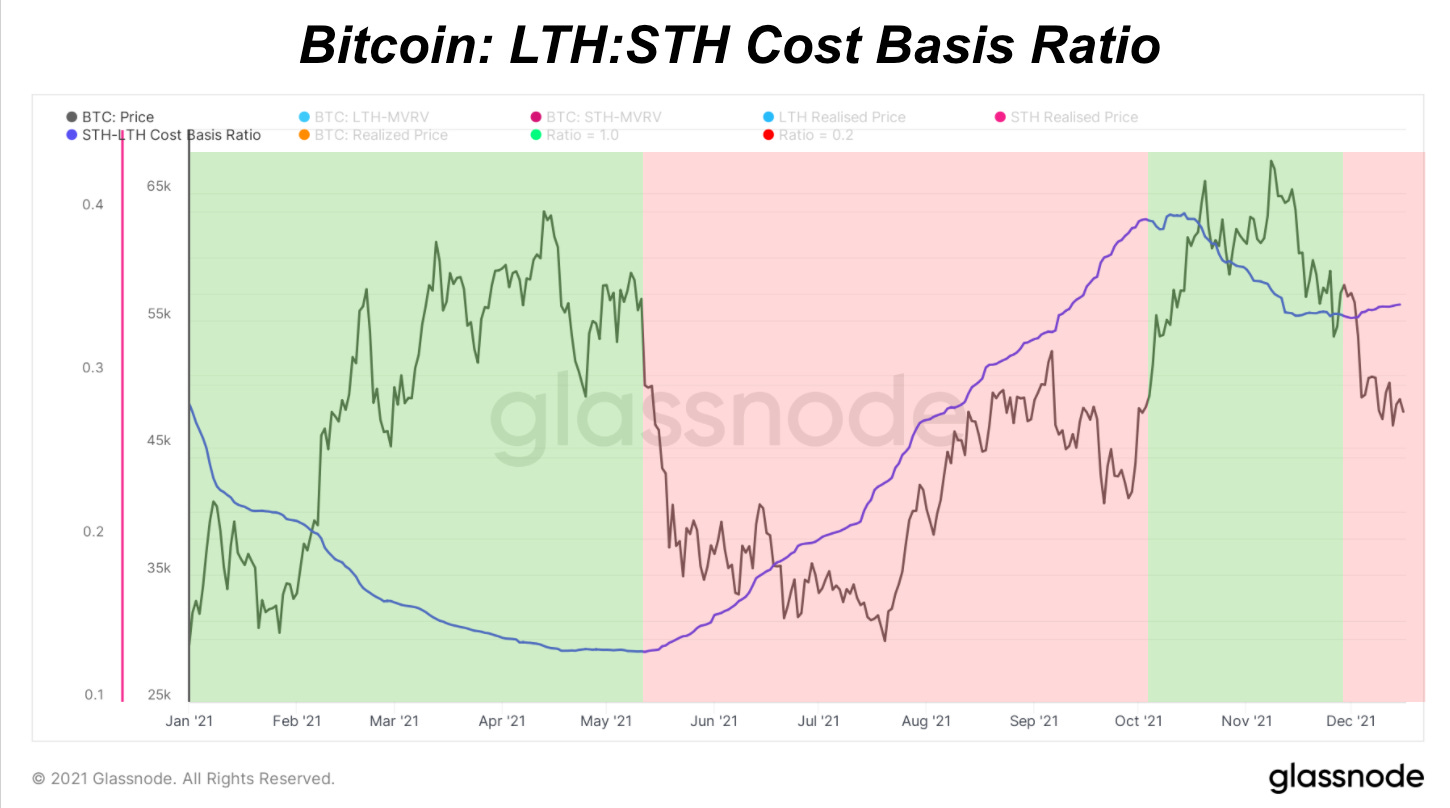

When the STH:LTH realized price ratio is increasing, it means that the cost basis of STHs is increasing relative to LTHs, and conversely, when STH:LTH realized price ratio is decreasing, the cost basis of LTHs is increasing relative to the cost basis of STHs.

This is extremely insightful, as the price of bitcoin rises when the marginal seller is exhausted. This is why you see the cost basis of LTHs stay somewhat stagnant during explosive bull markets, while the cost basis of STHs (many of whom are new market participants) explode upwards - there are simply not enough coins to go around to meet newfound demand. Thus “number go up.”

Looking at the metric recently, with price recently breaking below the cost basis of short-term holders, their cost basis is decreasing, and thus the metric is just barely increasing.

This is occuring as some recent market participants are capitulating and taking on-chain losses. A downtrend will resume once price has reclaimed the cost basis of short-term holders, ($52,495), or the aging in of coins into the long-term holder cohort causes their respective cost basis to increase against that of short-term holders.

Final Note

The secular trend of global bitcoin adoption will continue. Despite various macroeconomic uncertainties heading into 2021, there is never a bad time to increase your share of the world’s most sound monetary system. Consolidation to finish 2021 is the most likely scenario.

Sat stackers rejoice.

accumulation never stops; figuring out how to do it might.