Rising Spot ETF Demand

One way to measure the trend of institutional demand and adoption of bitcoin is to look at the Canadian Purpose Bitcoin ETF, which has added 4,324 BTC so far this month. When more investors buy shares of the ETF, the ETF then purchases and stores more physical bitcoin in cold storage with a custodian (Gemini Trust Company in this case). This is the ETF’s largest series of daily inflows since inception with the total holdings growing 380% YTD.

Although not the same as buying spot bitcoin, the spot ETF provides institutional investors with a bitcoin exposure option that they can immediately invest in while giving up self-custody and the ability to exchange ETF shares for bitcoin directly. The spot ETF also offers investors a better alternative than a futures ETF, where investors can lose potential upside as futures contracts have monthly rollover costs.

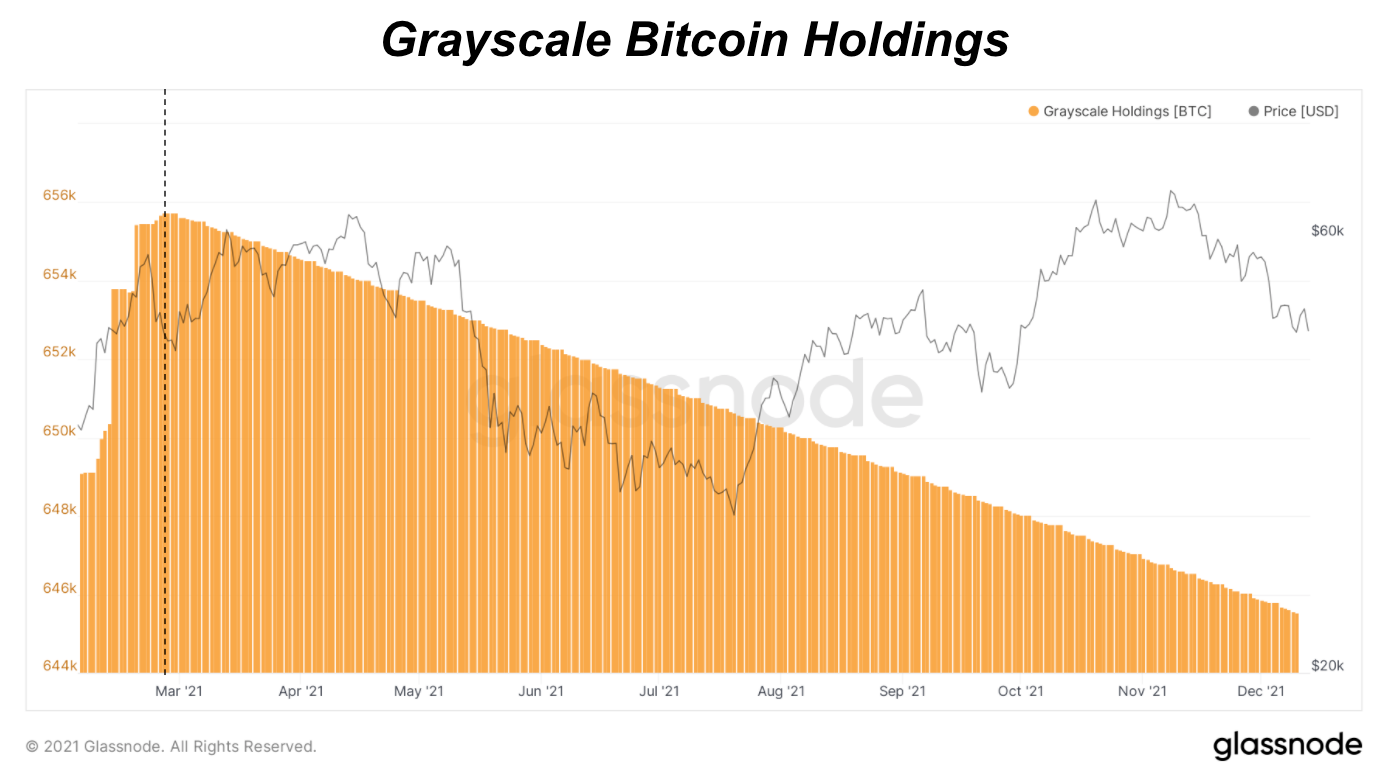

Grayscale Bitcoin Trust Update

Shares of GBTC are currently trading at a 19.06% discount to NAV (net asset value). GBTC shares have not traded at a premium to NAV since February 23, and subsequently, inflows into the product have completely halted.

With the built-in 2% annual fee, Grayscale has sold more than 10,000 BTC since the product first began trading at a discount to NAV. This is a result of the one-way redemption structure of the trust.

Displayed below are the daily inflows/outflows of BTC in the Grayscale trust:

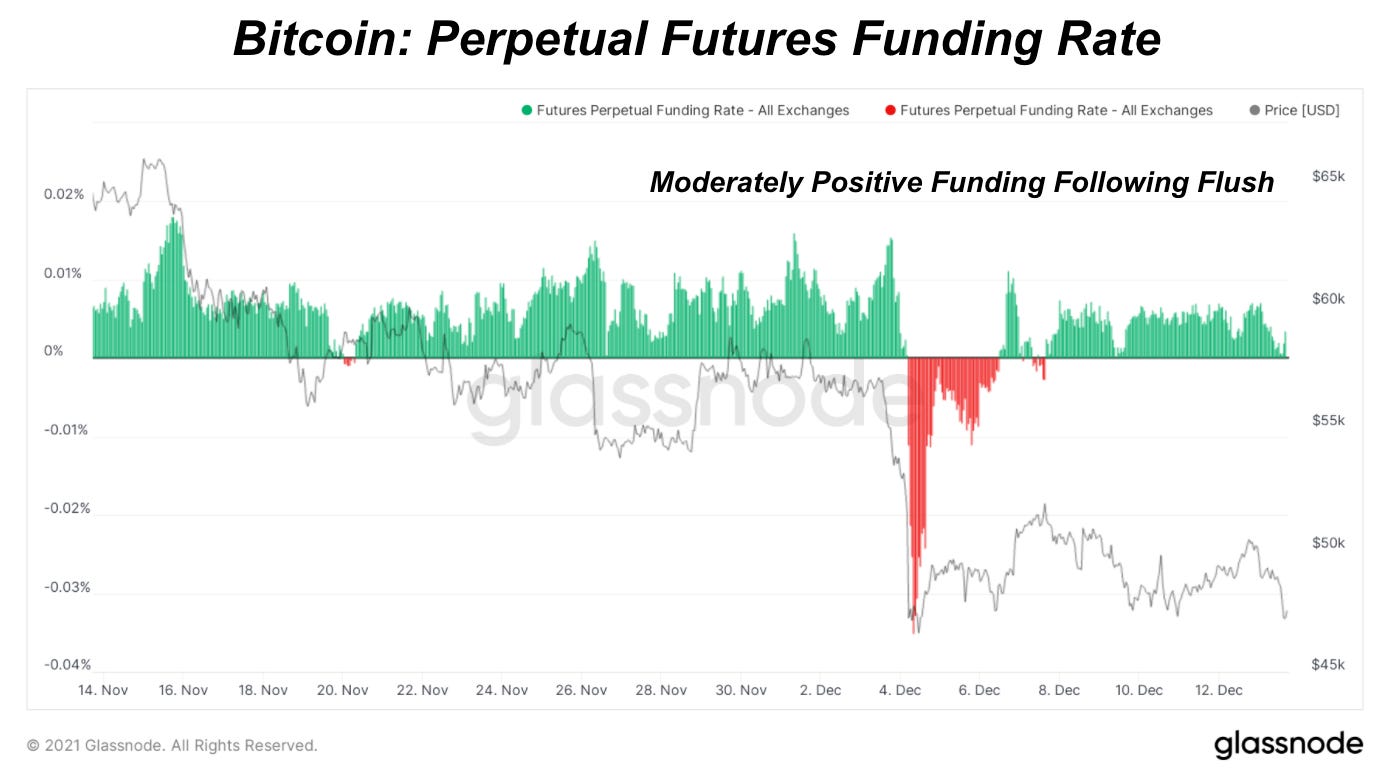

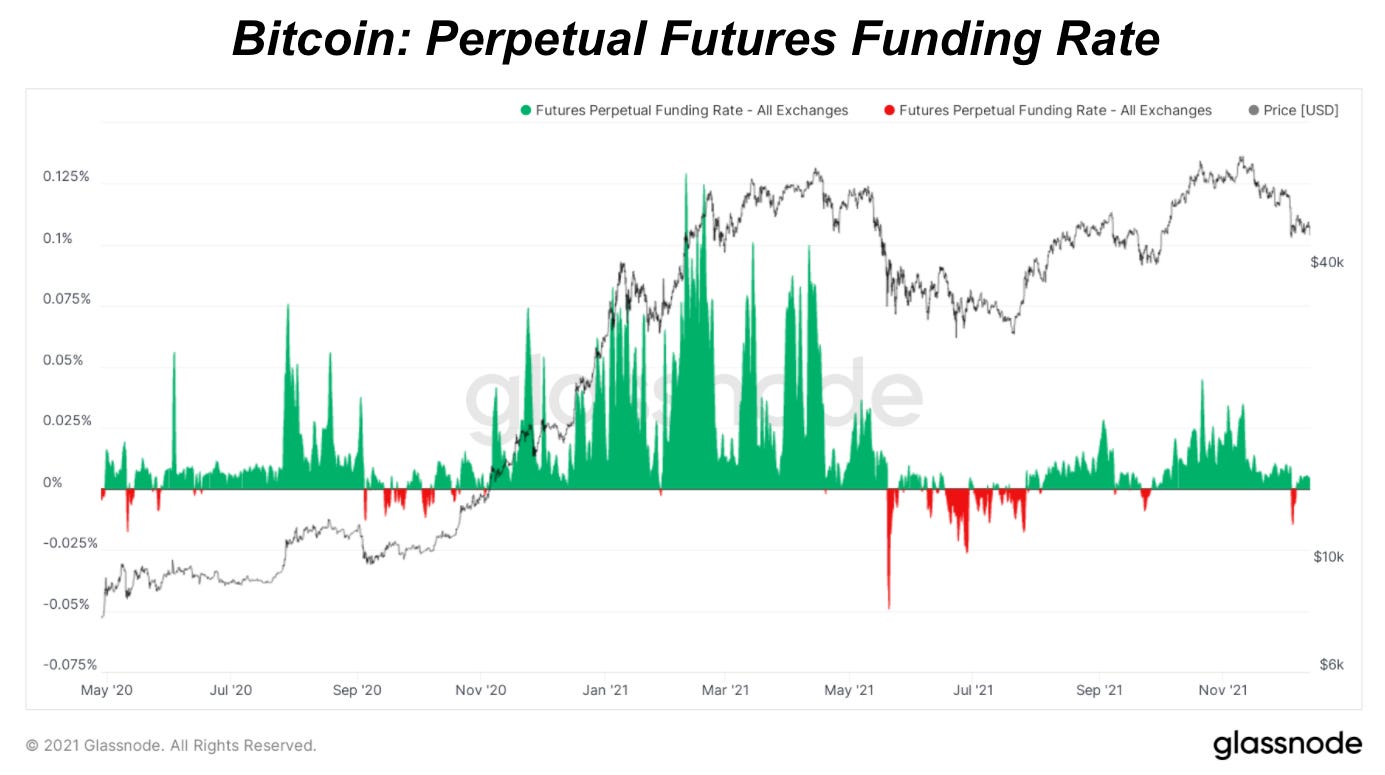

Derivatives Market Update

Following the long liquidations that occurred early in the month, funding in the perpetual swaps market has recovered to moderately positive levels.

Similarly, the futures basis spread that exists between the spot price and the three-month forward futures price, approximately an 8% annualized rate exists. The futures basis can be thought of as a quasi cost of capital in the bitcoin/crypto markets, and with the recent 30% correction from the all-time highs, speculation and demand for yield has withdrawn, to single-digit yields. Both the funding rate in the perpetual swaps market and the annualized basis present in the futures curve shows that the current market is more spot driven compared to October/November prices.

Net Unrealized Profit/Loss

In the November Monthly Report, we talked about the Net Unrealized Profit/Loss (NUPL) indicator showing the market in a healthy state of unrealized profit compared to previous cycles. We can further break down that indicator into short-term holder and long-term holder groups.

As for short-term holders, one of the biggest near-term concerns is that there are increasing unrealized losses in the market. As price continues to range below the short-term holder cost basis around $53,000, there’s a rising risk that more of the new buyers capitulate and sell their bitcoin at a loss, driving the price lower. This can be a bear market forming or an opportunity for holders to buy cheaper bitcoin.

Periods of sustained, short-term holder capitulation spark new bear markets as new, short-term holder buying is the main bull cycle driver. Yet, we can see in many bull market dynamics that the rising unrealized losses of short-term holders is common and can be short-lived as long as long-term holders have conviction, waiting out for higher prices.

This is a different story for long-term holders who seem fairly comfortable and largely in a healthier state of profit at the current price relative to their realized price (cost-basis). So far with the latest price drawdown, long-term holder supply is in a slightly declining to neutral state. There’s healthy, not excessive profit taking right now signaling a market on hold in a ranging and consolidating state.

super thorough! The SEC approved the MEME ETF but still no spot BTC. such a joke.

the patient game is waiting for the large money to come into the space... it takes time and is a lot longer than most retail monkeys are willing to wait. don't be stupid and give your bags to saylor.