Bitcoin Hash Rate All-Time High

The mean Bitcoin hash rate over the last seven days has broken its former all-time high (average is used to account for variance), at 182.01 EH/s.

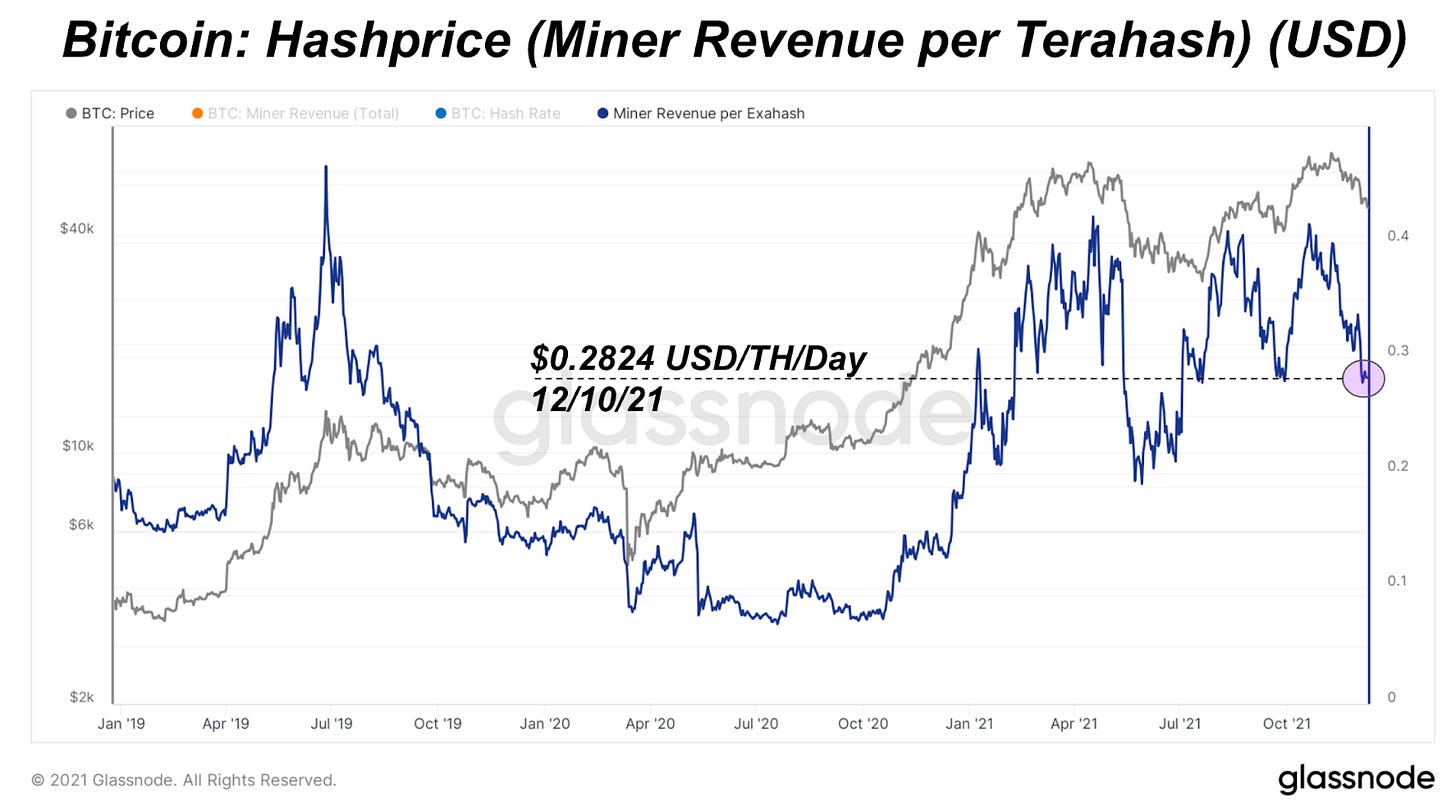

A rising hash rate means that mining competitiveness is rising, and this can be seen in the hash price metric. Hash price is found by dividing daily miner revenue by hash rate to calculate how much revenue per one terahash.

Currently, the Bitcoin hash price is approximately $0.28 down from a high of $0.42 earlier in 2021.

Over time, as ASICs become increasingly efficient and more hash rate comes online, the hash price has continued to decline, in logarithmic scale nonetheless. This shows how competitive the mining industry is, with many participants mining at zero marginal cost (due to sourcing waste energy, among other things).

The mining difficulty adjustment is the mechanism that adjusts for a rising (or falling) hash rate, and keeps Bitcoin blocks coming in at a 10-minute interval on average.

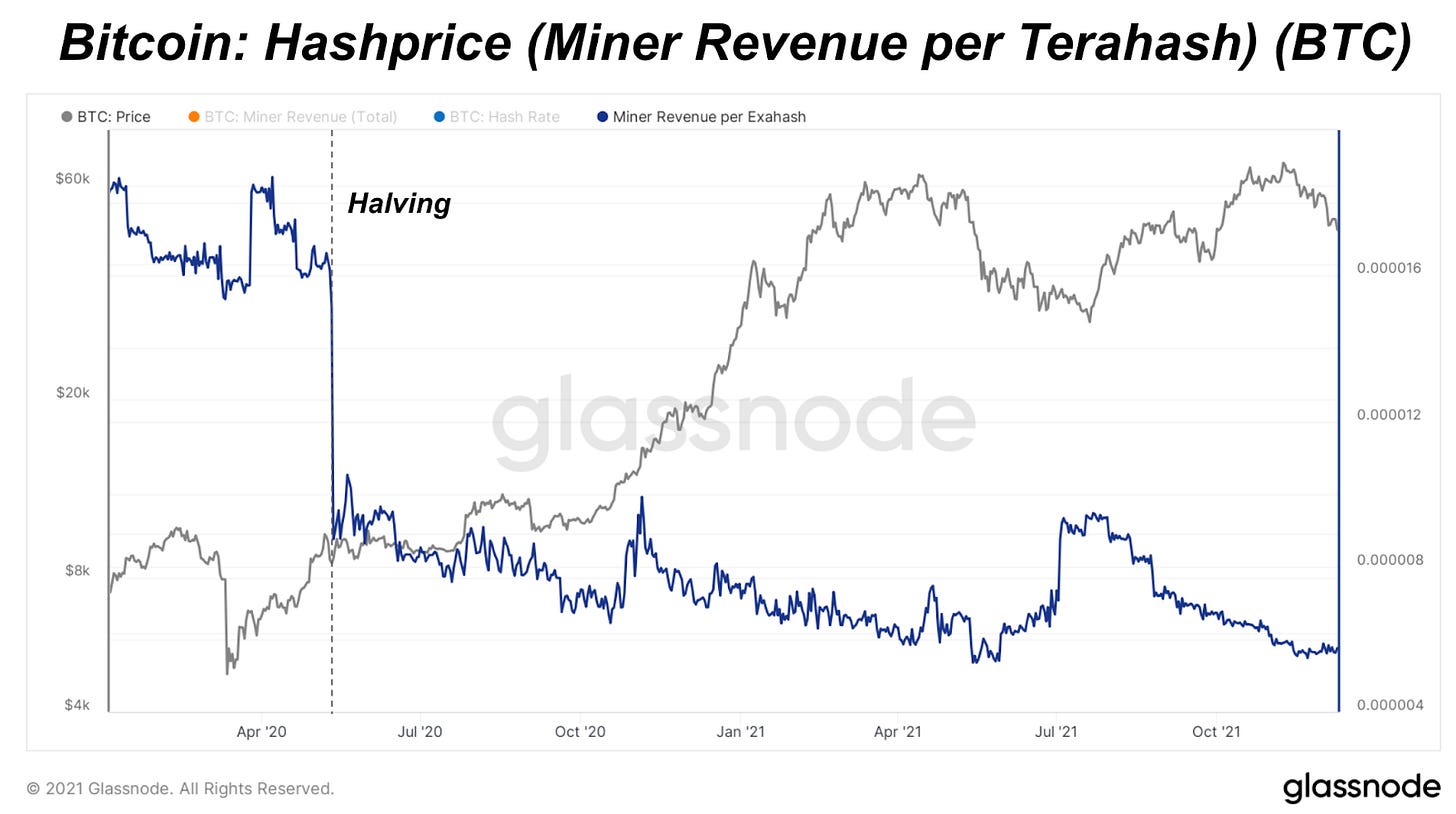

When looking at hash price denominated in BTC terms rather than USD, there is no increase in revenue due to an appreciation bitcoin price, but only during times when hash rate declines (and subsequently difficulty adjusted downwards).

If you look closely enough, the hash price in BTC terms is perpetually trending downwards in a step-like function, with large downwards moves during halvings (as the block subsidy decreases by 50%).

The logical conclusion is that as long as there is energy able to be harvested at a low marginal cost, Bitcoin mining will be extremely lucrative, thus we can expect hash rate to continue to increase, as the ability to monetize excess/stranded energy is one of the largest breakthroughs in the digital age.

Thus, with the halving and the difficulty adjustment, it can be expected that BTC will become harder to produce in perpetuity (assuming an increase in hash rate).

It’s going up forever.

i feel like the mining stats show the dramatic dislocation between value and price… just waiting for the world to catch up!