The Rise Of Stablecoins

One of the most important economic discussions this year, apart from Bitcoin, is around the rise of stablecoins, and especially the rise of stablecoins pegged to the U.S. dollar. As the world reserve currency, everyone around the world demands U.S. dollars. Stablecoins can help satisfy that demand by enhancing the U.S. dollar’s features across accessibility and efficiency.

2021 has been a transformative year for the aggregate supply of USD stablecoins in the market with total supply reaching near $140 billion. That’s 401% year-to-date growth from a circulating supply of just $27.67 billion back in January.

Of the circulating supply, Tether and USDC issued by Circle, are the dominant USD stablecoins in the market. Tether makes up nearly 55% of the aggregate circulating supply while USDC accounts for nearly 30%, more than doubling its market share of supply this year alone.

The rise of USDC circulating supply has been accelerating this year, outpacing Circle's initial 2021 end-of-year supply projections. By 2023, Circle is anticipating $194 billion circulating USDC. This pace of growth and demand for USD stablecoins, that will continue to make up a higher share of total circulating U.S. dollars, is one of the main reasons we’ve seen a continued focus on developing stablecoin regulation.

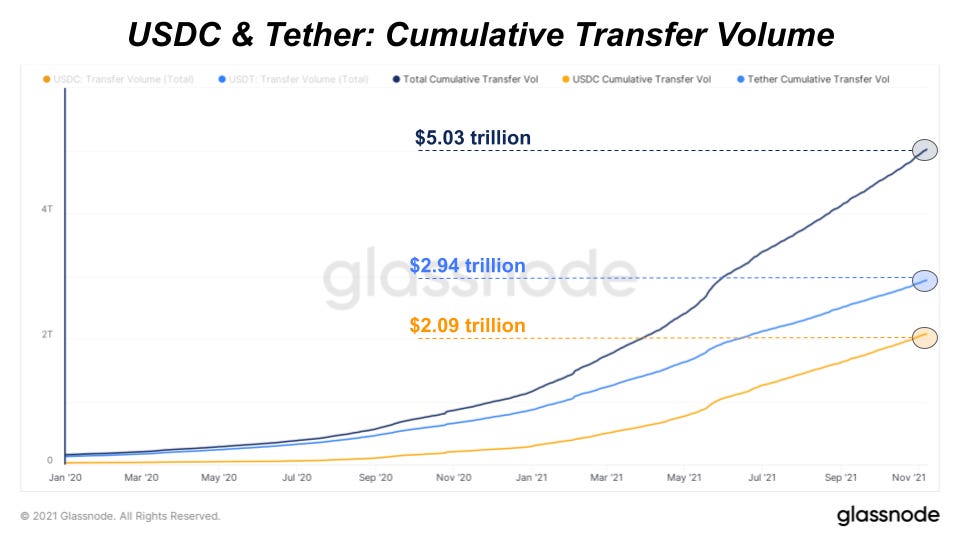

This growth is forcing the U.S. government to consider public-private partnerships with companies like Circle to digitize the U.S. dollar versus creating a Central Bank Digital Currency (CBDC) under the Federal Reserve Board. Now with over $5 trillion in cumulative transfer volume across both Tether and USDC, USD stablecoins are becoming too big of a use case to ignore.

Stablecoins have become an increasingly large part of the bitcoin/cryptocurrency economy, doing everything from giving offshore exchanges dollar on/off-ramps, as well as allowing traders/speculators a way to borrow against their assets.

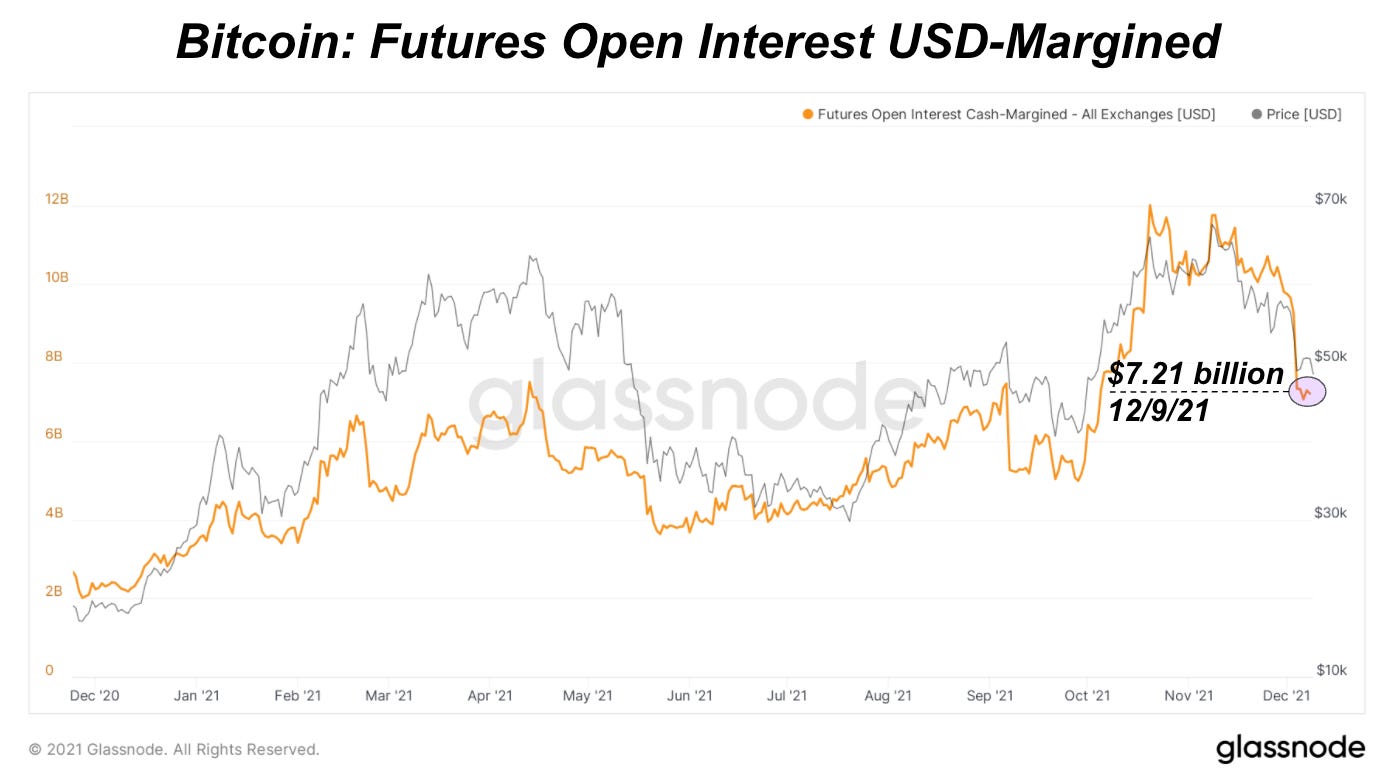

Just since April, the type of margin used in the bitcoin futures/derivatives market has dropped from 70% to approximately 45%, meaning that bullish traders/speculators increasingly no longer need to worry about a declining collateral value when the market faces a downturn.

There is currently $7.21 billion of bitcoin futures open interest that is collateralized by stablecoins.

The exponential growth being witnessed in stablecoins is occurring while the U.S. is holding congressional hearings in regards to “digital assets” and stablecoins. One clip from the hearing in particular stood out:

In the clip, it was discussed how the growth of stablecoins in the crypto industry are actually strengthening the dollar’s hold as the world reserve currency, and increasing the demand for dollars. Empirically, this seems to be the case.

Final Note

The explosive growth of stablecoins in the bitcoin/cryptocurrency ecosystem is a large net benefit, as it is a vast improvement compared to the legacy banking system rails in terms of settlement speed and transparency, and it allows for holders of bitcoin to get in-demand USD liquidity against their assets.

Your coverage is saving me from sifting through so much crap out there, big up !

Great read Dylan and Sam!