The Daily Dive #112 - Exchange Balance Lows And Congressional Hearing Recap

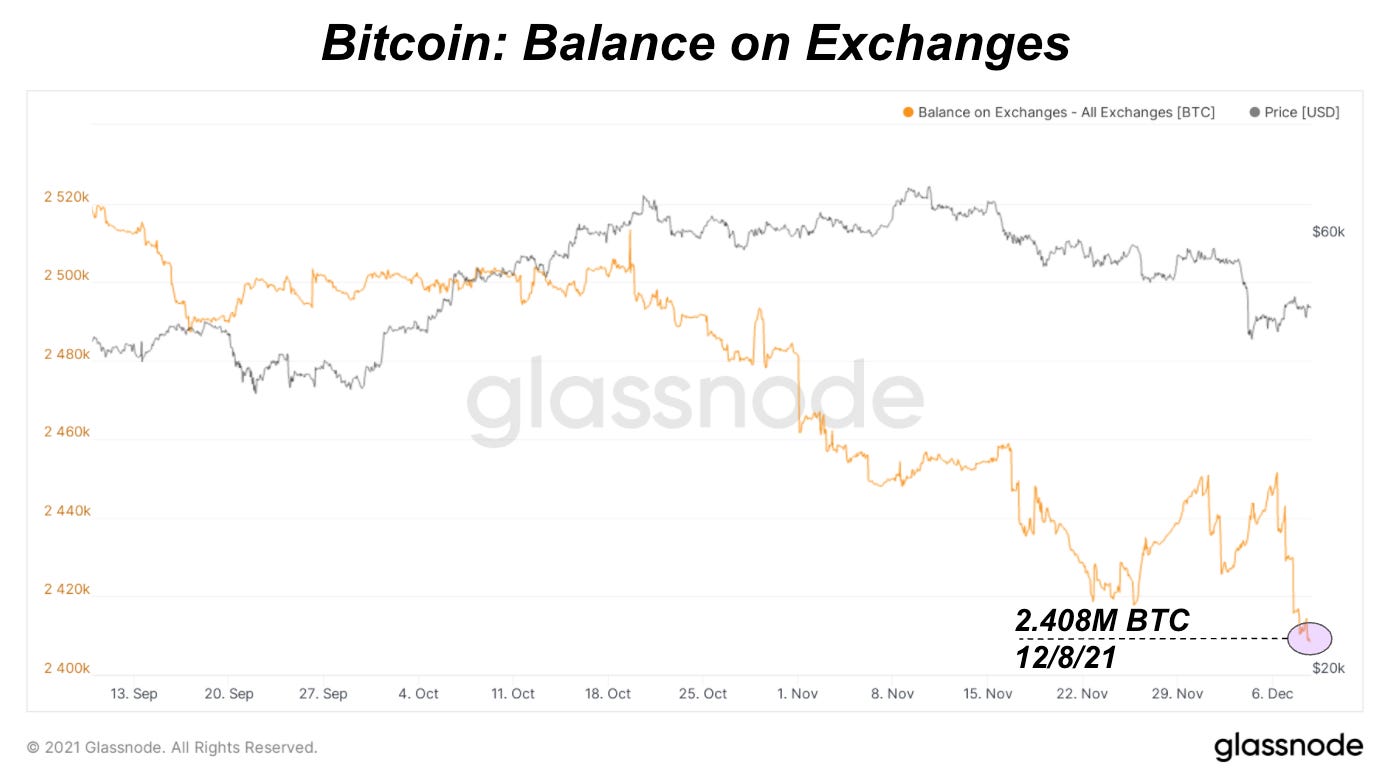

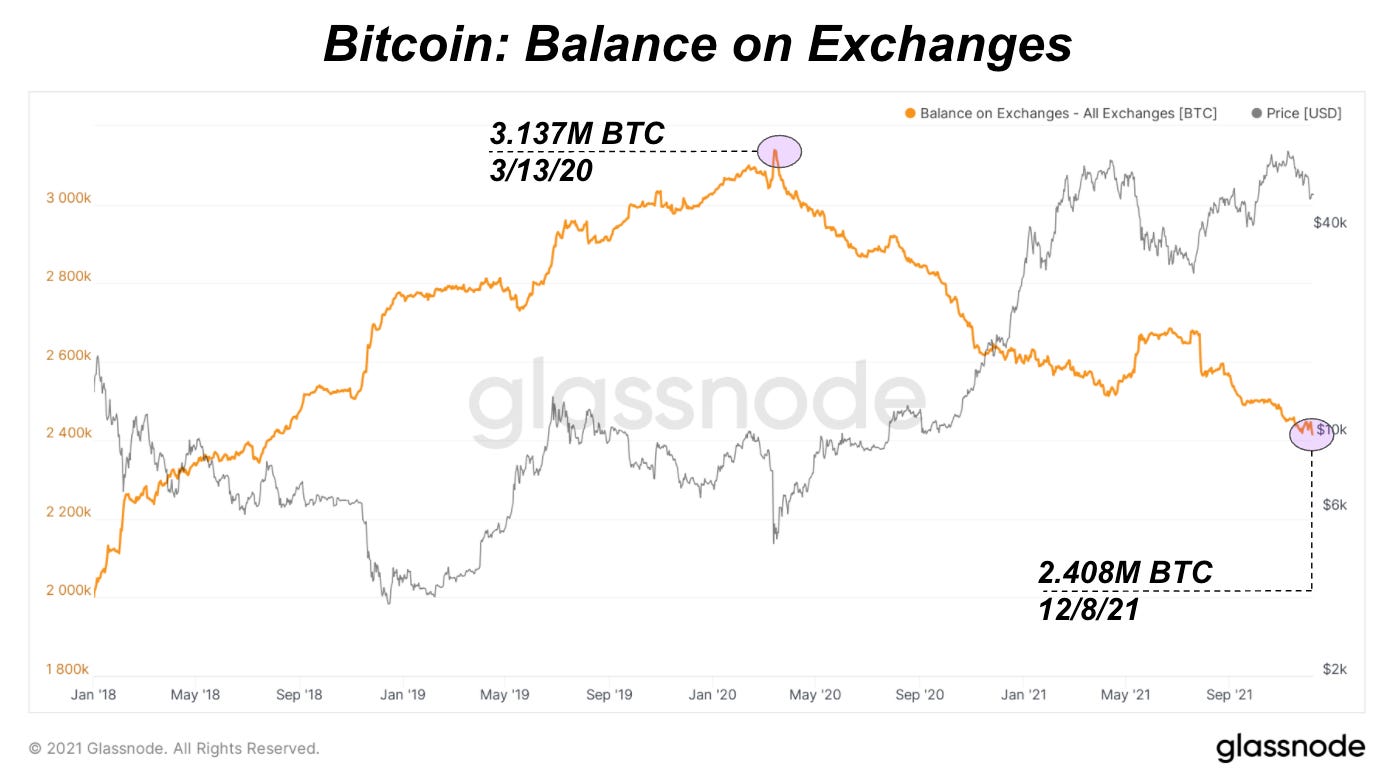

Balance on Exchanges Hit Three-Year Low

Total bitcoin on exchanges has hit another three-year low today, with 2,408,237 BTC across all reported exchanges.

When looking at the net daily transfer volume on exchanges with a 30-day moving average applied, it can be seen how different this recent sell-off and subsequent derivatives market liquidation was compared to the one seen in April/May.

During the May sell-off, 5,149 BTC were deposited per day on average during the peak of the sell-off. Comparatively, today 1,178 BTC have been withdrawn from exchanges per day on average over the last month.

We can also take the 30-day moving average of exchange netflow and adjust it by adjusted supply (circulating supply adjusting for lost coins).

The green and red arbitrary thresholds are times when 0.7% of bitcoin’s adjusted supply were withdrawn or deposited on exchanges respectively.

Digital Assets & The Future Of Finance

The U.S. House Committee on Financial Services held a hearing on digital assets today, “Digital Assets & The Future of Finance” (watch on YouTube), where congressional committee members questioned various cryptocurrency CEOs on a wide variety of topics around: Bitcoin, stablecoins, regulation, innovation, derivatives markets and many more.

Surprisingly, the conversation was educational and fairly productive which was largely open to exploring the cryptocurrency industry's innovative potential while aiming to address some legitimate concerns. Here are some of our highlights, notes and paraphrasing from the hearing:

The committee's overall focus was on financial inclusion and increased understanding, as cryptocurrency has become mainstream in the public. Top concerns were around financial systemic risks and environmental impacts of mining.

Brian Brooks, CEO of Bitfury, stood out today. He consistently highlighted the United States is "unquestionably" behind the curve when it comes to developing legal, financial instruments, such as Bitcoin spot ETFs or various funds like other G20 nations have, that can provide liquidity to reduce volatility and enhance price discovery.

Across the testimony witnesses, there were several comments and answers highlighting that there's not enough regulatory clarity in the market, largely criticizing the Securities Exchange Commission.

There was discussion around the potential concern of a cryptocurrency challenging the supremacy of the U.S. dollar. The U.S. dollar can't take it's popularity as the dominant reserve currency for granted going forward.

Questions arose as to why a U.S. dollar stablecoin should exist over a government issued CBDC? CBDCs are not as open and accessible. U.S dollar is winning the stablecoin race versus the competing CBDC Chinese yuan experiment.

Developing world wants more access to U.S. dollars and U.S. stablecoins are advancing that but need more reserves clarity. Panel agrees that one of the most important market factors is creating more trust in U.S. stablecoins.

Many comparisons to the growth stage of the industry to the internet which also struggled with regulation.

Consistent trend of highlighting the benefits of innovation happening: more instant, equitable access to financial markets, true decentralization, lower fees and increased transparency.

Consistent questions and concerns around KYC/AML, surveillance techniques to counter fraud, consumer protections and leveraging blockchain transparency.

To summarize the hearing, it was one of general curiosity and an attempt for the committee to question and understand the current market developments and dynamics with an open mind. It was easily the most favorable view we’ve seen from the U.S. Congress yet.

Brian Brooks had some of the most impactful, concise answers that will carry the most weight with his background. His full written testimony can be found here.

A full reporting note recap of the hearing from Bloomberg is here.