Bitcoin Transfer Volume

This year has been an impressive one for proving how much value the Bitcoin network can settle and how efficiently it can do so. Over its lifetime, Bitcoin has settled more than $60 trillion in total transfer volume and over $21 trillion in change-adjusted transfer volume.

Nearly 70% of the total value transferred on the network, in USD terms, has come in 2021. Total transfer volume and change-adjusted volume have grown 5.5x and 5.1x from last year, respectively. That doesn’t include the pending December volume for this year either.

Annualizing the total transfer volume for the year puts Bitcoin on pace to settling nearly $45 trillion in 2021. As a competing monetary network with final settlement, that puts Bitcoin at near 6% of volume as a percentage of the average annual Fedwire volume over the last seven years.

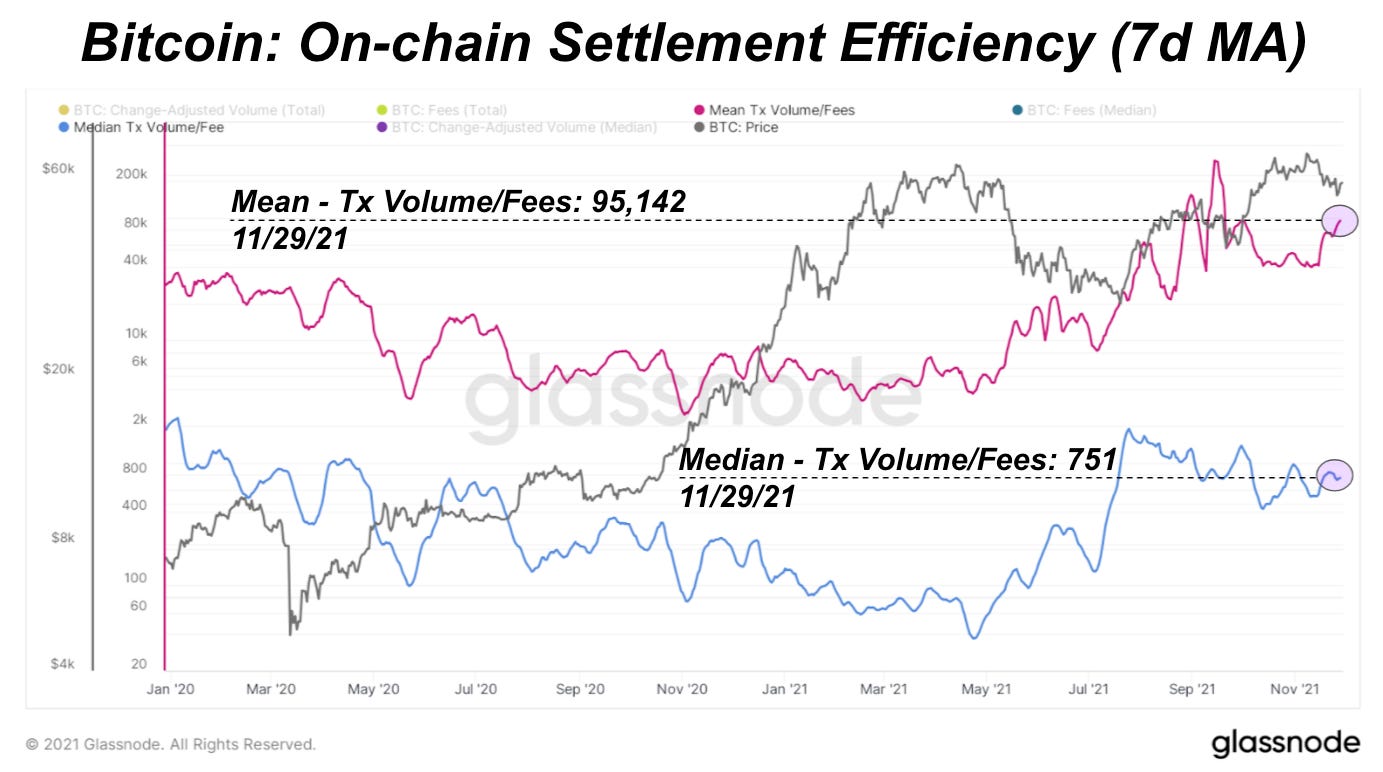

Transfer Volume Efficiency

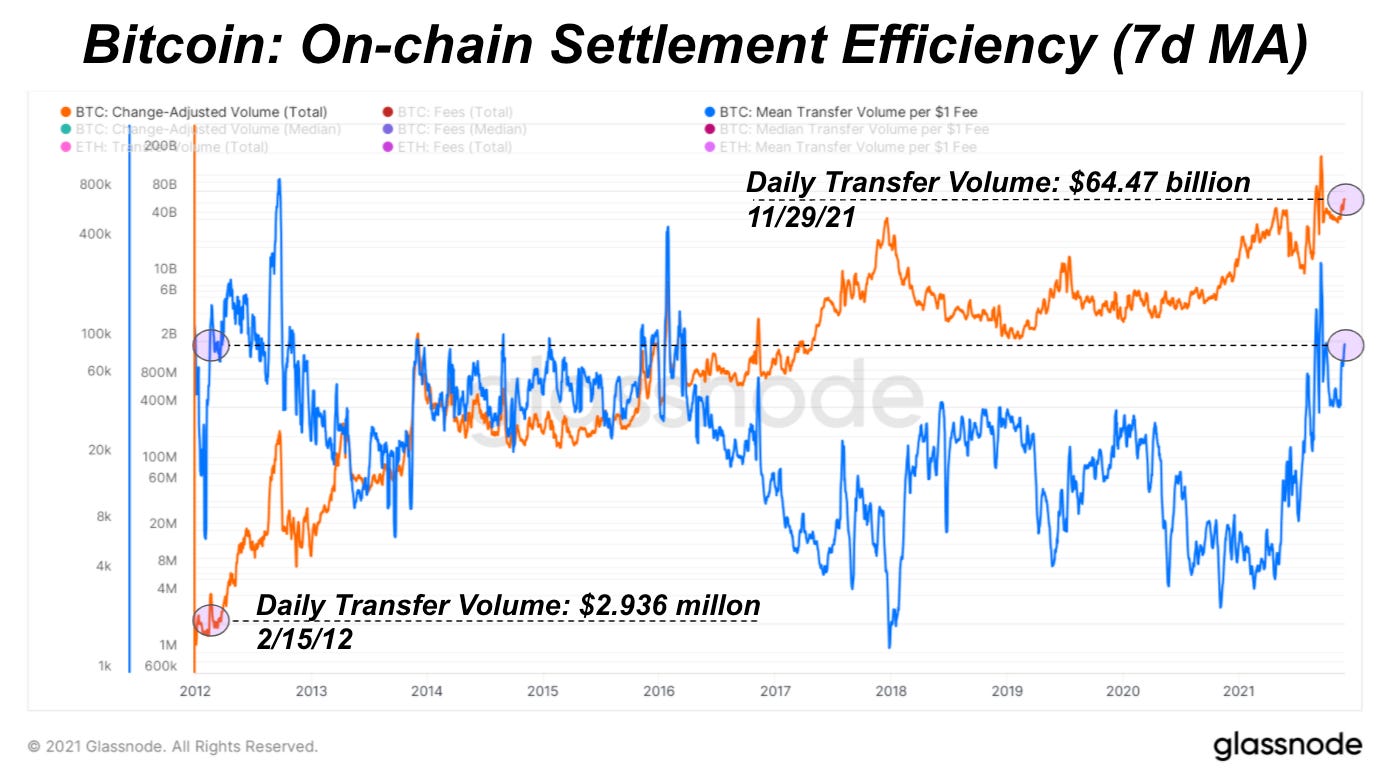

When looking at the all-time chart of bitcoin daily on-chain transfer volume (change-adjusted), in a very similar manner as the BTC/USD price chart, volume has grown exponentially over the last decade, and is best viewed in logarithmic scale. Over the last week, $64.47 billion has been transferred across the network daily on average.

However, the most impressive aspect of this feat is the efficiency in which this value is transferred amongst network participants.

Over the last seven days the Bitcoin network transferred an average $95,142 of value for every $1 worth of fees. This means that final settlement costs amounted to a minuscule 0.00105% of total value transferred ($451.3 billion). The most secure form of property rights humanity has ever seen can be transferred in a trustless manner anywhere in the world, in a more efficient manner than any other value-settlement network/protocol before it.

When analyzing the efficiency of the Bitcoin network over its history, it is amazing to see that Bitcoin is as efficient today (transfer volume/fees) transferring approximately $60 billion per day as it was when transferring around $3 million per day in 2012.

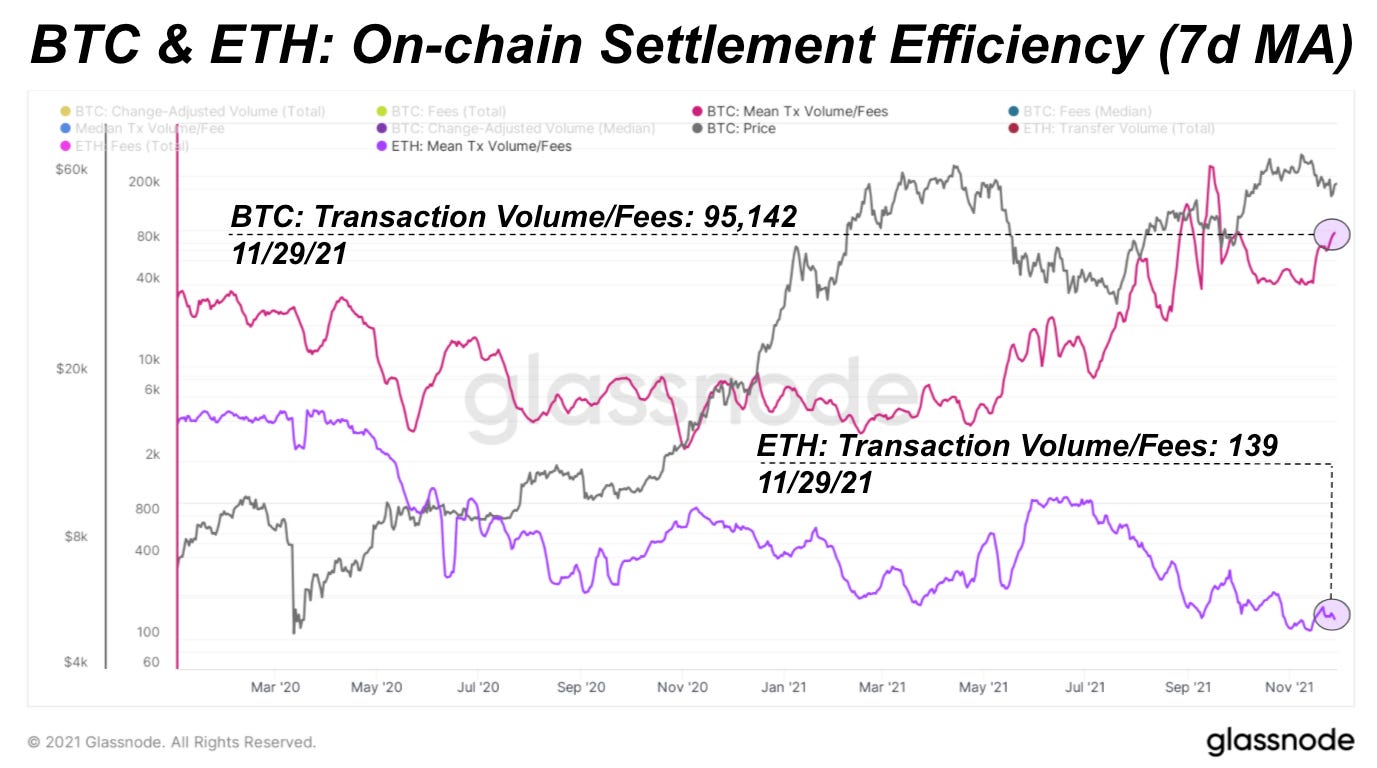

When comparing the settlement efficiency to that of Ethereum, which (unfortunately) is often compared to Bitcoin, a glaring disparity becomes evident. Over the last week, for every $1 in fees, the Bitcoin network has transferred $95,142 while Ethereum has transferred $139.

The reality is that the two assets are extremely different, and aren't competing in the way that many believe them to be.

Bitcoin is an immutable monetary settlement network which is secured by an absolutely scarce asset. Ethereum is a smart contracts protocol that isn't purely purpose-built for value settlement and storage, and has shown in the past that it is far from immutable.

Paradoxically, we are comparing the two assets in this analysis, but it is to highlight the disparity between the two assets/networks and what they set out to achieve.

As shown above, the settlement efficiency of Bitcoin has been maintained (albeit with plenty of variability) for nearly a decade, meanwhile Ethereum’s settlement efficiency continues to decline in a steady downtrend. As bitcoin the asset has continued to accrue value, Bitcoin the network continues to remain extremely efficient at securing that value with maximum security, while allowing for the transfer of said value with the utmost efficiency.

With Ethereum, as more value has accrued to the token, the efficiency of using the network has steadily declined since launch, while various smart contract competitor chains have arisen, looking to siphon value away from Ethereum due to its scaling challenges.

Final Note

The largest market in the world is the market for money, and our macroeconomic analysis has led us to the conclusion that there is a $300 trillion problem in the world today: The cost of capital in the world today is completely broken and has drifted away from any free market forces.

Our belief is that bitcoin, the world’s dominant digital monetary asset; the best money the world has ever seen, fixes this. With the current market capitalization slightly above $1 trillion, the opportunity to increase your purchasing power by saving value in the asset remains immense.

Bitcoin as a monetary asset is in a league of its own.

gross understatement:

> Bitcoin as a monetary asset is in a league of its own.

🤣

... it bought all the teams in the league.

These articles keep getting better and better! Excellent work guys!