Happy Thanksgiving to all of our Deep Dive premium subscribers! Thank you for your support and for helping to keep The Dive Dive going everyday. Because of the holiday, we won't be pushing a newsletter tomorrow. See you again on Friday.

Whales Buying Bitcoin

As the price has fallen 18% from the all-time high, whales have been adding bitcoin over the last week. When looking at the supply held by entities with a balance of over 1,000 BTC (this excludes exchange balances), these entities, estimated whales, have increased their position by nearly 55,000 BTC. That’s around $3.1 billion at a price of $56,000.

Some of these whales look to be net new entities with the total number of whales increasing since November 12, and bitcoin per whale falling in tandem. With every price drop, whales are adding more with the largest increase in supply happening over the last two days.

At the same time, we’re seeing exchange balances continue to fall over the last eight days suggesting that these larger players are taking the opportunity to accumulate more bitcoin after the price correction. Even with price selling off, bitcoin is consistently outflowing from exchanges over the last few weeks. These are signs of more long-term accumulation and the dip being bought by stronger hands, not the signs that the bull market is over.

We can confirm where this bitcoin is going by looking at the change in illiquid supply. The illiquid supply net change, which shows the monthly net change of supply held by illiquid entities, is increasing at the fastest rate we’ve seen all year. The Illiquid supply is hitting new all-time highs and has increased by nearly 79,000 BTC since November 12. For those thinking short-term and selling their bitcoin, longer-term-minded holders are quick to buy up supply right now, taking it off the market.

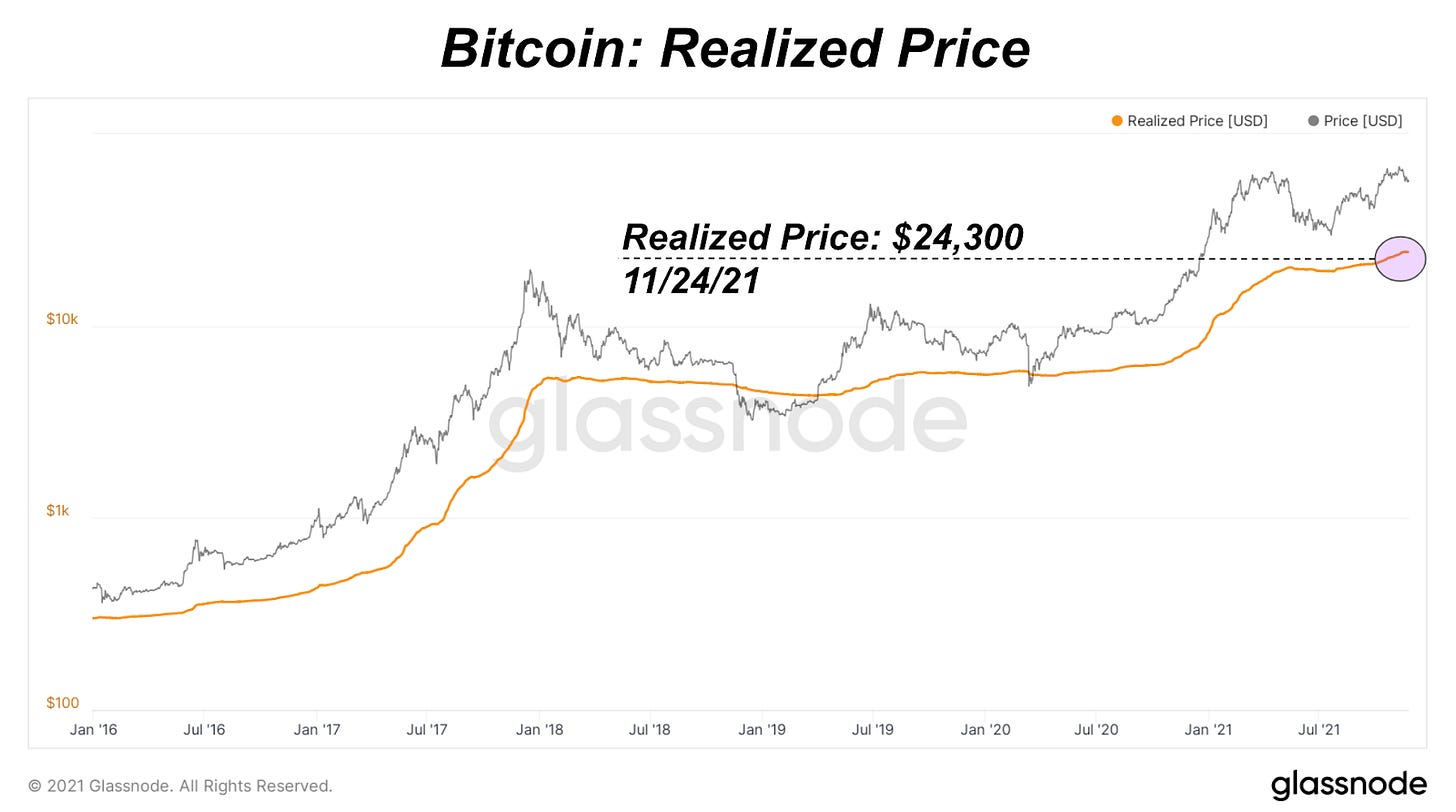

Realized Price

The bitcoin realized price has stagnated over the last two weeks around the $24,000 level as a decline in price has reduced the inclination for old coins to sell. Realized price increases as UTXOs that were last spent at lower prices are transferred.

During bull runs, especially during the later stages of them, realized price aggressively bends upwards as price is going parabolic and old coins are spent at an increasing pace. This behavior is not unfolding currently.

With the stagnation in realized price and the fall in the market price, the MVRV ratio has declined over recent weeks, now at 2.33. This means that the market price of bitcoin is 2.33 times the price that every coin has last moved on the network, and historically is a level seen in either bull market pullback/consolidation periods or following bull market blow-off tops.

With price and subsequently MVRV drifting down over the last month, investors can take comfort knowing they are acquiring bitcoin at an increasingly attractive relative risk/reward.

While it should be stated that we hold the belief that buying bitcoin for any price in dollars will be viewed in hindsight as a wise decision, there are definitely more and less attractive times to allocate to the asset class, and MVRV provides a fantastic signal in that regard.

Great post! Again! Happy thanksgiving

today's price is effectively a "rounding error" in the long journey forward... stack those sats.