Side note: Glassnode has been down all day. Bitcoin on-chain analysis should (hopefully) continue as usual tomorrow.

Nation-State Bitcoin Bonds

Over the weekend, the president of El Salvador, Nayib Bukele, and Blockstream announced the issuing of a $1 billion U.S. “Bitcoin Bond” on the Liquid Network. This comes directly after the International Monetary Fund announced last week that “for the moment, it is not discussing a possible financial agreement with the Salvadoran government” referring to the potential $1 billion loan agreement.

The $1 billion bitcoin bond will be split 50/50 for buying bitcoin and building out energy and bitcoin mining infrastructure. The bond's duration is 10 years, paying 6.5% initially with additional dividends paid out to bondholders from bitcoin holding liquidations after a 5-year lockup period. The initial bonds will be issued in 2022, with Blockstream highlighting that they can easily accept investments as small as $100.

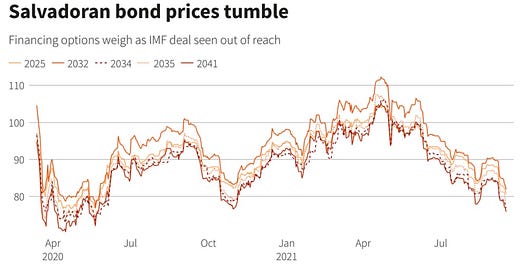

With El Salvador U.S.-denominated government junk-bond debt now yielding over 13% in the market, El Salvador has ventured into a creative alternative to raise money at lower costs while directly betting on bitcoin’s upside over the next five years. Without an agreement with the IMF, the government’s main alternative would be to issue more junk-bond debt that has already been selling off in distressed territory all year. When backed into a financial corner, Nayib Bukele and El Salvador have doubled down on Bitcoin.

We’ve now seen the issuance of cheap U.S. dollar-denominated debt to directly buy bitcoin at the nation-state level. This is the same playbook that we’ve witnessed with Microstrategy, Marathon Digital Holdings and now El Salvador. Many of the previous debt-issuance strategies, that have offered investors bitcoin exposure, have been oversubscribed almost immediately. We’ll see what the demand looks like as the bonds are rolled out. It may be an appealing option to emerging market fixed-income allocations that want bitcoin exposure. If the full $1 billion is satisfied, that would take an estimated 8,929 bitcoin, at today’s prices, off the market for five years.

Jerome Powell’s Second Term

With the announcement of Powell being renominated for a second term as Chairman of The Federal Reserve Board, it can be expected that the expansion of the Fed’s balance sheet and the broader dovish policy will continue. Although it is becoming increasingly likely that a 25-basis-point rate hike is coming at some point in the future, this comes at a point in time when the Fed Funds Rate is 600 basis points below the rate of consumer inflation year over year.

Dollar Strengthening

In The Daily Dive #102, we covered the dollar currency index (DXY), and the role it plays in the global financial system. The DXY, which measures the United States dollar against a basket of other fiat currencies, rises viscously during times of financial risk-off, due to the global dollar-debt dynamics.

Shown below is the DXY from the start of 2021 and 2020:

While inflation is running at three-decade highs in the United States according to the consumer price index, the DXY is rising due to the relative weakness in other global fiat currencies.

If the DXY continues to rise with strength, it is bad news for all asset classes, and would require further fiscal and monetary stimulus from Congress and the Fed.

How would bitcoin react in that scenario? While it is highly unlikely that a dollar spike similar to the one in March of 2020 occurs again due to the extreme circumstances that presented themselves 20 months ago, bitcoin would most likely react in a similar manner: byleading legacy markets lower as global investors scramble for dollar liquidity, and then responding in a BIG way following the stimulus that would inevitably have to follow a sustained dollar spike.

Is a 50% daily drop likely to occur again? No.

But a brief risk-off followed by an extremely strong on-chain accumulation is the most likely outcome of a dollar superspike, and any long-term investor/holder of bitcoin should welcome that scenario, as the response from the Fed and politicians following a steep decline across ALL asset classes would be historic in nature.

Final Note

The dollar spike scenario highlighted above is not a definitive outcome, rather a probabilistic one. Investors should be prepared for a variety of scenarios over the short term, and despite the strong on-chain market dynamics that we have highlighted in depth in The Deep Dive, a broad market dip is possible, and one that we hope and encourage to happen as opportunistic bitcoin accumulators.

hodling strong... btd!