Mining Metrics Breakdown

The story during the summer of 2021 in bitcoin was the mass mining migration out of China. What has followed has been nothing short of remarkable, with the hash rate recovering to an impressive 161.7 EH/s on average over the last week.

When looking at the daily miner revenue, figures are near all-time highs, with miners generating $63.82 million yesterday alone. When applying a 30-day moving average, bitcoin miner revenue is at an all time high of $60.15 million. Said differently, bitcoin miners just had their largest 30-day grossing period in the history of the network, earning $1.818 billion in the process.

When looking at the profitability of miners, the metric with the most pure signal is hash price, which measures miner profitability on a per hash basis by dividing the daily miner revenue by hash rate.

Hash price, although trending down in an exponential manner over time as ASIC machines continue to be produced and increase in efficiency, has increased by 187.4% year over year, and has served as a boon for the entire mining industry (more on this shortly).

Below displays hashprice since the beginning of 2020 as well as over the entire history of the network:

The main takeaway should be the trend shift since 2020 of a higher hash price, as ASIC production and miner installation has been unable to keep pace with the rising price of bitcoin. Over the short/medium term, this dynamic is incredibly bullish for bitcoin miners.

Marathon Continues Speculative Attack

Acquire a stronger currency via borrowing a weaker currency. This is the speculative attack dynamic that we’ve covered extensively at the Deep Dive. In The Daily Dive 071, we discussed Marathon Digital Holdings’ new $100 million bitcoin-secured line of credit saying,

“Simply put, Marathon can now borrow dollars against their bitcoin to grow their business and increase their bitcoin treasury. By doing so, they are participating in a speculative attack on the U.S. dollar: the act of borrowing a weak currency to buy a strong currency. This is the same strategy that Michael Saylor has championed with Microstrategy, covered in The Daily Dive #005 and The Daily Dive #014.

“With rising inflation concerns beyond “transitory” and interest rates still held near zero by global central banks, holding fiat currency or negative-yielding debt securities is a losing proposition. What can a company rationally do as a response? They can acquire the most scarce currency on the market by taking advantage of the weaker currency’s infinitely growing supply.”

Clearly this strategy is paying off for them because today, Marathon announced a $500 million of senior convertible notes offering due in 2026 to buy additional miners. The company will take on cheap USD debt to acquire bitcoin miners. Those miners will acquire bitcoin, which they are strategically committed to HODLing more of long-term. It’s from the same page of the MicroStrategy playbook but with an investment in mining equipment step in-between.

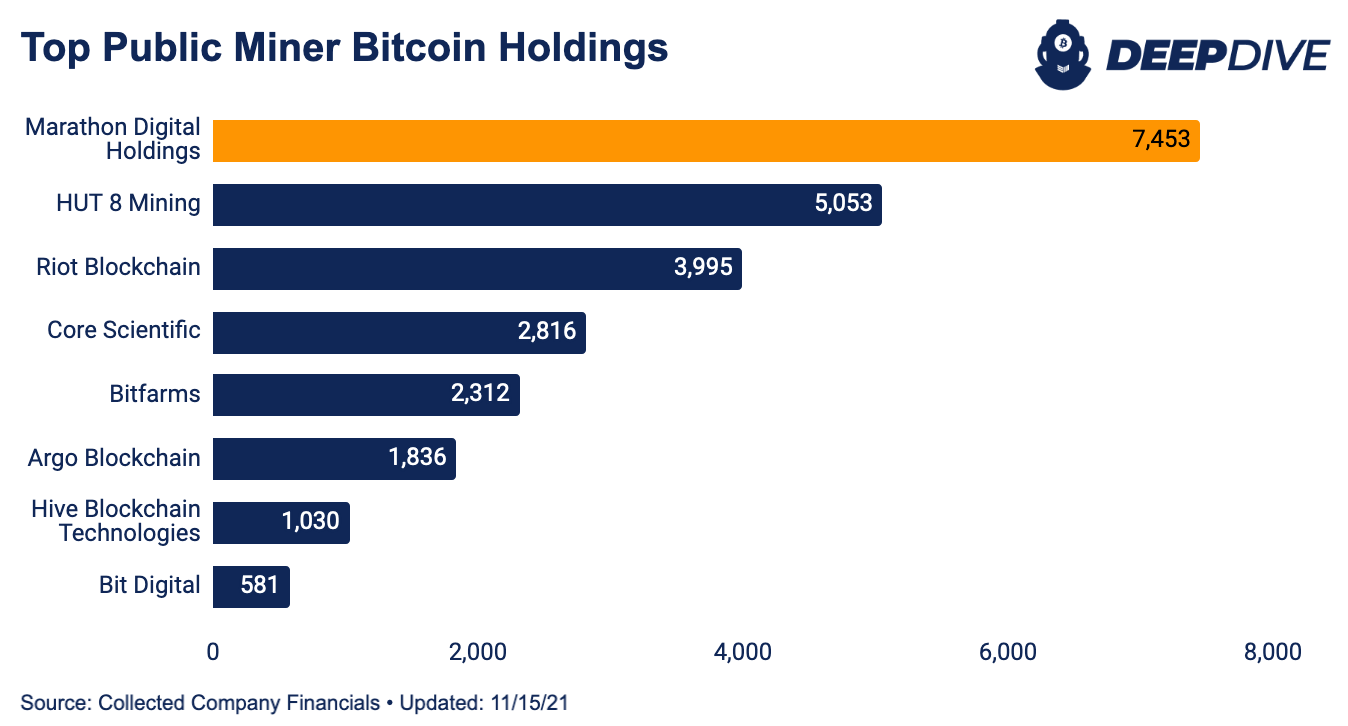

Public Miners Increase Bitcoin Treasuries

There’s a new paradigm unfolding amongst the large public bitcoin miners: They don’t want to sell their bitcoin, and they also want to acquire more. As a result, they are finding creative ways to raise capital or leverage their bitcoin holdings to help cover operating costs rather than having to sell for fiat.

One strategy is to loan out a portion of their bitcoin holdings, thus earning fiat yield that can directly go towards paying their operating expenses. Hut 8 Mining has been doing this, loaning out 2,000 BTC (nearly 40% of their BTC holdings) to earn a 4% interest rate starting in January. That interest rate has since come down to 2.00% to 2.25% as of their latest Q3 financial reporting. (There’s more on the dynamics of lower interest rates below.) At today’s price, 2,000 BTC is around $130 million in total value earning an annualized $2.6 million at the lower 2% interest rate. An average bitcoin price for the entire year of $46,792 would generate $1.8 million.

Generating revenue from loaned bitcoin to cover costs allows public miners to better execute on their increased HODL strategies. The Hut 8 bitcoin treasury is now 5,503 BTC which is already up 68% since March this year. It’s the second largest public miner treasury behind Marathon. Marathon and Riot, major public miners that report November production updates, both increased their bitcoin treasuries over the last month.

Hut 8 deploys 1,000 BTC with Genesis Global Capital and 1,000 with Galaxy Digital. That bitcoin is then used mostly for institutional trading arbitrage opportunities. Interest rates for bitcoin yield have been pushed further down this year as the cash and carry basis trade narrowed and GBTC shares started to trade at a discount instead of a premium.

A decrease in higher-yield opportunities drives lower market demand for bitcoin loans which then drives lower interest rates. Too much bitcoin supply is chasing yields while there is less demand for bitcoin borrowing. However, the futures ETF interest may help raise and sustain BTC market interest rates with a widening cash and carry spread. Right now that contango trade, longing spot and selling futures, is sustaining around 14% yield which is up from single digits in Q3.

Genesis Global Capital noted in their latest reporting that although bitcoin loans have increased, the weighting of their loan book in Q3 favored more Ethereum and USDC loans as investors are pushed further along the risk curve in the search for a higher yield. This is a key market to watch into Q4 as increased interest rates for bitcoin lending will supply miners with yet another financial vehicle to continue their strategies to acquire more bitcoin.

Final Note

As we highlight in many of our bitcoin mining industry posts, it will be incredibly difficult for most investors to beat the performance of holding spot bitcoin over the long-term compared to holding bitcoin mining equity. We will see waves of capital seeking bitcoin exposure continue to pour into this market, but that capital will actively have to navigate, assess and value public miner management and execution risks in one of the most competitive industries.

At the end of the day, pay attention to what bitcoin miners are doing. They are acquiring as much bitcoin as they can and that’s the game to play.

the coolest thing is that individuals can do the same types of economic decisions with their bitcoin as a large, public organization. this is the power of bitcoin: it's universality of utility.