The Daily Dive #092 — Bullish Indicators And Estimating Cycle Tops

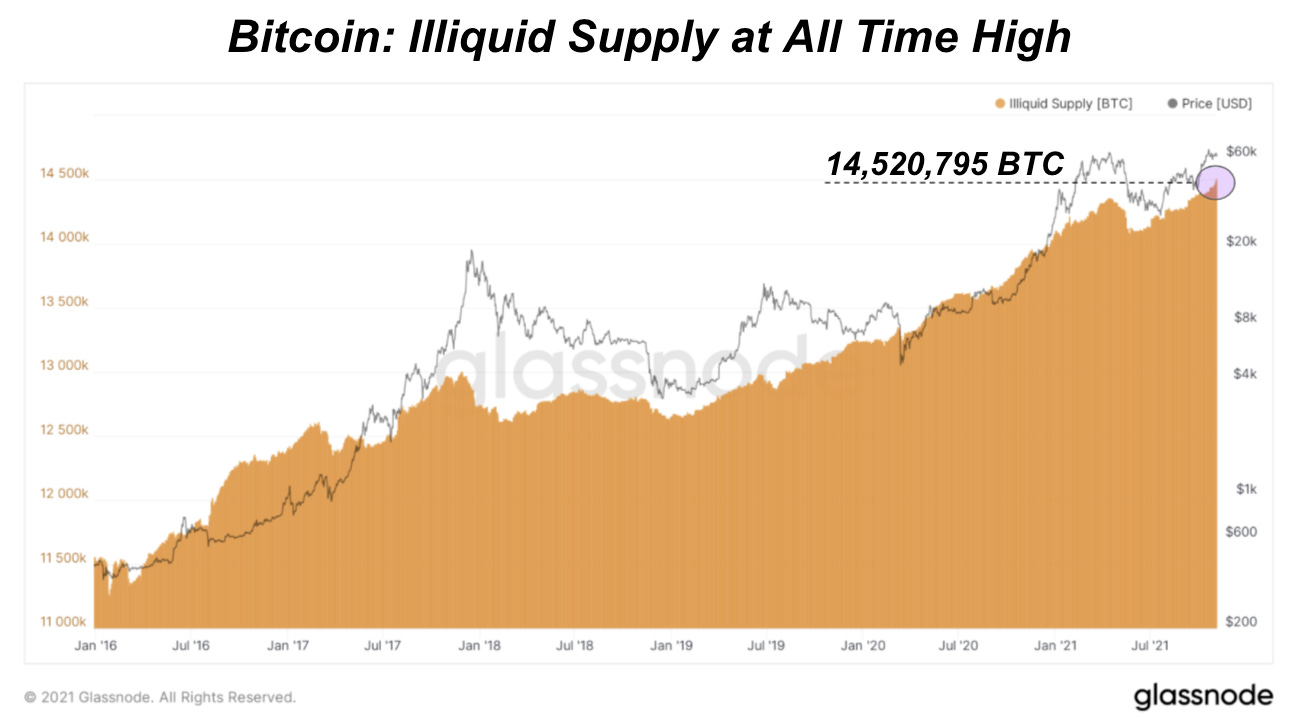

Illiquid Supply Breaks All-Time High

For more information on quantifying bitcoin liquidity cohorts, click here

Bitcoin’s illiquid supply has broken another all-time high, as coins continue to be accumulated by strong hands. A total 14,250,795 BTC is now classified as illiquid.

76.97% of circulating supply is now classified as illiquid, surpassing the previous 2021 high.

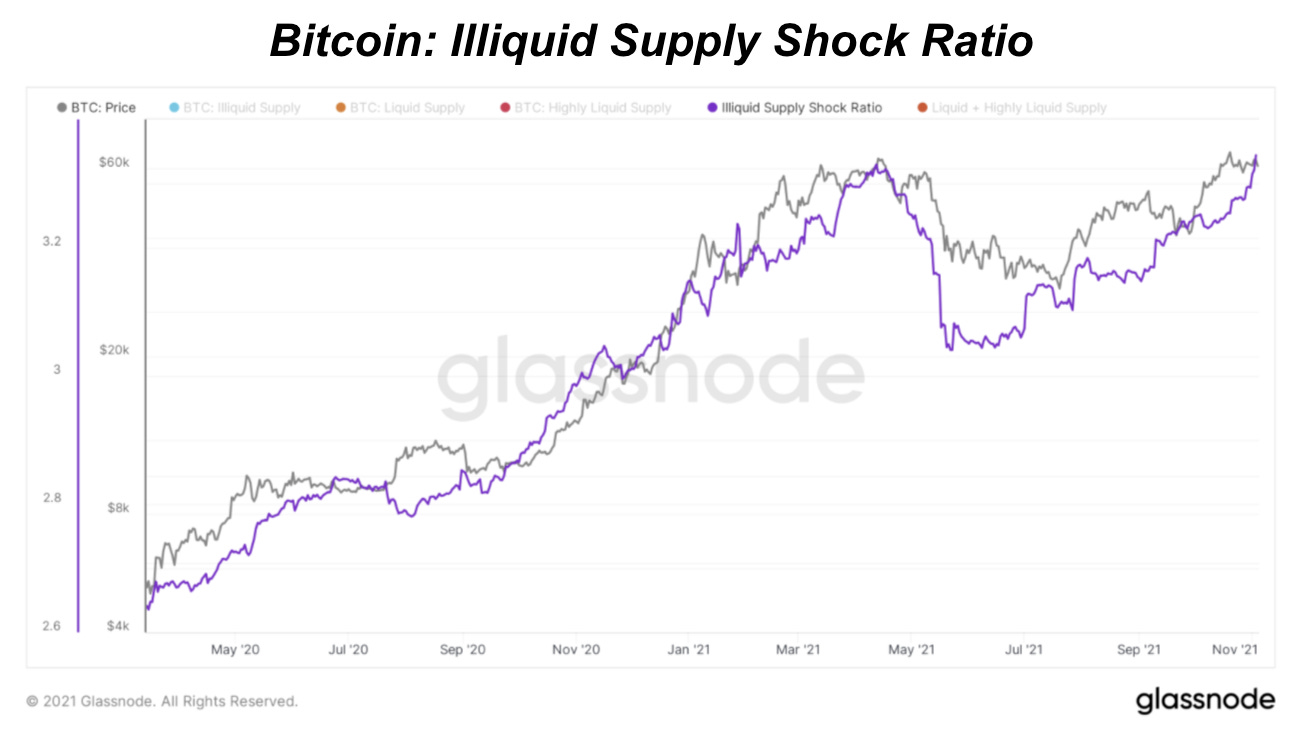

When looking at the illiquid supply shock ratio (defined as illiquid supply/(liquid supply + highly liquid supply)), it has also surpassed its 2021 highs, and looks to be accelerating its upward trend.

On-chain supply dynamics are suggesting that the next leg up for bitcoin is imminent:

Lastly, we have the non-exchange percentage, which has also been very correlated to the price of bitcoin since the March 2020 macro event. Currently 86.98% of bitcoin is not on exchanges, and this percentage is looking like it will increase over the coming weeks and months ahead.

Unequivocally, this is bullish for bitcoin.

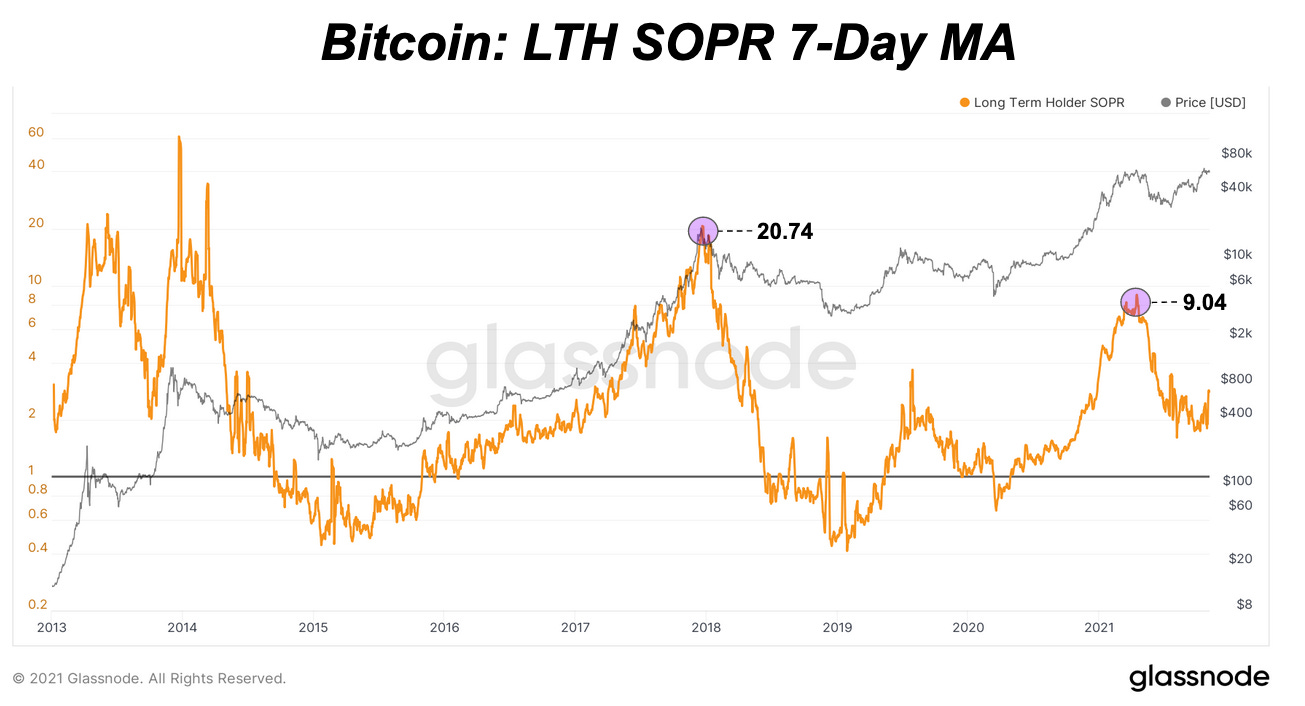

Estimating Cycle Price Tops

As the bull cycle carries on, everyone wants price predictions and a better understanding of when price may top out and reverse course. Although we expect bitcoin to reach a six-figure price this cycle, it’s difficult to estimate how far the cycle will extend beyond that. There’s a lot of different models, thoughts and projections on this already. We will add one framework to the mix using long-term holder cost basis and long-term holder historic spent output profit ratio (SOPR) trends. This shouldn’t be taken as a price prediction for the cycle but rather a logical thought exercise based on simple historical assumptions.

SOPR tells us price sold over price paid, indicating what profit levels long-term holders realized in the past. At the peak price over previous all-time highs in 2018 and 2021, long-term holder SOPR peaked at 20.74 and 9.04 respectively. Said otherwise, that’s 1,974% and 804% realized profit. A big market question is at what price level will a portion of long-term holders be incentivized to sell some of their bitcoin? That will likely mark the cycle top.

Using the long-term holder cost basis, an estimate for the market price paid, and the profit ratios of the past two cycles, estimates for price sold, we can multiply the two to get implied cycle top prices for this cycle.

For example, the long-term holder cost basis is now $17,751. If long-term holders look to take the same level of profits like they did at the previous all-time high (804%), the cycle price would need to be $160,469. If they expected to take profit levels at the peak in January 2018 (1,974%), the cycle price would need to be $368,157. A midpoint between the two would be 1,389% with a price around $264,000.

It’s also a fair assumption that long-term holders may expect lower profit percentage returns as larger returns diminish over time. So the long-term holder SOPR peak may exist below the January 2018 peak but above the previous all-time high, assuming that we haven’t reached the cycle top yet.

All that said, we don’t really know how this cycle will behave compared to previous cycles or how long-term holders will respond to profit taking this time around. Maybe they realize a lower level of profit this time around or hold out for higher prices, expecting a new type of adoption cycle unfolding.

After all, we’re not stacking sats to just get rid of them at cycle tops. This is a multi-decade adoption thesis where timing the local cycle tops won’t matter in the long-run.

Peter Schiff shaking after reading this.

Spencer stacks the dip before ATH's while his dad is in the other room making dinner.