Price Falls With Long Liquidations

As proven to be a typical move in the bitcoin market, price fell back under $60,000 as there were $154.5 million in long liquidations yesterday with the majority share of 28% coming from Binance. We covered the potential for another leveraged-longs wipeout move to the downside in The Daily Dive #084 saying,

“With the percentage of BTC-margined open interest declining this meaningfully since the previous April all-time high, the conditions for a similar derivatives-led market cascade are all just not there compared to the way they were in April. That does not mean that leveraged longs cannot get wiped out over the short term, and a pullback below $60,000 caused by liquidations is entirely possible, but rather that, broadly speaking, the market is much less susceptible to downturns than it was previously in 2021.”

With leveraged open interest ramped up into an already declining price, the entire cryptocurrency market had $810.58 million in long liquidations. For context, this is relatively a modest liquidation over the last three months after seeing $1.23 billion in just bitcoin long liquidations in early September.

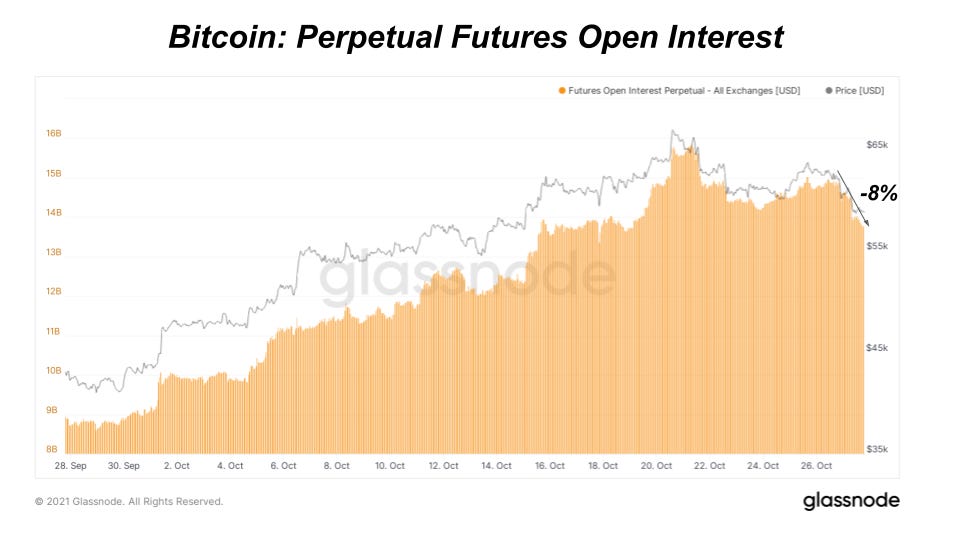

With the liquidation move, we can see the daily futures perpetual funding rate unwinding from 0.3% back down to 0.1%. Along with the funding rate cooling off, the perpetual futures open interest wiped out approximately 8% in the move.

For context, the average daily percentage drawdown for bitcoin this year is minus 3.10% while the average daily percentage increase is 3.45%. Yesterday ended at a negative 4% move with an additional 2% down so far for today, which settles around a two-day move of minus 6%. Although slightly higher than the daily drawdowns we see on average this year, this looks to be a typical market move that’s nowhere close to being an outlier for the year.

When drawdowns are a direct result of too much leverage in the system getting flushed out, it's an overall healthy sign so bitcoin can continue its spot-driven long-term trajectory upwards.

Stepping further back and taking a more macro view, the current bitcoin price is only a 12% drawdown off the previous all-time high. In the bitcoin market, that’s nothing compared to what long-term holders are used to and we don’t expect the move to even phase most of them.

As a new Hodler beginning February 2021 it’s fascinating to see the lack of core selling. One can liken it to massive pension fund credit portfolios that work around occasional deep sell offs in the credit markets. In addition to its scarcity one can see bitcoin continuing to track upward in fiat terms in contrast to fixed income portfolios melting.

Not phased one bit.