The Daily Dive #087 — Bitcoin As Collateral

The Roadmap For Bitcoin And Banks

In a major announcement today, news broke that U.S. banking regulators are exploring a roadmap for traditional banks to hold bitcoin so that the asset can be used for client trading, as collateral for lending or just to exist on banks’ balance sheets. Even under the guise of increasing regulation, this is clear evidence that traditional banks and their clients are demanding more use of bitcoin which will further accelerate the growing financialization of bitcoin.

"I think that we need to allow banks in this space, while appropriately managing and mitigating risk," FDIC chair Jelena McWilliams said. "If we don't bring this activity inside the banks, it is going to develop outside of the banks...The federal regulators won't be able to regulate it."

Outside of the traditional banking system, we’ve been seeing the increased level of demand for bitcoin-denominated loans and bitcoin as collateral for both trading and lending. One of the best places to see this action is in the rise of Genesis’s digital asset lending loan portfolio. As of their results in Q2, they have $8.3 billion in active loans outstanding with 42.3% of those loans denominated in bitcoin worth $3.5 billion.

Since the launch of their lending business in March 2018, cumulative loan originations have reached $66 billion indicating significant growth and demand for bitcoin loans.

BlockFi is another company where we can track market demand and with BlockFi sharing internal numbers with Arcane Research in this special report, we can see the 50x and 7x growth in their retail loan bitcoin collateral demand over the last two years denominated in USD and BTC respectively.

Silvergate Bank is yet another market example pointing to the increased demand for the usage of bitcoin as collateral. Looking at their Silvergate Exchange Network Leverage product in Q3, which provides secure institutional-grade access to USD loans collateralized by bitcoin, the growth in credit was up 9x over the last year, now totaling $322.5 million. This number reflects the total approved line of credit amount that institutions can tap into which is the same line of credit that bitcoin miner, Marathon Digital Holdings, is leveraging which we covered in the The Deep Dive #071.

These three examples show the potential role that bitcoin will play as a competing asset in legacy banking markets. As of Arcane Research estimates early this year, bitcoin only comprised 0.15% of a total collateral market size worth $20 trillion. What bitcoin can help mitigate in these markets is the growing problem of rehypothecation that generates more risks for the stability of the financial system. The asset has no counterparty risk.

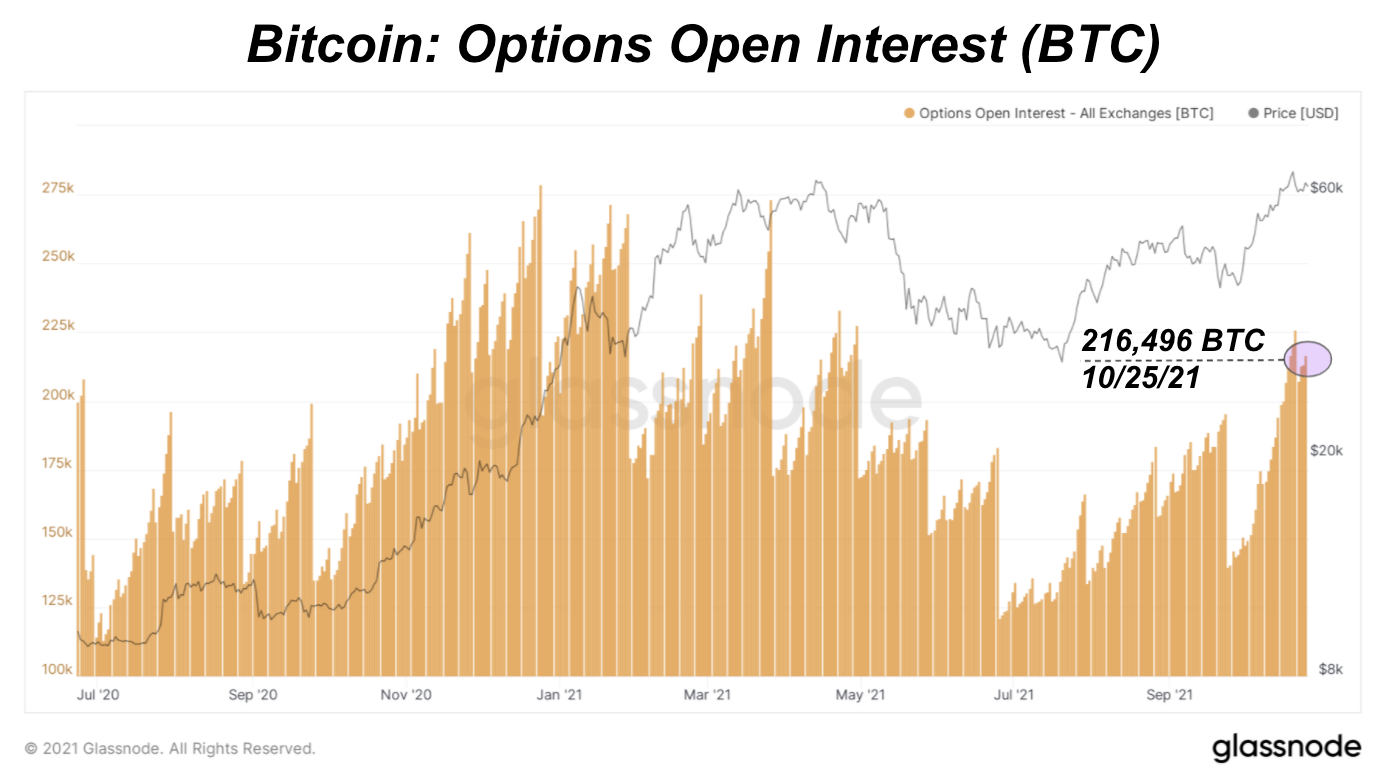

Lastly, there are the cryptocurrency-native derivatives and options markets that are perfectly operational today that combined have over 350,000 BTC in open interest on futures/derivative bets. Said differently, there are over $10 billion worth of financial derivative assets that are trading 24/7/365 that are collateralized with bitcoin TODAY, with positions marked to market every second.

Compared to the legacy financial system, where collateral is often rehypothecated multiple times over, the Bitcoin network’s UTXO is the ultimate arbiter of truth for ownership, and given the global liquidity and 24/7/365 status of the bitcoin market, it was always inevitable that the commercial banks would eventually enter the bitcoin market.

Over-collateralized bitcoin lending is a no-loss business for the lender.

The game theory of global bitcoin adoption continues to unfold.