Relevant Articles:

The Daily Dive #070 - Short-Term:Long-Term Cost Basis Ratio

The Daily Dive #083 - Bitcoin All Time High

The Daily Dive #081 - HODLer Engineered Supply Squeeze

In previous Daily Dives we examined the supply dynamics of long-term and short-term holders and what it means for the bitcoin market. Today, we will further examine the dynamics of short-term holders during bull markets and bear markets.

Before we begin, it is important to define some terminology for those who may not be familiar.

In this piece, when referring to cost basis, we are referring to the realized price, which uses the price at which the coins were last transferred on the bitcoin blockchain. Due to the transparent nature of Bitcoin’s ledger, we can quantify a cost basis of various cohorts of holders. Below are a few other terms and abbreviations that will be mentioned frequently in today’s Daily Dive.

Cost Basis = Realized Price

MVRV = Market Value (price) to Realized Price Ratio

LTH = Long-Term Holder

STH = Short-Term Holder

Let’s dig in.

Short-Term Hodler Cost-Basis Analysis

For information about the quantification of short/long term holders click here

Pictured below is the cost basis for short-term holders over time:

It is clear that the STH cost basis oscillates around the bitcoin price, but when analyzing further, bull markets are driven by new capital flowing into the market, and as a result price will far outpace STH as new money competitively bids for allocations. Examine the trends between STH cost basis and price since the beginning of 2020, as well as the 2017 bull market.

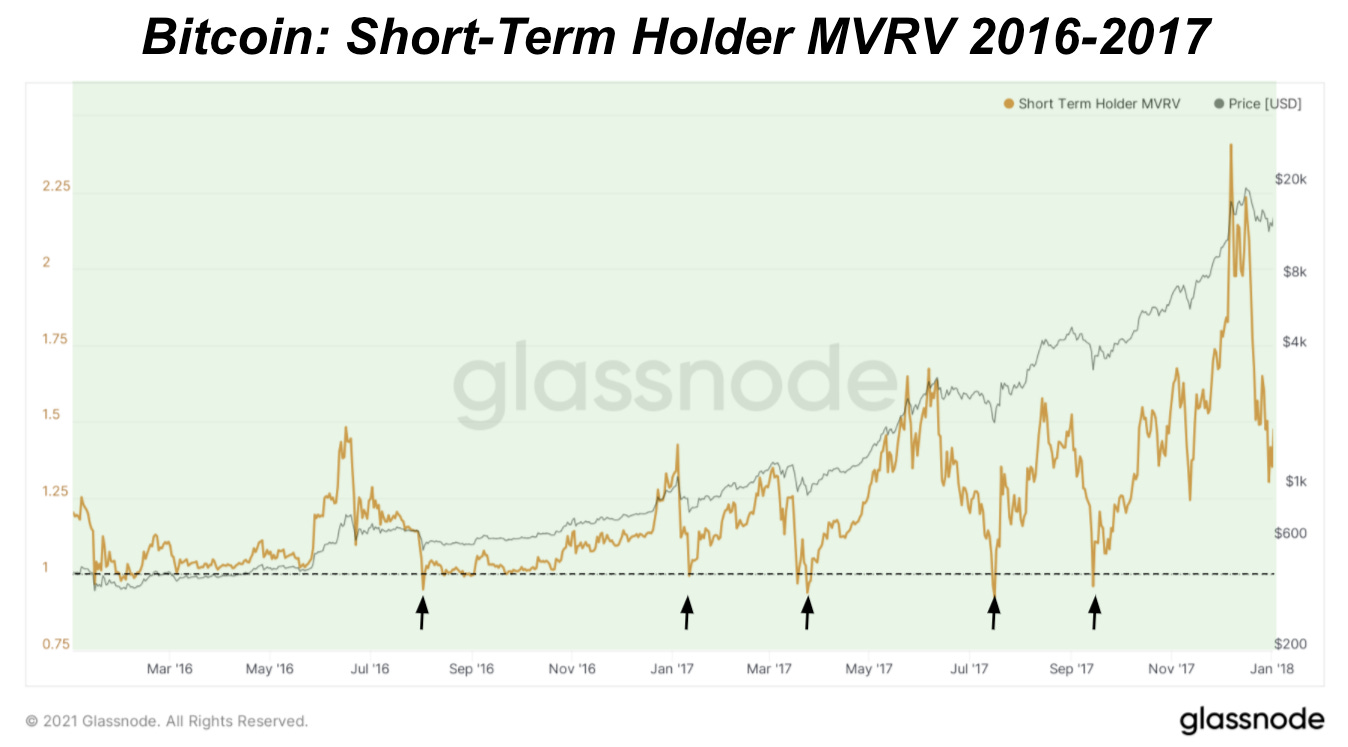

We can display the same value as a ratio using STH MVRV (short-term holder market value to realized value ratio). Notice how 1.0 acts as support for STH MVRV in bull markets?

This can be thought of as new participants aggressively defending their average cost basis, as they continue accumulating a position size.

So now let's revisit the very reason that new money has to aggressively bid up the price in the first place. It is a direct result of HODLers soaking up the free float of an absolutely scarce digital asset. If an overwhelming majority of the market for an asset is not selling, then any marginal increase in demand will need to be resolved through higher prices.

Supply and demand 101.

Below is the relative long-term holder supply since 2014. The 80% threshold (only 20% of market is a short-term holder) has been an especially significant bull leading indicator (early 2020 pre COVID-19 aside).

Now, with bitcoin trading directly below all-time highs, we have another supply squeeze on our hands.

Short/Long-Term Holder Cost-Basis Ratio

Originally covered in The Daily Dive #070 - Short-Term:Long-Term Cost Basis Ratio

Characteristics of a start to a bitcoin bull market:

Long-Term Holders hold majority share of coins

New money (Short-Term Holders) has to competitively bid for market share

Short/Long-Term Holder Cost-Basis Ratio trending down.

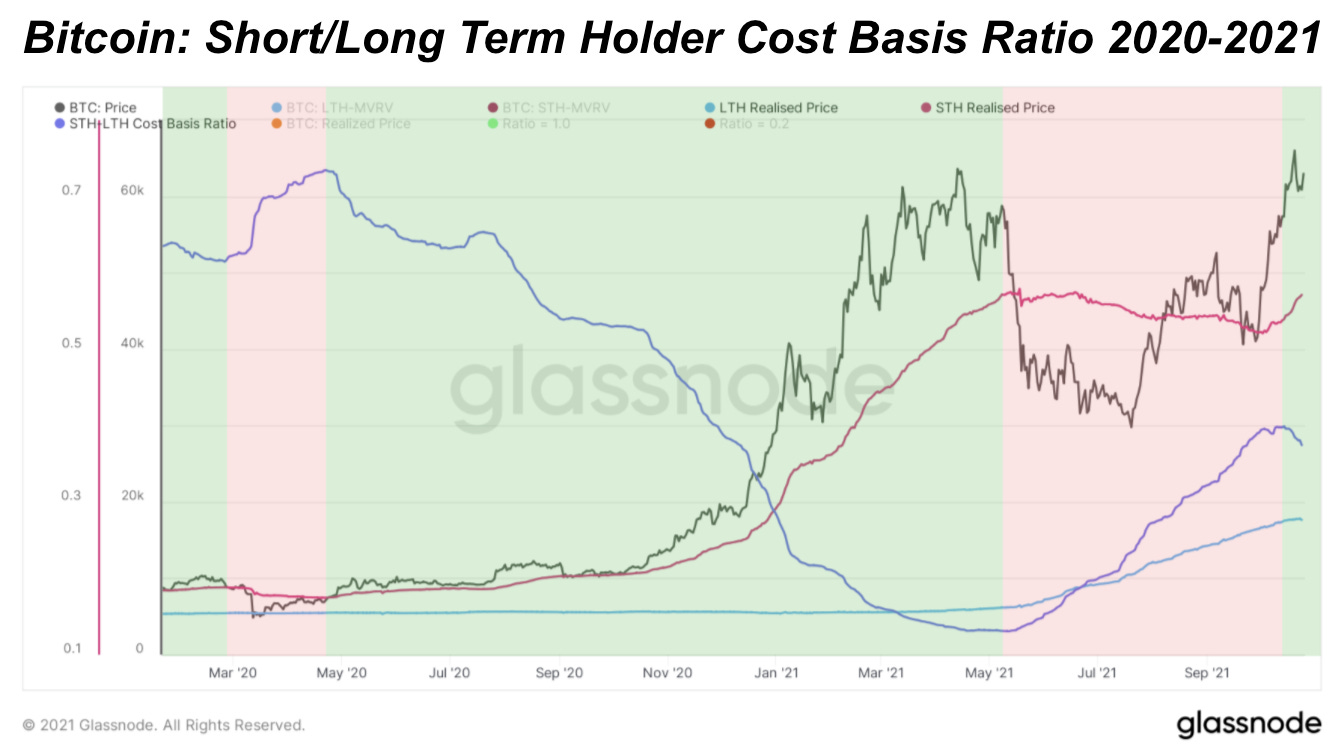

Let’s examine this relationship more closely. Below we show bitcoin since 2012 with the cost basis of short-term holders and long-term holders displayed first with the ratio pictured in the second chart:

Green highlights display when the cost basis of STHs is appreciating against the cost basis of LTHs.

Once again, think of this as quite literally as an engineered supply squeeze.

Here is a view of the ratio since the start of 2020. The bull market of 2021-2022 has just begun. As new capital attempts to secure an allocation to the world’s hardest monetary asset, a parabolic run that very few think is feasible is likely to commence.

Few around the world understand the significance of Bitcoin. Fewer understand the dynamics of a bull and bear market, and the seemingly “random” parabolic moves upward. Now, with the price of bitcoin at $62,700 and STH cost basis currently at $47,115, new capital is bidding up the order book to secure allocations.

Final Note

Guess what folks?

We just started the beginning stages of a new bitcoin bull cycle. Sit back, make sure to flip your charts into logarithmic view, and enjoy, as the rest of the world watches bitcoin’s ascent in shock.

You can’t fight math.

always appreciate the definitions. :)

SLCBR model is a license to print money for investors. Thanks LeClair for pushing our understanding of Bitcoin valuation to the limit.