The Daily Dive #084 — Derivatives Market Analysis

Futures-Long Liquidations

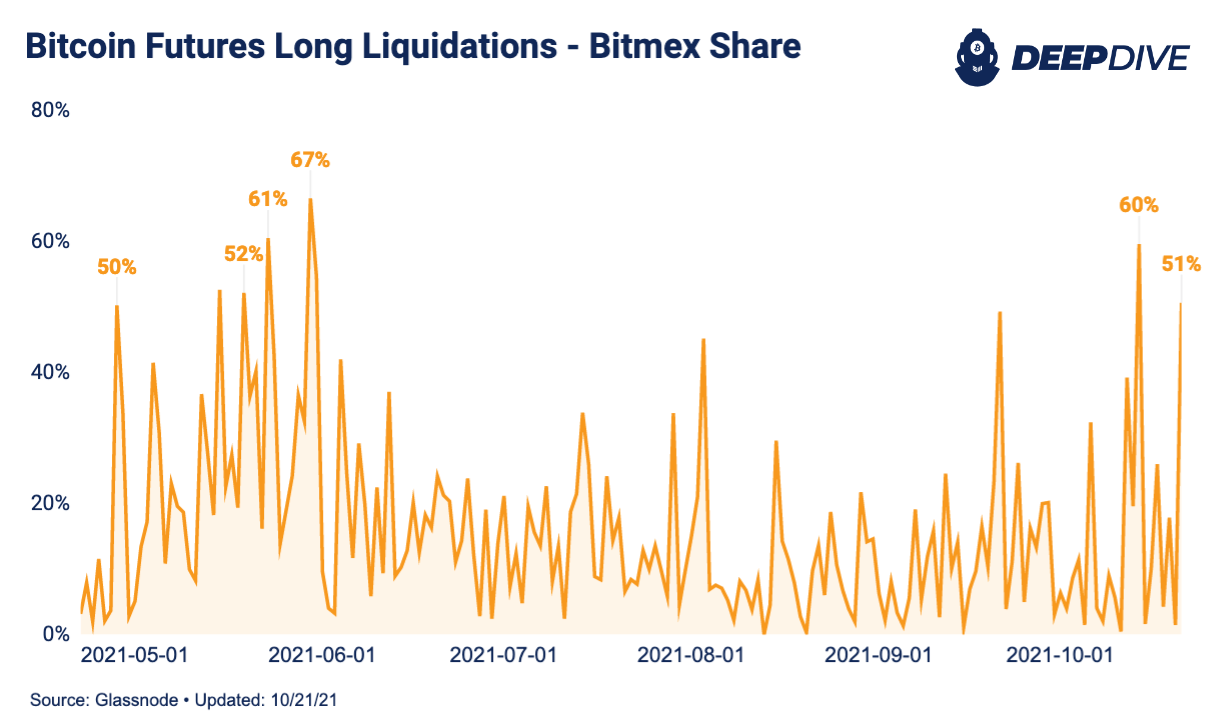

The bitcoin price sharply fell 5.3% today as leveraged futures-long liquidations hit $39.3 million in just one hour with over $80 million in total on the day so far. Liquidations on BitMEX accounted for over 50% of the action. BitMEX notoriously is a bitcoin-only derivative exchange, which results in leveraged-long positions carrying a convexity during drawdowns as the position and collateral value decline in tandem (more on this later). While some longs that were late to the party after the all-time high break were liquidated, no large-scale liquidations occurred with the recent pullback to $63,000, but there are a few things to watch for.

Aggregate Futures Open Interest

The rise in aggregate futures open interest is slightly below all-time levels made at the local bitcoin market top in April. Is this cause for concern? While futures open-interest and leveraged bets favoring the long side have certainly increased over the recent weeks with bitcoin’s feverish rally past previous all time highs, there are a few key distinctions between the market structure in April versus what we are seeing today.

The biggest and maybe the most important difference between the derivatives market in April compared to today is the percentage of futures-open interest that is using BTC as collateral to enter a position. With bitcoin derivative markets, you can either use BTC or stablecoins as collateral.

If you are long (directionally betting on prices to increase) using bitcoin, then if the price decreases your position PNL (profit and loss) and your collateral decrease in value in tandem, this raises the liquidation price of your position. This can result in mass-market liquidation events, similar to what happened in May following the April highs.

Thus, it holds great significance that the percentage of open interest using BTC as collateral has declined significantly since April, from a high of 70.17% to 45.04%. This is a trend we have been covering in detail since July, when we broke down some of these dynamics in The Daily Dive #028 - Structural Changes To BTC Derivatives Market.

With the percentage of BTC-margined open interest declining this meaningfully since the previous April all-time high, the conditions for a similar derivatives-led market cascade are all just not there compared to the way they were in April. That does not mean that leveraged longs cannot get wiped out over the short term, and a pullback below $60,000 caused by liquidations is entirely possible, but rather that, broadly speaking, the market is much less susceptible to downturns than it was previously in 2021.

Using the percentage of BTC-margined open interest as well as funding rates on perpetual swaps (covered in next section), one can garner a clear picture of the state of the market.

Here is an interaction that took place in July on Twitter:

On a similar note, there has been an increase in aggregate open interest using BTC as collateral since the start of October, and this can be attributed to traders looking to speculate on the run-up to new all-time highs. Stablecoin-collateralized longs are more prudent, but naturally most market participants that trade with size hold far more bitcoin, and with bullish price action comes speculation fueled by human greed. While the aggregate BTC-margined open interest (denominated in BTC) isn’t yet worrisome, it is something we plan on keeping an eye on into the future.

Perpetual Futures Funding

For those unfamiliar with perpetual futures and how they work, a perpetual futures contract is a contract that never expires, but rolls every eight hours. To align the price of the perpetual-swap market with the spot market, a funding rate is introduced, which incentivizes the market to stay close to the spot price.

Over the last month, the funding rate has spiked significantly with price breaking all-time highs, which was followed by derivative traders opening lots of long positions. As noted previously, lots of market dynamics are different compared to April, but this should give reason for pause over the short term.

Below is the hourly funding chart for all of 2021. The recent spike is notable, and could leave the market vulnerable to a short-term pullback. But long term, any significant dislocations resulting in derivatives will naturally correct.

One should also note that perpetual swaps as a percentage of futures market open interest had been increasing over the course of the entire summer and has since pulled back.

Futures Annualized Rolling Basis - “Contango”

The bitcoin futures-annulled rolling basis, known as the contango yield or “risk-free” rate earned from selling futures and longing spot, has climbed to 16.91% from the 1.87% low in July. A rising futures basis isn't necessarily a bad sign in a bull market, as long as underlying spot demand remains strong. The yield arises from speculators looking to outperform bitcoin by buying contracts at defined dates into the future. During bull markets, this yield tends to increase as speculative tendencies arise, and this is a fine development as long as spot demand continues to increase. If the annualized basis is increasing significantly without a follow-up spot bid, that is a sign of an unhealthy market, which is what occurred towards the end of April.

Blow ups occur in the bitcoin futures market when there is a divergence between spot and derivatives, whether that is bullish derivative speculation with a declining spot market or vice versa, derivatives work to increase volatility and exacerbate price action, which can catch some people off guard as these dislocations are often developing under the surface, unbeknownst to most market participants.