Bitcoin Breaks New All-Time High!

As you most likely already know, the price of bitcoin has broken its previous all-time high, with the price now trading at $66,000! Throughout the summer, The Deep Dive detailed the underlying supply-and-demand dynamics which led our team to stay extremely bullish. We encourage all readers to check the archives and read for themselves.

The reason for our persistent bullishness is quite simple, and it boils down to just a couple key things:

Bitcoin is the best monetary asset humanity has ever seen, and as an increasing number of people with capital to allocate realize and understand this, the price of bitcoin must increase due to the supply inelasticity of the asset.

The incumbent financial system is irreversibly broken, and this reality is actively forcing people to seek an alternative system.

With on-chain analytics, we can quantify the supply-and-demand dynamics in real time.

Long-Term Holder Supply

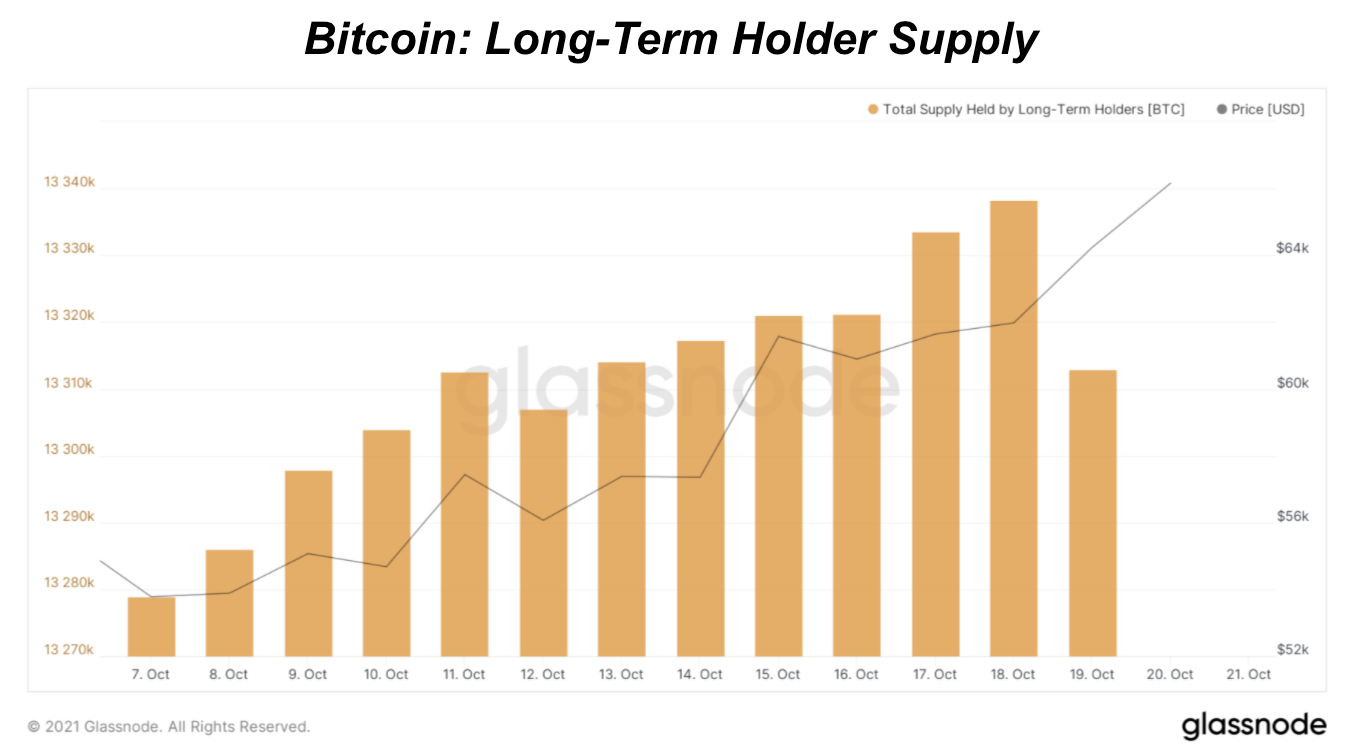

The Deep Dive has been covering the supply of bitcoin held by long-term holders with great interest, and we have another update today. Most recently, in “The Deep Dive #081 — HODLer Engineered Supply Squeeze,” we went in depth on the dynamic between long-term holders and bitcoin market cycles. In particular, we highlighted how the recent accumulation trends mirrored that of previous bear market/consolidation periods, not that of a traditional bull market, and why this was extremely bullish.

Below is the year-to-date chart of long-term supply as well as the two-week view.

The two-week chart clearly shows the first meaningfully sized downturn in long-term holder supply, so what does this mean? A week ago, when the first dip in long-term holder supply happened, this was the first reaction.

Contrary to what some might expect, this trend break in long-term holder supply looks to be a telltale sign of the start of a reflexive bull market. This is further supported by the turn in the ratio of cost-basis between short- and long-term holders.

The phase of the bitcoin market cycle where new money relentlessly bid to acquire a position while old holders distribute a small proportion of their holdings looks to be just starting, and if we can have learned anything about human psychology and bitcoin market cycles over the last decade, the price is going to explode further and faster upward than most can fathom.

Bitcoin Price Drawdowns And Recoveries

As most people who own bitcoin know, price drawdowns that are greater than 50% have been a regular occurrence after each all-time high. What we also know is that bitcoin price has proven to significantly recover from every major drawdown, which has made it the best performing asset over the last decade.

Currently we’re rebounding from a 56% price drawdown post a 228% recovery. Historically what comes next is yet another massive recovery. This double top pattern playing out is eerily similar to 2013 where price went on to explode over 10 times in just 52 days, starting in early October. As we hover around $66,000, a six-figure bitcoin price is only a 51% price move away. This is a more conserative percentage move during a bitcoin bull cycle recovery based on previous cycles.

History may not repeat itself exactly but all of the on-chain metrics, recent price action and expectations of new entrant demand, during the most bullish holder behavior in bitcoin’s history, have signaled a major price recovery underway.

At its core, bitcoin price is a function of new demand, through increased adoption, relative to the amount of limited supply available on the market. And right now, there’s just not that much supply on the market until the current holders of bitcoin find a new, higher price worth selling at. This is the free market, volatile nature of bitcoin that so many criticize playing out. Except this time the volatility is price exploding to the upside just like it has in every previous cycle.

I'm afraid of how high bitcoin can go. I want this to happen. But I'm still afraid.