The Daily Dive #076 - Mining Overview Monday

Public Bitcoin Miners Ramp Up

China’s mining exodus this year has become the biggest opportunity for bitcoin miners to capitalize around the world. Not only have we seen the network hash rate continue its aggressive recovery over the last few months, but we’ve seen mega growth in public bitcoin miner production with major mining opportunities unfolding, especially in the United States. One country’s ban is another country’s hash.

From Luxor’s Hashrate Index Quarter 3 Report, "Collectively in Q3, these miners mined 79% more bitcoin than they did in Q2 and 155% more than they mined in Q1."

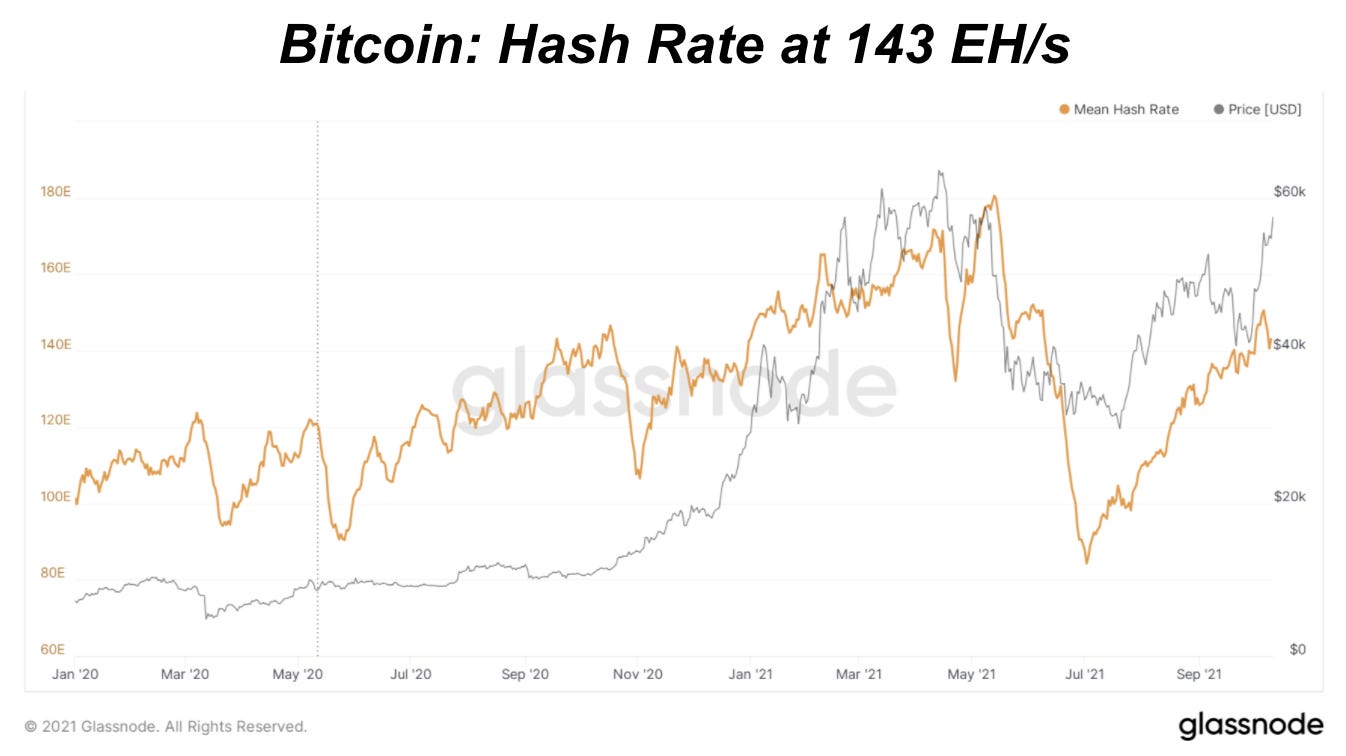

Luxor also expects global hash rate to reach previous all-time high levels in Q4 of 185 exahashes per second (EH/s; 1 exahash is 1 quintillion hash calculations), which would be a 215% increase from July lows. Currently we’re around 143 EH/s.

These public bitcoin miners above are just six of the now 24 in the growing market of a $15.82 billion industry market cap. The market cap doesn’t include Core Scientific, valued at $4.3 billion which went public via SPAC this year, or Bitfury, who announced plans to go public today valued at $1 billion.

Even without projecting increases to current valuations or tracking smaller upcoming public mining deals (i.e. Stronghold Digital Mining valued at $100 million to go public this year), the public mining industry is already valued at over $21 billion. The North American public bitcoin mining firms alone are holding over 20,000 bitcoin worth more than $1.1 billion. One major bitcoin price up could double or triple the industry’s market cap in a few months. That’s some incredible growth and upside for an industry that only had its first public miner in 2016.

Opportunity In The United States

Data from Foundry USA, one of the largest mining pools in the world with 9-10% of hash rate, shows the United States has nearly a third of global hash rate with New York, Texas, Kentucky and Georgia amongst the top mining states in their mining pool. Foundry’s latest data, presented by Nic Carter and Castle Island Ventures at the Texas Blockchain Summit, roughly estimates a doubling in U.S. hash rate using the Cambridge Bitcoin Electricity Consumption Index’s data from April 2021. Although these are different data estimates and reference points, they give us a rough idea of the U.S. hash rate picture.

China’s bitcoin mining exodus may go down as the catalyst that propels the United States to become a bitcoin mining powerhouse. Texas Senator Ted Cruz this weekend spoke about how he sees bitcoin “as a way to strengthen our energy infrastructure” and how it has the “ability to unlock stranded renewables”.

This came in the same discussion where he spoke about an enormous opportunity for Bitcoin to address the West Texas flared natural gas issues, which is home to 50% of the country’s flared natural gas. Never have we seen a U.S. politician speak to Bitcoin’s energy innovation as intelligently as this. The arguments for Bitcoin as a demand response innovation and controllable load resource are growing too important to ignore. Many are waking up to the idea that Bitcoin is an energy innovation just as much as it is an economic one.

Bitcoin Hash Rate

The bitcoin network has continued its remarkable recovery following the China ban with the hash rate (7-day moving average) now at 143 EH/s.

For some context on the remarkable growth of the Bitcoin network and hash rate, here is a mind-blowing stat: a single Antminer S19j Pro ASIC (application-specific integrated circuit) produces more hash rate than the entire Bitcoin network did in April of 2013 at the market peak.

It is important to zoom out when evaluating the pure strength and resiliency of the Bitcoin network and the physical infrastructure built around it. The amount of purpose-built hardware specifically made for proof-of-work mining with the SHA-256 hashing algorithm ensures that Bitcoin is — and will remain — the strongest computing network in the world, periodically securing over a trillion dollars worth of wealth every 10 minutes with each subsequent block.

Other Miner Statistics Updates

Total transaction fees remain very low, with just 1.92% of bitcoin miners’ revenue over the last week coming from fees. This is very low compared to early in 2021 and one can expect this number to tick up in the coming week and months with the return of retail and new money as bitcoin flirts with and eventually breaks new all-time highs in price.

Over the last week, bitcoin miners earned $49 million per day in exchange for securing the world's most dominant digitally-native monetary network. The pure simplicity and beauty of the economic incentives provided by the Bitcoin network should not be forgotten. As the world watches bitcoin’s ascent, the free market energy renaissance that will result from a global buyer of last resort for energy has otherworldly second- and third-order effects. We will continue to watch and document the strengthening of the Bitcoin network and, thus, we will report on bitcoin miners, who immutably secure the ledger in a capitalistic race that occurs every 10 minutes.

Tik-tok, next block. The Bitcoin network continues to work as designed.