The Daily Dive #071 - Speculative Attack And Realized Cap

Speculative Attack On The U.S. Dollar

In today’s Daily Dive, we revisit the concept of a speculative attack. The news of the day is that Marathon Digital Holdings, one of the largest North American bitcoin mining operations, has secured a $100 million commercial line of credit with Silvergate Bank which will be used for the acquisition of mining equipment and to cover expenses. The line of credit is secured by USD and bitcoin as collateral.

Simply put, Marathon can now borrow dollars against their bitcoin to grow their business and increase their bitcoin treasury. By doing so, they are participating in a speculative attack on the U.S. dollar: the act of borrowing a weak currency to buy a strong currency. This is the same strategy that Michael Saylor has championed with Microstrategy, covered in The Daily Dive #005 and The Daily Dive #014.

With rising inflation concerns beyond “transitory” and interest rates still held near zero by global central banks, holding fiat currency or negative yielding debt securities is a losing proposition. What can a company rationally do as a response? They can acquire the most scarce currency on the market by taking advantage of the weaker currency’s infinitely growing supply.

As a result, Marathon can continue growing their mined bitcoin holdings which have grown nearly 10x already this year.

Bitcoin as Collateral

Although we take the position that bitcoin is the best form of collateral the world has ever seen due to its scarcity, verifiability, transferability and other properties, it takes time for the market to develop a financial system that can make bitcoin collateral possible. We cover this growth and The Financialization of Bitcoin more in-depth in The Daily Dive #032.

Marathon’s financial collateral partner, Silvergate Bank, is a registered commercial bank with the Federal Reserve who has been key for banking the digital assets industry, serving Coinbase, Gemini, Kraken and over 1,224 customers. The bank had $4.3 billion in new digital currency deposits in Q2 this year, adding to their $11.37 billion total.

Silvergate has a product that provides secure institutional-grade access to USD loans collateralized by bitcoin using Fidelity Digital Assets, Coinbase, Bitstamp and Anchorage as custody partners. If you’re an institution using one of these bitcoin custody services, you can tap into the Silvergate Exchange Network using your bitcoin for U.S. dollar loans. Although the product is still in its early stages, Silvergate already has $258.5 million in bitcoin-collateralized USD loans, up 11.5x in just a year. This data doesn’t include anything from Marathon’s additional $100 million revolving line of credit.

Marathon’s announcement comes at the same time Hut 8 Mining released their monthly update today showing that they held all of their 264 mined bitcoin in the month of September. This is consistent with their commitments to hold 100% of mined bitcoin and to have over 5,000 self-mined bitcoin by the end of Q4.

With the large-scale mining operations now being plugged into the legacy financial system and with their increased commitments to HODL mined bitcoin, we’re likely to see more players join this speculative attack on the U.S. dollar. In this hypercompetitive, capitalist industry of infrastructure, other miners will have to respond to Marathon’s new capital efficiency strategy or risk being left behind.

Realized Market Capitalization

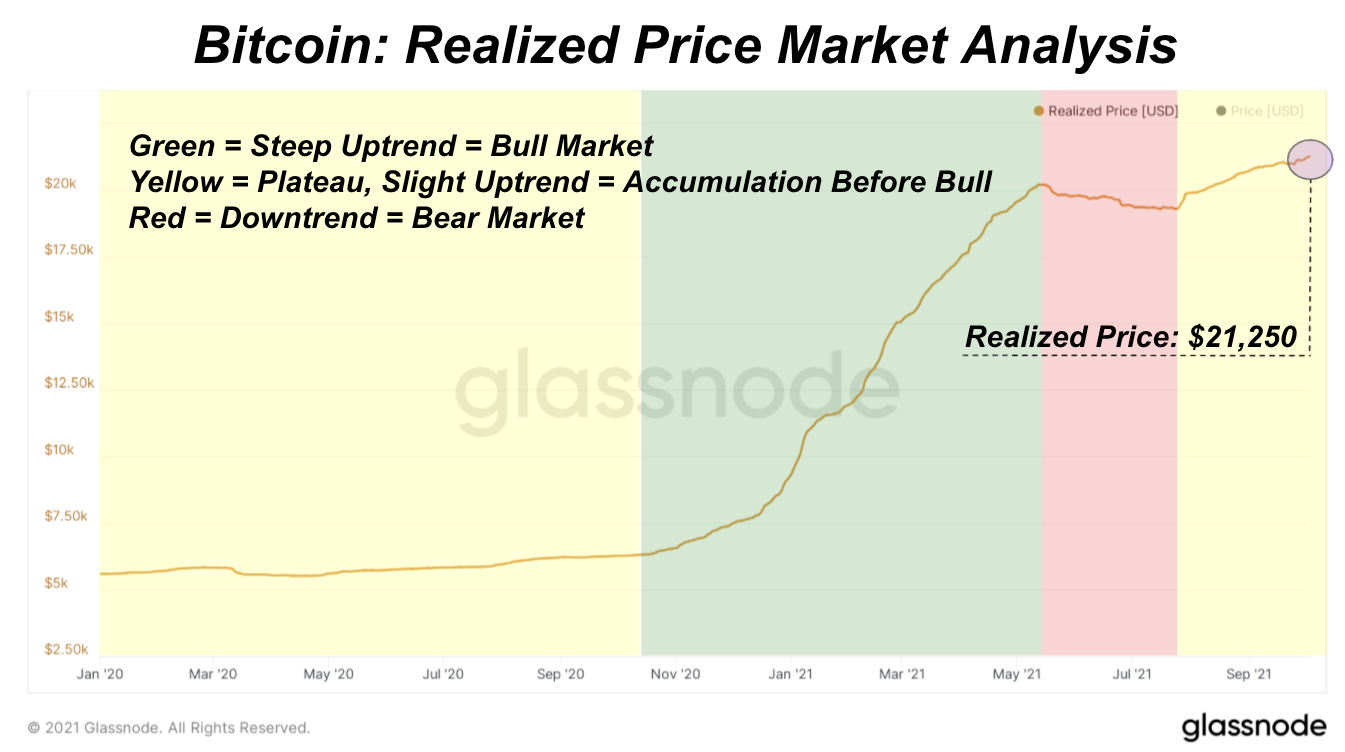

The realized market capitalization of bitcoin just broke another all-time high and surpassed $400 billion. Realized price and market capitalization is an on-chain trend we follow extremely closely in The Deep Dive, as the realized price is essentially the average cost basis for all bitcoin on the network.

With the realized market capitalization breaking $400 billion, the bitcoin realized price is at $21,250.

When analyzing the history of the bitcoin realized price, we can identify clear trends that identify the underlying market trends. First covered by The Deep Dive in July in The Daily Dive #022, realized price gives a very transparent view of the status of the bitcoin market cycle. When realized price is appreciating rapidly, it means that bitcoin is in a bull market (green). This occurs as a new wave of entrants enter the market and attempt to secure their share of the network, which places a large bid in the market.

At the same time, with price going parabolic (due to the fundamental supply/demand imbalance) old holders take some chips off the table and the dynamic of coins switching hands leads to a rapid appreciation of realized price/cap.

Conversely, during bear markets (red), the realized price trends downwards as coins are spent at a loss (compared to when they were originally acquired). It is important to note, however, that the realized price falls far less proportionally compared to the market price/market capitalization, which was subject to the reflexive phase of the bull market.

Lastly, during the accumulation phase (yellow) of the market cycle, you will see realized price stay stagnant or rise slightly as coins are transferred from weak hands to strong hands, from speculators to convicted hodlers.

Although some may argue that we have been in one constant bull market since the halving in May of 2020, when looking at realized price trends we observe a bull market from October 2020 to May 2021, a brief two month bear market and now a reaccumulation phase before the next parabolic bull trend.

Some may argue that the recent upwards trend reflects that bitcoin is structurally in a bull market, however, it is important to note the slope of the uptrend in logarithmic scale is the true reflection of a bitcoin bull run. When viewed in linear scale (the chart above) for perspective, it may look like a bull market, but in logarithmic terms with a multiple cycle view it is clear that we are in the accumulation phase, coiling up for the next parabolic bull market move. The arrows below display the slope of realized price during each market phase.