The Daily Dive #069 - Global Energy Crisis And Miner Effects

Global Energy Crisis Taking Off

There’s a global energy crisis starting to play out that started with European natural gas and it’s now coming for the rest of the world. With European natural gas inventories at historically low levels and Russia deciding to pump less natural gas to the region, market concerns of a shortage sent prices soaring.

At the same time, China has been cracking down on coal usage while growing their demand for natural gas with bigger goals to reduce carbon emissions. Because of these efforts, resulting coal shortages and surging prices have led to power outages across China’s main manufacturing hubs. It’s gone so far that China is limiting electricity use in more than half of their mainland provinces. This comes at the worst possible time for manufacturers who are still facing pandemic supply chain bottleneck issues ahead of the highest global consumer demand period of the year.

Coupled together with Europe’s crisis, the natural gas shortage is now a global energy market concern and a rising inflation concern. Sustained increases to global natural gas markets heading into winter would bring along inflationary pressures as heating bills rise, as industrial users' costs of production rise (leading to price increases) and as agriculture fertilizer input costs rise (leading to food price increases).

Impacts are also hitting the United States and United Kingdom oil markets, sending WTI Crude and Brent Crude prices surging 7% in a week where they now sit just under $80, the highest price in three years and a key psychological resistance level.

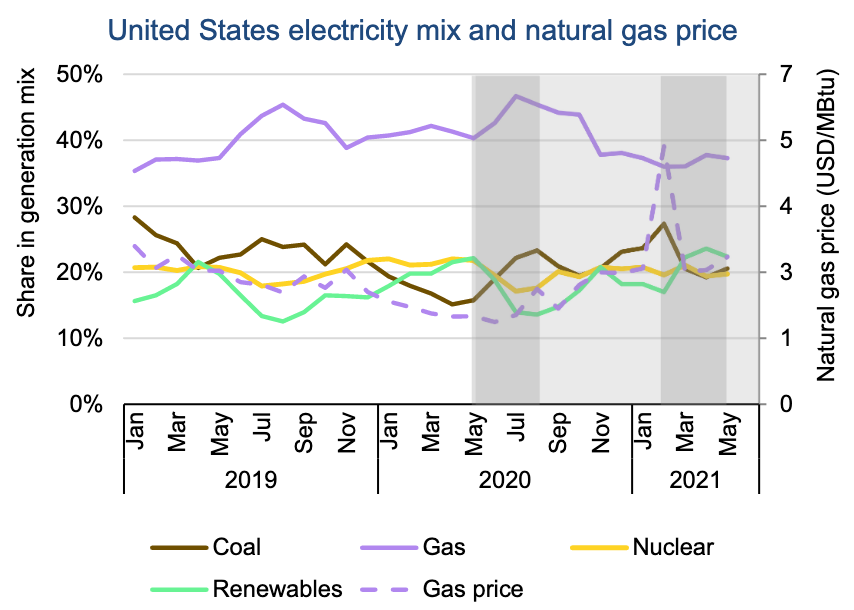

Natural gas futures are now pricing at $5.83 per million Btu (as of writing), which is the highest price we’ve seen since 2009. For context, natural gas accounts for 40% of the United States’ electricity generation mix. The “transitory” inflation narrative is now starting to look like it will make its transition to energy price concerns over the coming months.

Downstream Effects On Bitcoin Mining

When evaluating possible downstream effects on bitcoin mining, it is critical to understand that due to its extremely competitive, global nature, bitcoin mining is overwhelmingly conducted using excess or waste energy. What this means is that even though energy prices such as natural gas are going parabolic in various regions, bitcoin mining operations which are connected to energy grids are used as load-balancing systems. Said simply, when the demand for energy surges and energy prices on the grid increase above the price that energy suppliers can get from selling energy to the bitcoin network, the miners simply switch off until the economics align for the machines to turn back on again.

While this is the model for bitcoin miners operating on the grid, increasingly mining operations operate entirely off the grid using wasted energy such as methane and natural gas. For these operations, the marginal demand for the energy is often zero and thus the profit margins remain extremely large regardless of the price of bitcoin or the hash rate.

However, assuming a global energy shortage was in the works, what would it mean for bitcoin miners? Looking at miner revenue per hash in dollars tells quite the story.

Due to the increasingly competitive nature of bitcoin mining, the ever-increasing hash rate and the declining block subsidy, miners’ dollar-denominated revenue per hash has declined in an exponential manner over time. For context, a unit of hash would've fetched you approximately 51 times the amount of dollars back in December 2017 than it would've in July 2020. This is due to the relentless increase in hash rate while the price of bitcoin drew down 50% along with the halving decreasing the supply issuance from approximately 1,800 BTC/day to 900 BTC/day.

Okay, so what does this all mean? What relevance does this have in terms of the global energy crises that may or may not be developing currently?

In simple terms: Bitcoin is the most resilient, antifragile economic machine ever built. Due to the difficulty adjustment, it will always be profitable to sell energy to the Bitcoin network. On a dollar per hash basis, it is 4.2 times more lucrative to sell energy to the Bitcoin network today than it was in July 2020.

Thus, even with a sustained rise in energy prices across the world, we know a couple things for certain:

People will scour the Earth for the lowest cost energy sources — which often have zero market value due location — to mine bitcoin due to economic incentives alone.

Subsequently, blocks will continue to be mined and even with a sustained increase in energy prices globally (which is highly unlikely to happen in a uniform manner across the board), the worst-case scenario is that miners who can’t source cheap power will shut down, but then mining difficulty will simply adjust downwards to incentivize miners to join the network once again.

That’s the power of incentives.