The Daily Dive #068 - Bitcoin’s Private Property Rights

Berlin Votes To Seize Real Estate

In Berlin, Germany, a growing shortage of affordable housing coupled with increased demand to live in the city has reached a boiling point. Today, voters took part in a referendum on whether to force large real estate companies to sell off most of their housing units, turning them into socialized public housing.

The "yes" vote garnered 56.4% while the "no" vote received 39% in the non-binding referendum. The passing of the referendum will require incoming Berlin city-state government officials to debate the proposal.

With social unrest like this gaining momentum that may destabilize real estate private property rights in one of the world’s most popular cities, it points to yet another reason why bitcoin’s private property rights are so important and superior to any asset ever known. The invention of bitcoin has offered us many innovations with the evolution of private property rights at the top of the list.

Bitcoin’s Superior Private Property Rights

For the first time in history, bitcoin offers us a property option that does not rely on a local authority or legal system to enforce or protect it. It’s protected by the natural incentives of those participating in the network.

“Satoshi Nakamoto has created a form of property that can exist without relying on the state, centralized authority, or traditional legal structures.” - Eric D. Chason, How Bitcoin Functions as Property Law

It provides us with a store of value and savings technology where no government, central institution or voting bloc can seize, freeze or access it through violence or force when properly secured. Anyone in the world with an internet connection can secure this property without permission, and no other person or institution may take it away or erode its value. Whether it’s real estate, cash, equities, bonds, or gold, no other asset on the market provides this level of assurance and security.

What we know of strong, well-defined property rights is that they are the basis of human cooperation and economic activity. When private property rights flourish, so do the people. When we look at the nations of the world with the lowest ranking of property rights, we also find some of the key regions where bitcoin is making its mark.

Bitcoin’s Security Budget

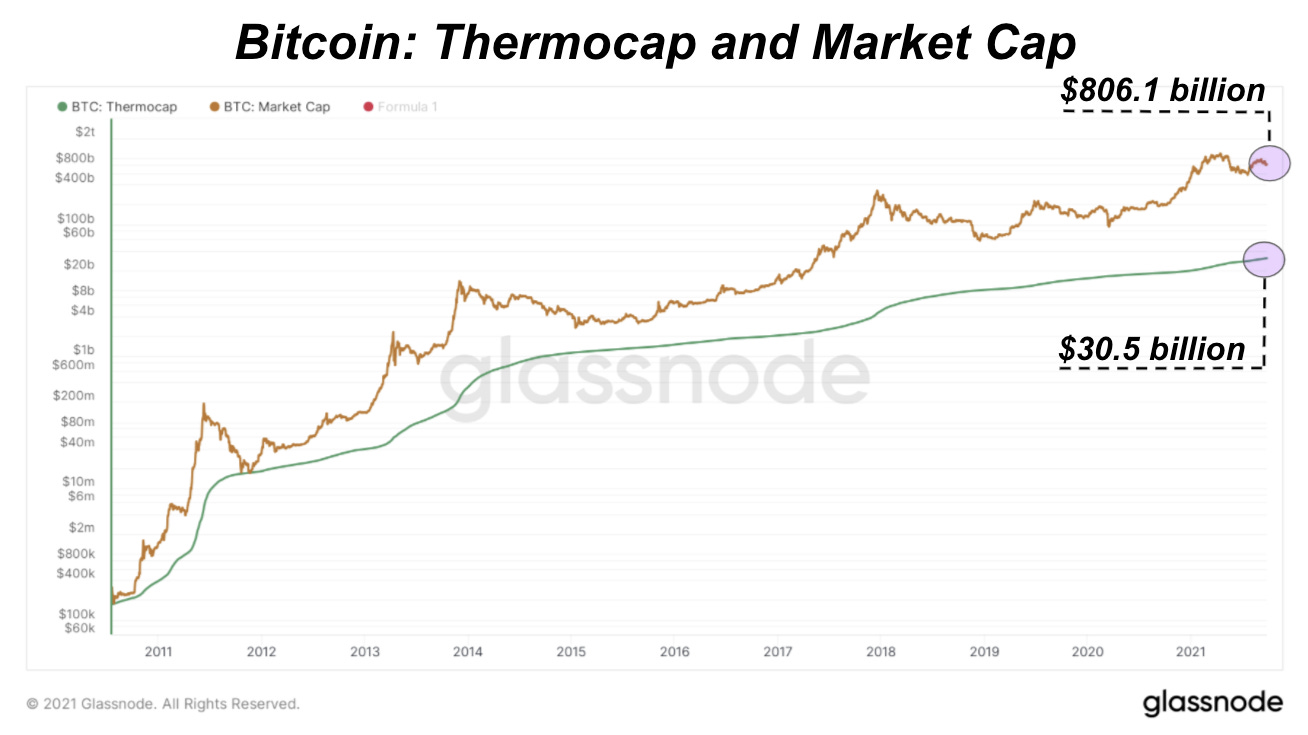

When taking a look at the thermocap of bitcoin, which measures the aggregate amount of bitcoin paid out to miners multiplied by the price of said coins in dollars at the time they were mined, you can quantify the total “security spend” throughout the history of the network.

One could think of this as $30.5 billion having been spent to protect $800 billion worth of assets (at the time of writing). The inherent problem with comparing this number with other assets is that bitcoin is the most transparent asset in the history of the world, whereas the costs of the United States Treasury market would involve the costs associated with the U.S. military, various regulatory bodies and regimes and the U.S. legal system.

The beauty of bitcoin is that property rights are inherently built into the protocol itself via public and private key cryptography, with miners providing a wall of security in terms of hash rate ensuring that the ledger remains immutable.