The Daily Dive #061 - Bitcoin Mining Industry Overview

Last Deep Dive Mining Industry review: #044 Mining Industry Overview

In today’s Daily Dive we will take an in-depth look at the mining industry. Bitcoin mining is incredibly competitive on a global scale, as operations ruthlessly look to gain an edge over competitors by upgrading their hardware as well as sourcing lower-cost power.

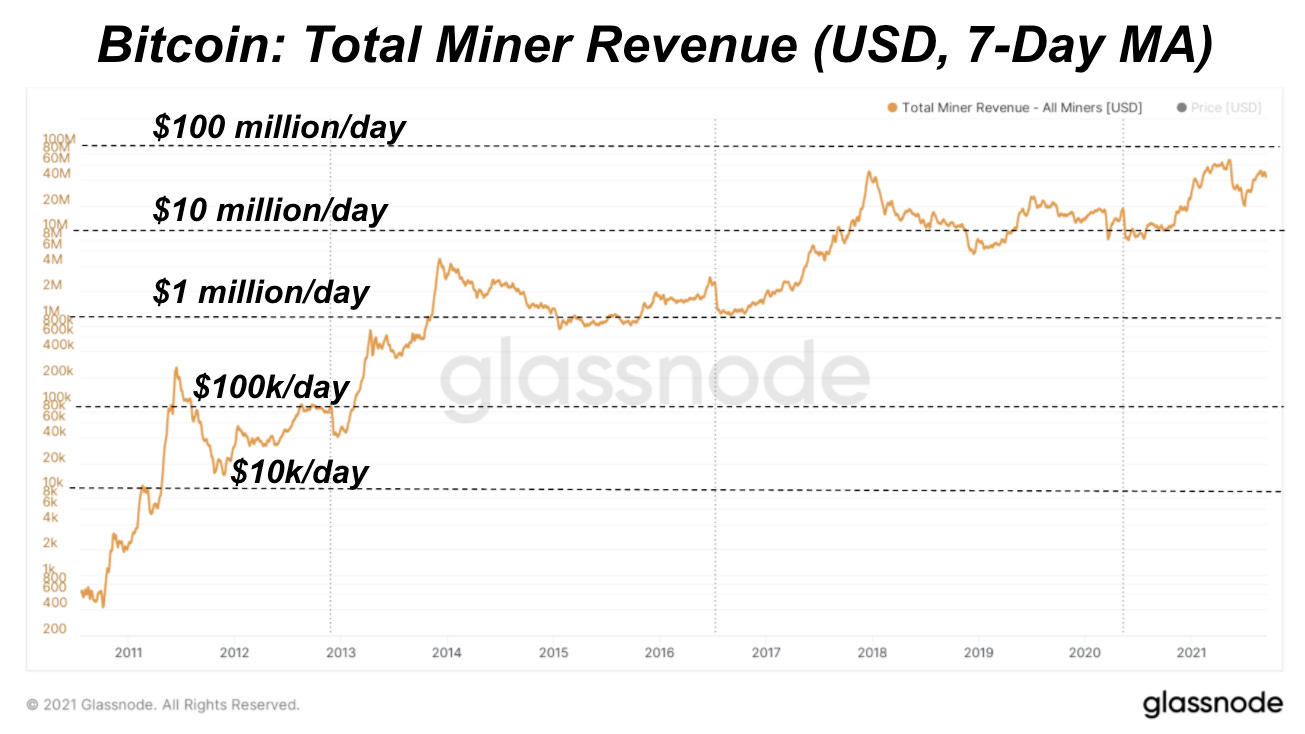

As the Bitcoin network bootstraps around the world, miner revenue (in USD terms) continues to rise.

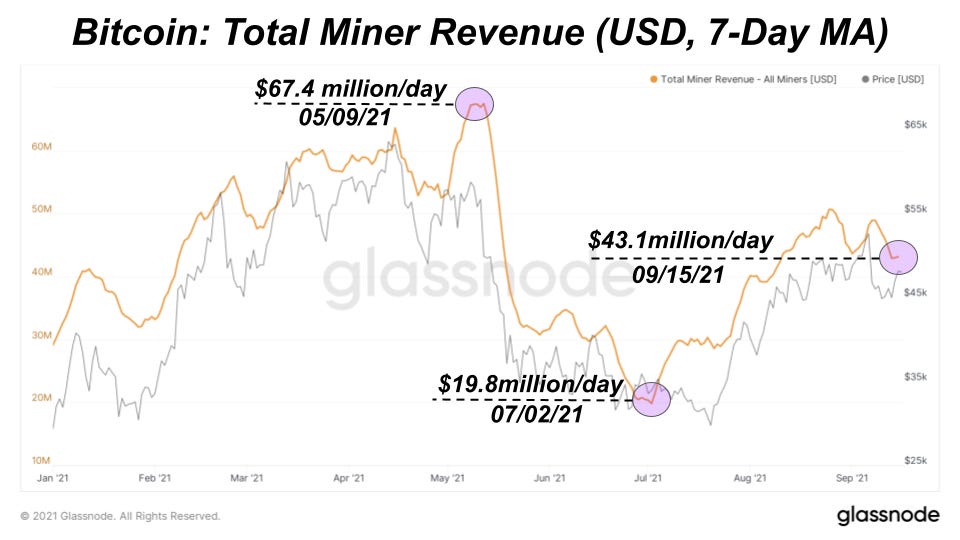

Examining more recent data, bitcoin miners have earned $43.1 million per day on average over the last week, which is more than double the yearly low of $19.8 million per day made back on July 2.

Going further, if we examine the relationship between miner revenue and hash rate, a very interesting and powerful trend emerges. Over time, miner revenue (BTC) per hash has declined in exponential fashion. In other words, it has become increasingly competitive over the last decade to mine bitcoin, and the later you enter the game, the more challenging it will be to acquire BTC for the same amount of hash (all else being equal).

A similar trend can be observed when changing the denomination of miner revenue from BTC to USD. Over time, it has become increasingly competitive to mine for bitcoin as the amount of revenue you can acquire per hash continues to exponentially decay over time.

However, interestingly enough, over the last 12 months this trend has reversed in a major way, due to the major run-up in the price of bitcoin, and the lack of corresponding response of an increased hash rate. Currently, miners are 4.77 times more profitable than they were in the middle of September last year from a revenue per hash perspective.

This can be attributed to a myriad of things, the two most notable causes being:

1) The COVID-19 economic lockdowns breaking down supply chains making it nearly impossible for chip manufacturers to complete deliveries on time and target, causing a major shortage of new ready-to-deploy ASICs.

2) The CCP crackdown on bitcoin miners forcing an estimated 50% of the network to pick up and move on a brief moments’ notice, which caused hash rate to drop significantly, which served as a boon to competing mining operations following multiple downward adjustments in miner difficulty.

This large (and possibly sustained) increase in miner profitability on a per-hash basis is one of the bigger bull cases for the publicly-traded miner industry going forward.

Extreme Low-Fee Environment

Despite the extremely favorable environment for bitcoin miners, fees to transact across the Bitcoin network have been near nonexistent. While this is not cause for concern for bitcoin’s security model today, due to the block subsidy remaining a hefty 6.25 BTC for the time being, a measly 1.5% of miner revenue has come from fees over the last two weeks.

Led by the 50% price sell-off in May this year, transaction counts and subsequent fees from those transactions have plummeted to 1.5% of miner revenue. Although transaction batching, increased SegWit adoption and growth in the Lightning Network are some of the smaller reasons for the decline, the main point is that there are just less users transacting on the network post price correction. As the bull picks back up in the late months of 2021, we expect this trend to change and for demand for blockspace to increase, subsequently raising transaction fees in the process.

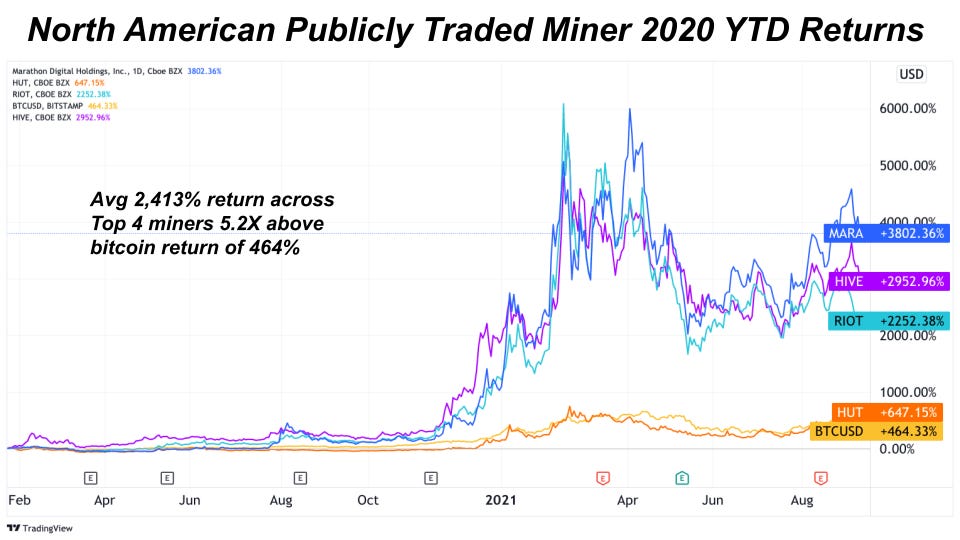

Miner Stocks Outperform Bitcoin Short Term

For those looking for indirect bitcoin exposure or value investment bitcoin opportunities in the public markets, holding North American bitcoin miner equity is where to get it. Of the top four publicly-traded North American miners (Marathon Digital Holdings, HUT 8 Mining, Riot Blockchain, Inc and HIVE Blockchain Technologies), average YTD returns are up to 140%, versus bitcoin returns of 49%. HODLing bitcoin still remains the best long-term option for most, but we’re clearly seeing a trend of effective bitcoin miners outperforming bitcoin returns over the last two years.

Zooming out to include the start of 2020, average returns across these miners are 5.2X above bitcoin’s returns of 464%. Collectively they hold a $9.18 billion market cap.

When we take a deeper look at quarterly and monthly miner updates, we see a broader narrative forming with the most successful miners trying to do two things — rapidly scale up production, and increase their HODLing supply.

Looking at Marathon, their monthly bitcoin production increased 6% in August bringing their total bitcoin holdings to 6,695 BTC. Of their bitcoin holdings, 4,812 BTC were purchased in January 2021 for an average price of $31,168. Like many bitcoin miners, Marathon continues to expand their bitcoin treasury, keeping the business well capitalized and ready to deploy the assets if ever needed.

As of August 31, Riot held approximately 3,128 BTC, all of which were produced by its self-mining operations. By Q4 2022, Riot anticipates achieving a total hash rate capacity of 7.7 EH/s with a fully-deployed mining fleet of 81,146 Antminers. Marathon also expects to have a mining fleet of 133,000 machines deployed by the middle of next year, and they look to be on track with 21,584 miners secured as of September 1.

What we’re seeing play out in the bitcoin mining world is a pure capitalist market in a race to scale up operations, drive down costs and drive up profit margins, with the goal to secure as much bitcoin supply as possible. Yet, many mainstream investors have not woken up to the mining industry dynamics and the risk/reward upside to holding miner equity as bullish price scenarios continue. Few have thought through what a 5-10X move in bitcoin price would do for these companies' balance sheets, earnings and overall share price. Many have yet to think through the nation state game theory that will play out as new players emerge such as the country of Laos legalizing bitcoin mining just last week.

Fidelity, Vanguard, Charles Shwabb, Blackstone and BlackRock have all taken relatively small mining positions over the last year. We’ve only seen the beginnings of the large-scale bitcoin mining operation industry really start to take off.