The Daily Dive #060 - 85% of All Bitcoin Hasn't Moved in 3-Months

The Evergrande Group’s stock is now down 81% year to date as their liquidity crisis deepens. With nearly $300 billion in debt obligations, Chinese major banks have been notified that Evergrande, China’s second largest property developer, won’t be able to pay any of their loan interest due on September 20.

This certainly looks to be the start of a fractional reserve monetary system, built on the backs of massive debt and easy credit, breaking down. Evergrande is one the world’s most indebted companies, levering up through the years to continue expansion into the world’s hottest property market. But now, the party is over and the debt bill needs to be paid. Evergrande can’t sell off assets fast enough to even cover their interest payments.

This is the dark side of a debt-fuelled fiat monetary standard starting to unwind. Now China is left with options quite similar to those that the United States faced with Lehman Brothers back in 2008 (dissolving $600 billion in assets): bail out Evergrande through restructuring the debt in efforts to limit potential economic contagion effects, or have them fail into bankruptcy leaving investors with the bag while hurting millions of Chinese homeowners?

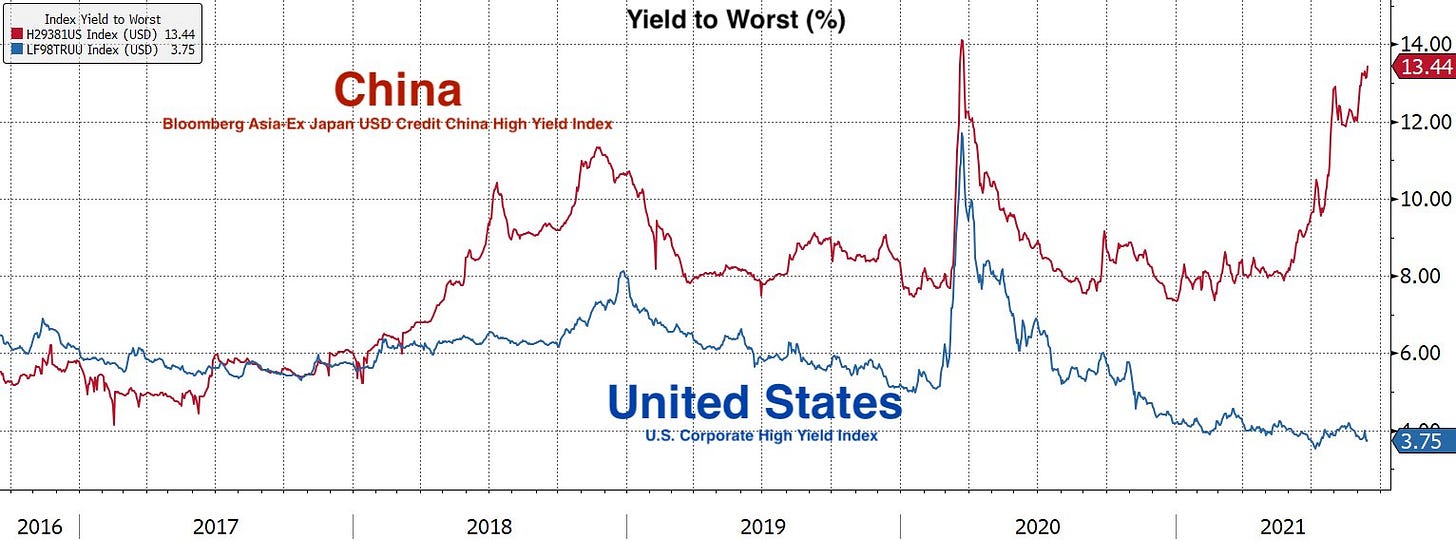

We wait to see what type of spillover effects this will have on the broader Chinese economy and global markets. As of now, China junk dollar bond yields are reaching similar levels to what we saw during the height of the pandemic concerns in March 2020.

The offshore dollar market is among the biggest causes for concern in the global economic system, as dollar-denominated debt offshore is oftentimes out of the reach of the Federal Reserve. A financial market contagion potentially sparked by Evergrande would ignite a global dollar short squeeze, which would crash financial markets touched by the dollar, bitcoin included. Below are high-yield corporate credit spreads (U.S. junk bond yields minus the 10-year Treasury yield) and the S&P 500 VIX:

The VIX is a measure of forward thirty-day implied volatility, and spikes in the index are accompanied by large sell-offs and periods of illiquidity in the equity index, but more broadly financial markets as a whole. While U.S. high-yield credit spreads are still near all-time lows, the Evergrande situation and subsequent spillover could quickly change this. Ultimately, this would have to be resolved by governments and central banks similarly to how all credit crises are resolved: currency debasement and debt monetization (read: money printing).

For comparison, here are yields in the Asian junk bond market versus the United States junk market:

We will be monitoring this situation closely in upcoming Deep Dive research reports.

HODL Waves Bullish As Ever

We have been covering the bullish bitcoin supply dynamics extremely closely over the last few months, as we believe this to be the fundamental driver of price action in this market. The monetization process of bitcoin unfolds as adopters acquire bitcoin for a price that they believe to be undervalued and hodl until this is no longer believed to be true. This act reduces the free float or supply available on the market, and as additional participants also wish to hold the asset, less satoshis are able to go around. Simple supply and demand tells us that only one thing can occur: the price of bitcoin rises.

Today we will review some recent HODL waves data for an up-close view on hodler activity.

The percentage of the bitcoin supply that has moved within the last three months is tied for an all-time low, with the other instance occurring at the bottom of the 2015 bear market. Said differently, 85% of the circulating bitcoin supply has not changed addresses in the last three months, an all-time high (tied with the instance in 2015).

Below is the same data but viewed in opposite ways:

Similarly, supply last moved more than five years ago has hit an all-time high, coming in at 22.76% of circulating supply. While undoubtedly some of this can be attributed to lost coins (see: increasingly-large purple band of supply last moved greater than 10 years ago), nevertheless this contributes to the supply-side dynamics currently playing out in the market. The supply of coins that have not moved in over 10 years is approximately 2.25 million BTC, and a large proportion of these coins can be presumably counted as lost, including Satoshi’s estimated 1 million plus BTC stash (which have never moved).

The bitcoin thesis is simple:

We are witnessing the rise of an emerging global monetary asset, the likes of which none of us have ever seen. The monetization process of bitcoin is an opportunity that only presents itself once, and from a game-theoretic perspective, your only choice is to play (acquire and HODL bitcoin).

Situations like Evergrande and any potential spillover effects that result are potential blips in this process (any sell-off in legacy financial markets will unfold similar to March 2020), and could possibly present extremely attractive buying opportunities.

This is not our base case, but it is something to watch going forward.

Stack sats, or someone else will.