The Daily Dive #055 - Evaluating Bitcoin Versus Ethereum As Settlement Networks

“We need to move NFTs onto the Layer 2 ecosystem to cut fees. However, doing that *right* requires good cross-rollup portability standards, so the ecosystem can avoid getting locked into one particular L2.” - Vitalik Buterin, Creator of Ethereum

Many people are familiar with the recent NFT craze that has occurred over the recent months, with digital images of rocks and pixelated characters selling for millions of dollars. Bubble, fad, or the start of something much bigger? That, we cannot know, and we aren’t going to discuss the validity of NFTs as an investment (read: speculation) in today’s Daily Dive, but rather we are going to dive into the comparison of bitcoin versus ether as monetary settlement networks, as Ethereum proponents have attempted to frame ETH as “ultrasound money” increasingly over the course of 2021.

Today, we will examine various metrics comparing the volume and efficiency of settlement on the base layer of the Bitcoin and Ethereum networks.

The first thing that is key to distinguish is the difference between transfer volume and change-adjusted transfer volume.

For an in-depth description of how change outputs work, click here.

When looking at total transfer volume across the base layer of the Bitcoin and Ethereum networks, the seven-day average for transfer volumes are as follows:

BTC: $168.5 billion

BTC (change adjusted): $41.8 billion

ETH: $8.7 billion

Below are the charts in both linear and logarithmic scale:

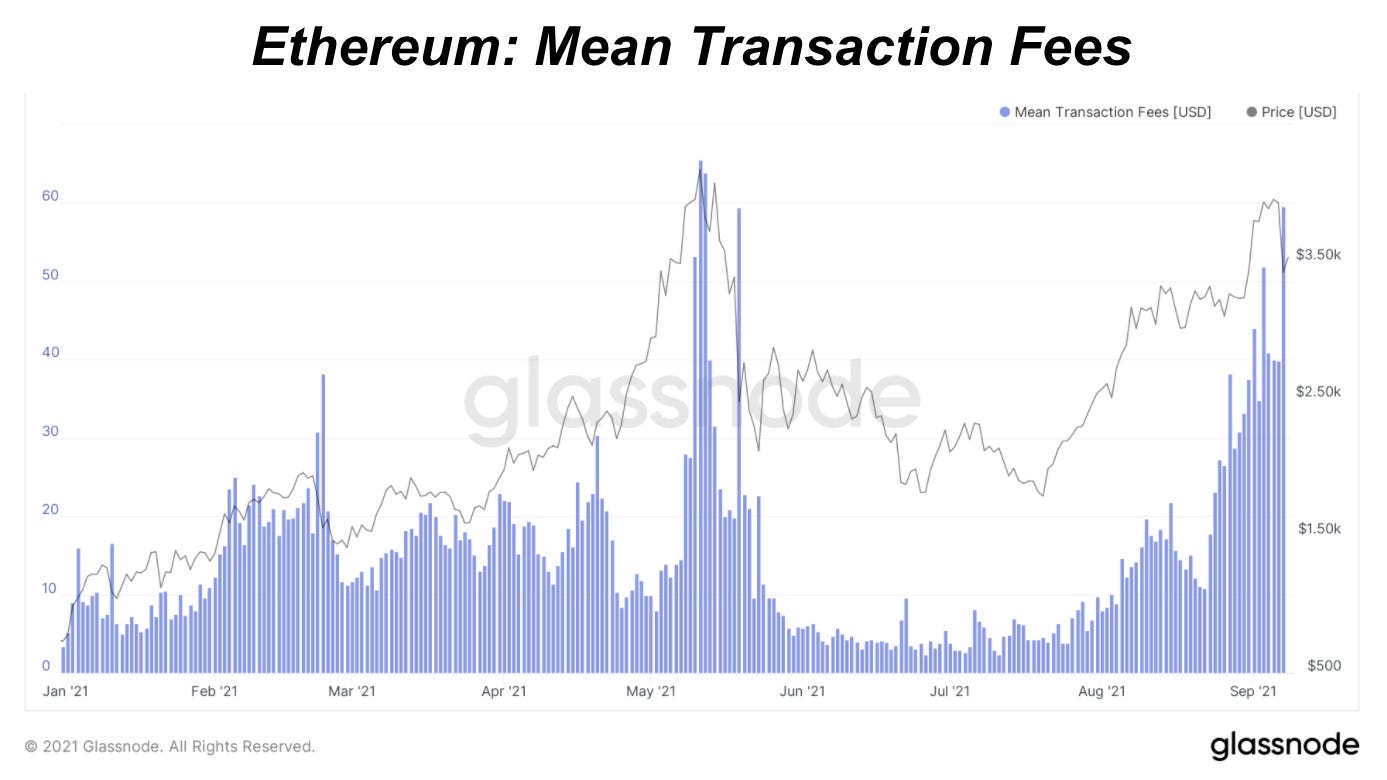

Here is the comparison of the average daily fees on the base layer of both blockchains over the last week:

BTC: $0.8 million

ETH: $54.3 million

When comparing the efficiency of settlement (total daily value transfer divided by daily fees) of the two blockchains, the comparison couldn't be more clear.

Bitcoin is purpose built for one thing: value storage and settlement. It is the world's first and only perfected monetary settlement network, and it is actively scaling to serve the entire globe.

Below is the comparison of settlement efficiency (total daily value transfer divided by daily fees) between the two blockchains (higher value equals greater value settlement efficiency):

BTC: 206,989

BTC (change adjusted): 51,428

ETH: 160

The sake of this argument is that when one makes the attempt to proclaim that Ethereum is “ultra-sound” money, they are in fact ironically overlooking that with ETH, by the very nature of attempting to do so many different things on the base layer of the protocol (ICOs, DAAPs, DeFi, NFTs, etc.), transacting on the ETH network becomes extremely costly, which ultimately prices out the lower-value use cases on the protocol. Given the fact that the highest-value use of a blockchain is money, you are then stuck with an extremely inefficient monetary network that is attempting to be used for various other purposes.

As a prime example of this, let's look at fees to transact on the Ethereum network during yesterday’s market crash. During the height of the crash, average transaction fees on Ethereum’s network reached as high as $350 per transaction, as demand for blockspace skyrocketed. This means that during peak market distress, if you needed to move value for any reason (i.e., to over collateralize or enter/exit a given market) you would be needed to pay on average $350 to do so.

Bitcoin is the world’s most efficient monetary network, and it isn’t particularly close.