The Daily Dive #048 — Long Term Hodler Supply Hits All-Time High

Long term holder supply has hit a new all-time high as the relentless spot market accumulation continues.

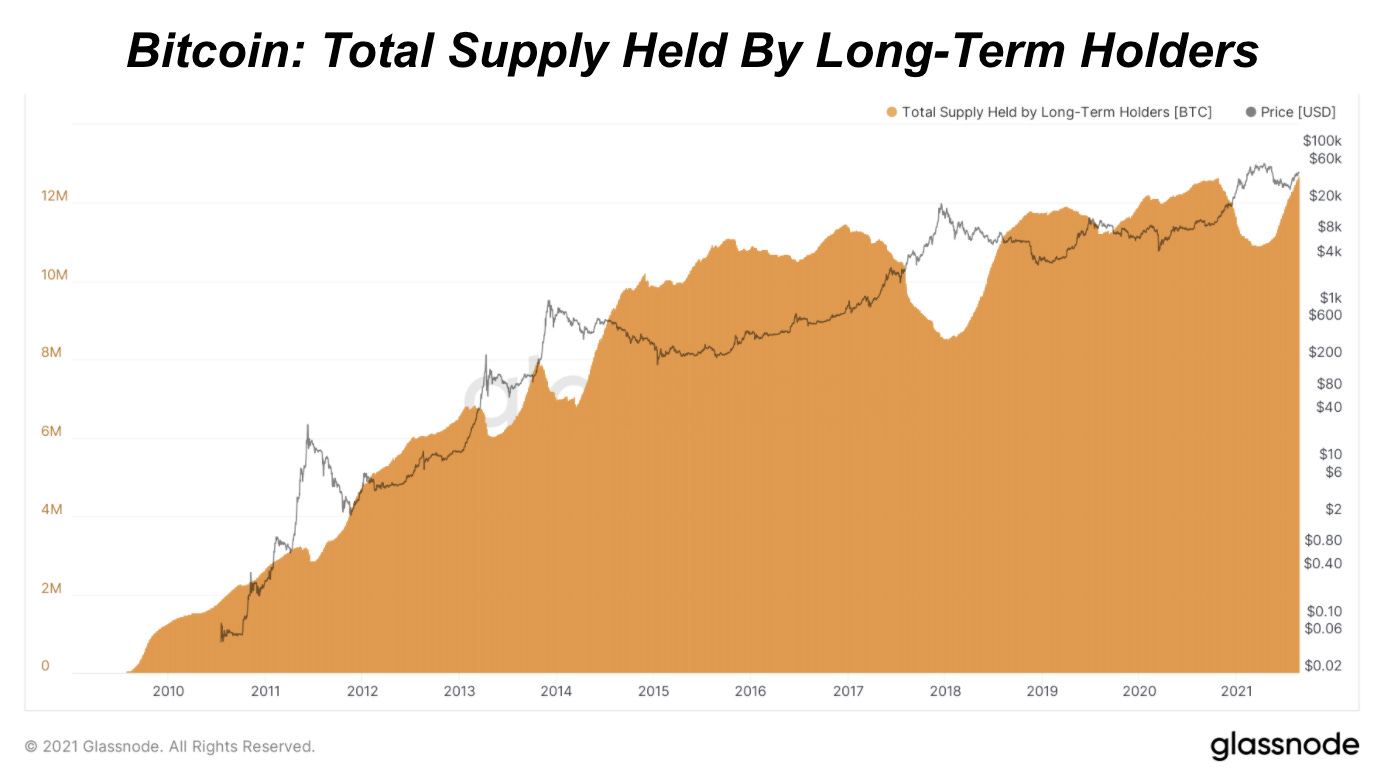

The total supply held by long-term holders hit an all time high of 12,656,092 BTC on October 19, 2020 before gradually drawing down over the following four months as new capital poured into the asset.

Long-term holder supply bottomed out on March 17, 2021 at 10,903,459 BTC, and started to steadily increase before a sharp acceleration following the mass market liquidations that occurred in May. With bitcoin more than 50% below its all time high, convicted market participants began to step in and accumulate bitcoin at a feverish pace. Today, long-term holders control 12,711,385 BTC and have accumulated 460,078 BTC on a net basis over the last 30 days.

When mapping out the percentage of the circulating supply held by long-term and short-term holders, it can be seen that hodlers are the ones who set the price floor. During pullbacks or periods of consolidation over the past decade, long-term holders take advantage by accumulating more of the circulating supply, essentially setting the price floor in the process.

In fact, recent history shows a pretty strong correlation between long-term holders increasing their holdings and bearish price action. Does this mean that this is a bearish signal or perhaps does this mean that, despite the 70% rally off of the lows over the last 35 days, the “smart money” is feverishly accumulating because they sense what is to come?

We suspect the latter. Feverish accumulation. Supply squeeze.

The rest of 2021 will bring fireworks. The Deep Dive’s call from late July stands.

A bitcoin all-time high over the next two months looks increasingly probable.