The Daily Dive #044 - Mining Industry Review

In previous Daily Dives we covered the mass exodus of bitcoin mining operations out of mainland China following the regulator crackdown.

In particular, we highlighted how bullish of a tailwind this was for North American miners. In The Daily Dive #021 - North American Miners Arise As Big Winners published on July 13, we said as follows:

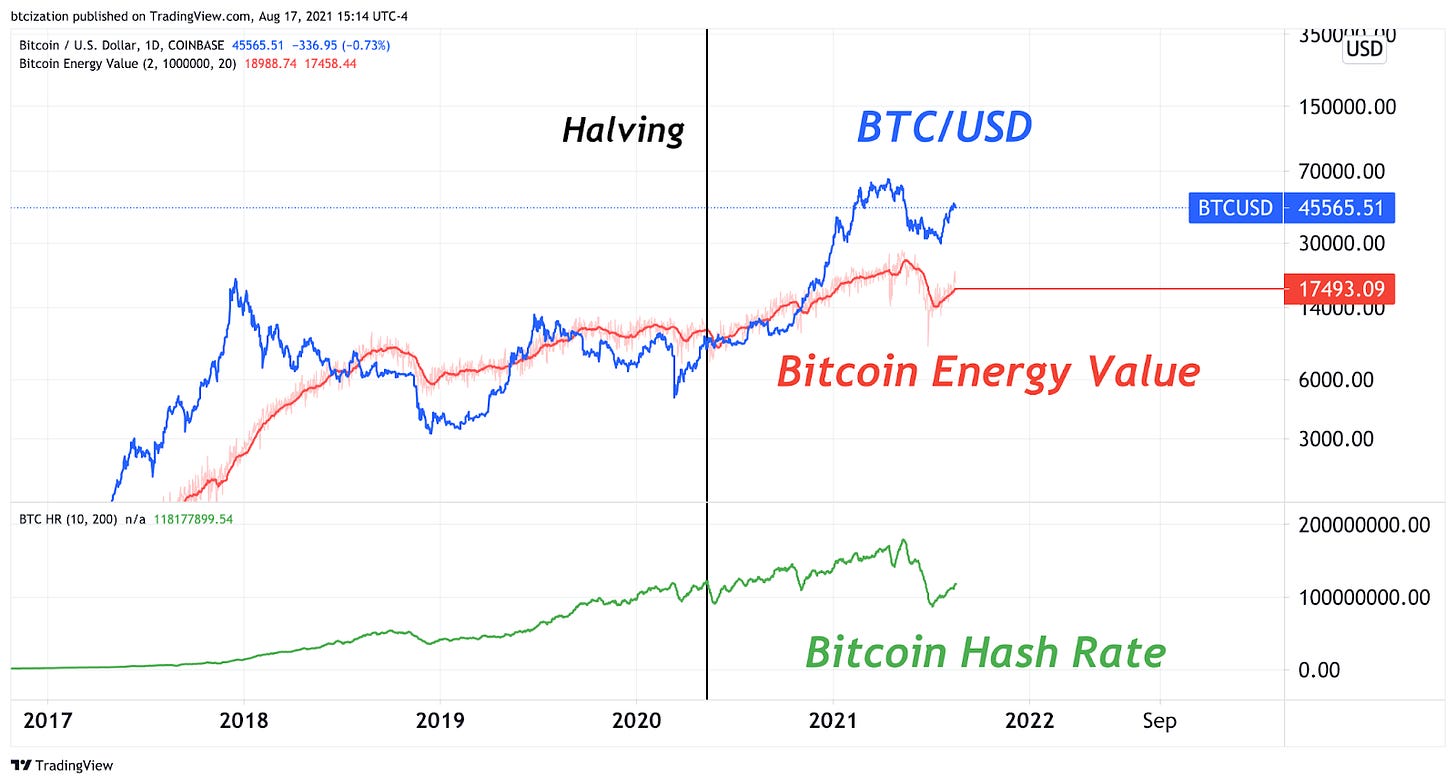

“The last time there was a disconnect of this size between the production cost estimated by the energy value indicator and the price of bitcoin was in December 2017, at the peak of the cycle, when the price of bitcoin briefly touched $20,000 while estimated energy value was about $2,300, but this was due to the parabolic increase in price instead of a fall in hash rate, which is what has occurred recently.

“What we can broadly take away from this is that we are currently witnessing one of the most profitable times to mine bitcoin ever, and industry stakeholders will not let this gift go to waste.

Some of the biggest winners of the mass mining migration: North American Miners.” - The Daily Dive #021 - North American Miners Arise As Big Winners

Since then, a number of North American publicly traded bitcoin miners have published their quarterly results, and they posted quarter over quarter increases in bitcoin mined across the board.

Bitfarms (BITF), mined 758 BTC over the course of the quarter compared to 598 BTC the quarter prior.

Hut 8 (HUT) mined 553 BTC over the course of the quarter compared to 539 in the quarter prior.

Marathon Digital Holdings (MARA) mined 654 BTC compared to 192 the quarter prior.

Riot Blockchain (RIOT) mined 676 BTC over the quarter compared to 491 BTC in the quarter prior.

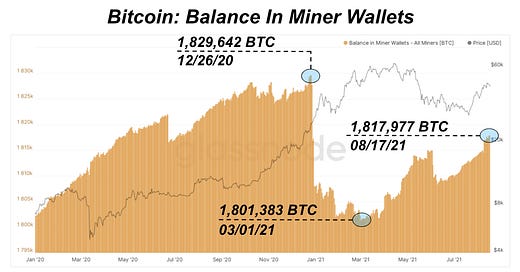

Miner Bitcoin Wallet Balance

Since March, the total bitcoin in miners’ wallets has been on the rise and is making its way towards the 2020 high of 1,829,642 BTC. The substantial decline in hash rate that followed the intervention by the Chinese Communist Party has been a gift for all other miner industry stakeholders, due to the substantial decrease in miner difficulty.

Over the last thirty days, miners have accumulated 5,357 more BTC than they have transferred, in an increasingly-bullish trend that reduces sell pressure across the broader bitcoin market.

A different view of this trend can be observed in daily miner net transfer. Following the large outflow from miner wallets in late December and early June, netflow from miners has been minimal. This can be partially attributed to the low cost of production that miners have for bitcoin across the industry.