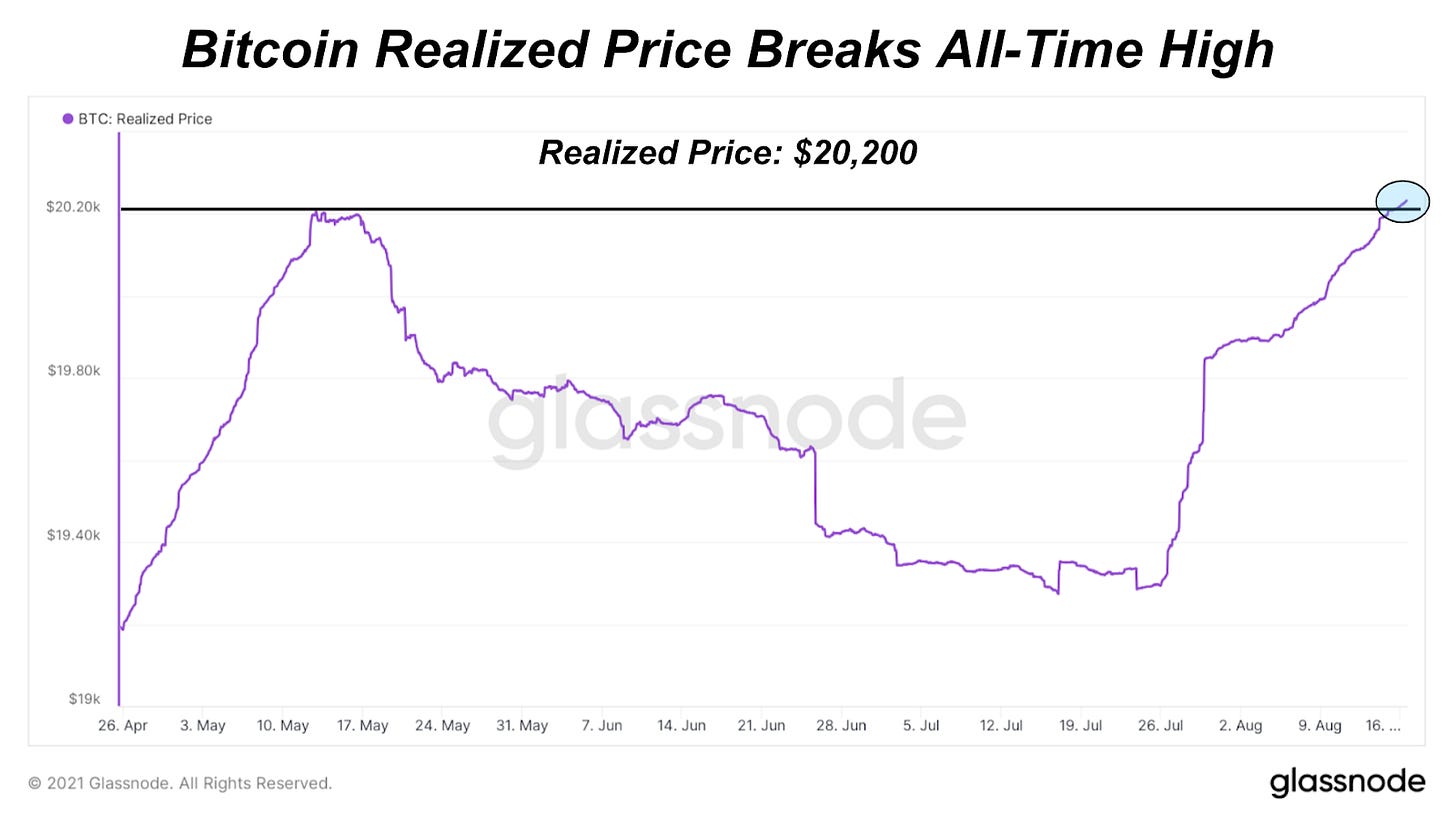

The Daily Dive: #043 - Realized Price Breaks All-Time Highs

The realized price of bitcoin has broken its all-time high made on May 12 earlier this year, with the metric currently at $20,200. Realized price measures the value that every UTXO on the network last moved to calculate the price of bitcoin.

Whereas the market capitalization of bitcoin is calculated by multiplying the circulating supply by the spot price, the realized capitalization takes every “coin” on the market and uses the price at which the coin (or more technically: UTXO) last moved in the calculation. Thus, the realized price is simply taking the realized capitalization and dividing it by the circulating supply.

Realized price can often provide more signal as to investor activity on the network, as it quantifies that bitcoin is actually exchanging hands, and that price is not just being bid up on the margin via the derivative markets, or by whales wash trading.

In the Daily Dive #022, we covered the trends surrounding realized price as bitcoin pulled back 50% from the all-time high, pulling down realized price with it, as class of 2021 investors capitulated in a major way.

When looking at the history of realized price, interesting patterns emerge in different market phases, and sustained drawdowns in realized price are not a positive sign.

“It is very possible that realized price could follow a pattern similar to the 2013 cycle, where realized price briefly started a downward trend before recovering with the start of the second act of the infamous ‘double bubble.’ In our opinion, this is the most probable case, rather than a multi-year bear market followed by re-accumulation.” - The Daily Dive #022 - A Deep Look Into On-Chain Accumulation

With the increase in realized price to all-time high levels, as well as bitcoin still being around 27% below the ATH price set in April, the market value to realized value ratio is at much more attractive levels.

In early February when bitcoin first touched the level where it is trading today, the price was 3.64 times greater than the realized price. Today, a little more than six months later, the market is trading 2.29 times greater than its realized price. For perspective, the average market value to realized value since the start of 2019 has been 1.85.

Our base case is a retest and break of all time highs in the bitcoin price over the coming months, with realized price following behind as old UTXOs exchange hands as profit taking occurs on the way up, which we see with most all parabolic runs throughout the history of bitcoin.