The Daily Dive #042 - Stablecoin Market Overview

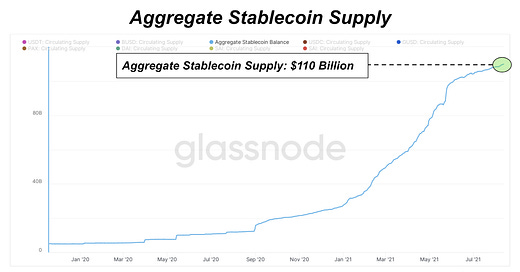

There has been a lot of noise made in recent weeks, months, and years, about the impact of stablecoins on the bitcoin (and more broadly, the crypto) market. In aggregate the total global supply of stablecoins continues to grow and make new highs, with a current tally of $110 billion in circulating supply at the time of writing.

In particular, a lot of noise has been generated on the legitimacy of the stablecoin Tether (USDT), with claims of fractional reserve or “pumping the price of bitcoin” having been made. The circulating supply of USDT is $62.9 billion at the time of writing.

On August 6, Tether made their reserves audit from June 30 public, in which they broke down the asset allocation and the maturity of the commercial paper held by the stablecoin issuer. This was a very notable step taken by Tether to increase transparency on the largest stablecoin in the crypto market.

With Tether increasing the transparency and the legitimacy of the market’s leading stablecoin, an interesting trend has emerged in the stablecoin and bitcoin markets.

The stablecoin supply ratio (SSR), which measures the bitcoin market cap against the circulating supply of stablecoins denominated in BTC, is near record low, and far below the levels seen throughout much of 2021.

The significance? The market is sitting on a lot of dry powder ready to deploy into the market. When looking at the SSR with Bollinger Bands (to adjust for changing market trends over time), breaks above the upper Bollinger Band, and conversely when the SSR breaks below its lower Bollinger Band, can show how relatively attractive it is to enter a bitcoin position. In this case the term “sell” refers to holding off on any FOMO (fear of missing out) smash buys, and depending on the situation stacking some additional cash to enter the market at a more favorable position later on.

Currently, the SSR is near record lows and happened to break below the lower Bollinger Band level on May 11, before the mass liquidation event on May 19.

While there is without a doubt a trend of a lower SSR ratio over time as an increasing amount of stablecoin projects enter the market — as well as the incumbent issuers vastly increasing the circulating supply (USDT as a prime example) — it should be noted that currently the ratio is at a much lower level than it was between March through April, when bitcoin was trading around the level it is today.

TLDR: Bullish BTC