The Daily Dive #039 - One Of The Biggest Buy Indicators In Bitcoin Flashes

Last night August 9, one of the best buy indicators in bitcoin flashed a buy signal:

Hash Ribbons.

The Hash Ribbons Indicator created by Charles Edwards uses the thirty and sixty-day moving averages of bitcoin hash rate to determine when miner capitulation has occurred, and uses this to estimate local bitcoin bottoms.

Below is the history of the bitcoin price and every time that the hash ribbons indicator has flashed:

Miner Capitulation

Hash ribbons serve as such an effective and historically accurate buy indicator for bitcoin because it uses the changes in bitcoin hash rate to measure miner capitulation in the bitcoin market.

During periods where mining operations are turning off their rigs, it shows that it is uneconomical to mine. Hash rate declines, blocks are mined slower than the 10-minute block target, and eventually difficulty will adjust downwards to encourage these miners to plug back in.

This is typically the process in which miners turn off their machines in large numbers, which is subsequently followed by the hash ribbon indicator signaling capitulation, followed by an eventual buy signal.

However, the cause for the massive decrease in hash rate wasn’t entirely caused by increased competitiveness in the mining industry driving profits down, but rather because of political decree in what ended up being the largest nation-state attack on bitcoin ever, from the arms of the Chinese Communist Party.

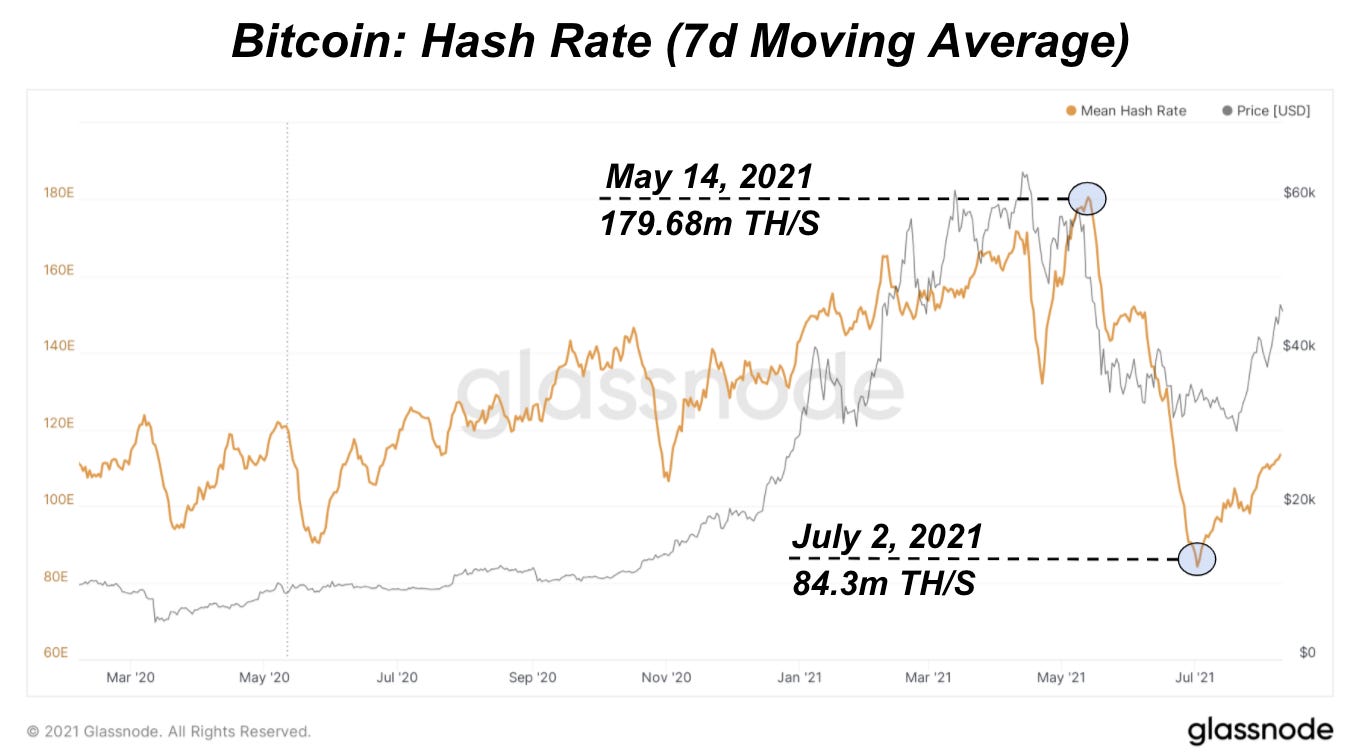

Over the course of six weeks the bitcoin mean hash rate declined by 53%, and although the capitulation event was more artificial, the decline in hash rate still had a very meaningful impact on miner revenues for those who still remained plugged in.

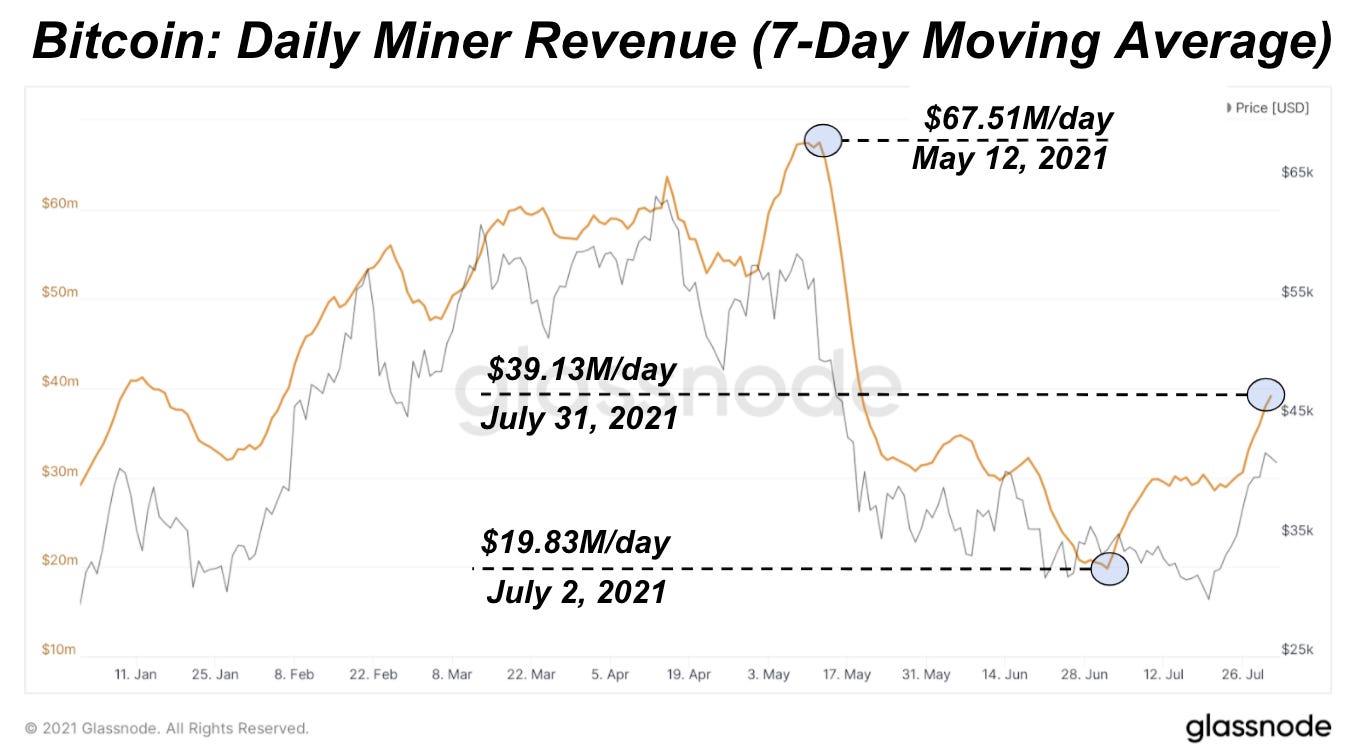

As seen in the July monthly report, daily revenue for bitcoin miners declined from a high of $67.5 million per day in May to a low of $19.8 million per day in early July.

Not only were the remaining miners squeezed while difficulty was lagging in the midst of four straight downwards adjustments, but mining operations in China who were abruptly faced with moving their entire operations out of the country most definitely had to liquidate reserves, of which a majority can be assumed to have been stored in bitcoin (as is the case with all miners, who aim to hodl as much bitcoin as possible).

Hash Ribbons Buy Indicator

As stated earlier, the hash ribbons indicator just yesterday flipped to a buy indicator. While this merely means hash rate is once again trending upwards, investors/traders and hodlers alike should be ready for quite the move in bitcoin.

Why? Because miners aren’t selling.

How? Because they don’t need to.

Not only do miners not need to sell much of their bitcoin due to the ridiculously low production cost of bitcoin currently (see energy value chart below), but also the recent trend of bitcoin miners going public has large implications for the financing that these operations are able to receive, and the cost of capital.

With the ability to get financing in public capital markets bitcoin miners no longer have to sell mined bitcoin to cover expenses, and can leverage the bitcoin on their balance sheet — as well as the physical infrastructure owned — in order to access cheap debt financing. Just recently, publicly traded North American Miner Hut 8 (HUT) didn’t sell any of the bitcoin mined in July.

If history repeats itself, bitcoin is primed to absolutely explode over the coming months. Below are the previous four times the hash ribbons indicator has flashed a buy signal and the BTC/USD performance over the following two months:

If there are any doubts, bitcoin will show its bull market form over the rest of 2021, and the recent signal from the hash ribbons indicator is just another reason to be extremely bullish.