The Daily Dive #036 - Publicly-Traded Miners Continue To Outperform

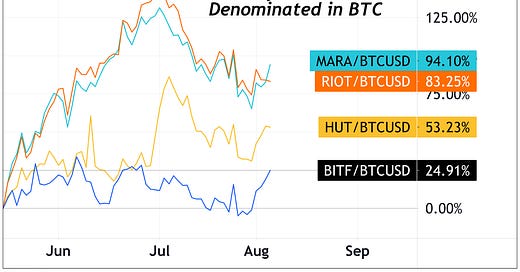

Shares of publicly-traded bitcoin miners continue to outperform, with shares of Riot Blockchain (RIOT), Hut 8 Mining Corp (HUT), Marathon Digital Holdings Inc (MARA), and Bitfarms Ltd, (BITF) up big during Thursday’s trading session.

It was announced this week that trillion dollar asset manager Fidelity had purchased a 7.4% stake in Marathon Digital on July 22 to add to four of its index funds. The news of Fidelity’s acquisition came following Marathon’s announced intention of purchasing 30,000 Antminer S19J Pros for $120.7 million.

Overall, bitcoin miner valuations continue to skyrocket, and have actually outperformed the price of bitcoin in a substantial way since the May 2021 market liquidation event.

Since the start of 2020 in particular, miner stocks have outperformed by a wide margin.

While it is important to note that investing in mining stocks (obviously) does not offer the same freedom and flexibility that comes with acquiring and holding bitcoin the bearer asset, it is notable that miners seem to function as high beta bitcoin during an upcycle.

Another increasingly bullish trend that has been developing over the past couple months has been the steady increase in bitcoin held in miners' wallets. Due to the steep decrease in miner difficulty following the mass miner exodus out of China, profit margins have increased significantly for the remaining operations able to stay plugged in.

Bitcoin in miner wallets has increased by 6,2018 since June 9.

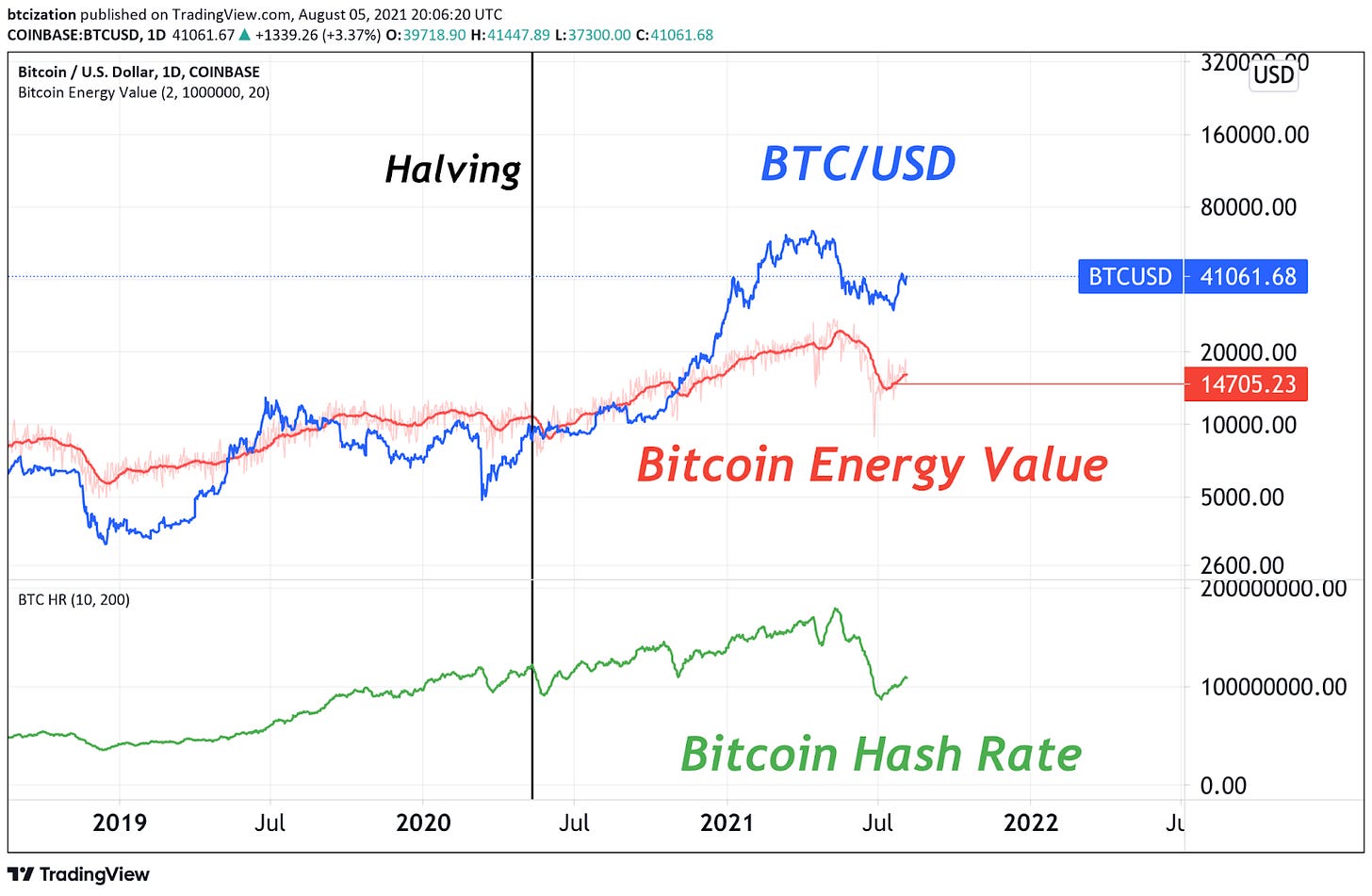

Bitcoin Energy Value, an indicator created by Charles Edwards that estimates bitcoin production cost, estimates that miners currently are mining at a breakeven cost of $14,705, which is far below the current price of $41,000.

This results in less sell pressure on the market, further increasing price in a positive feedback loop that further increases profitability.