The Daily Dive #034 - Credit Funds Are Coming

GoldenTree Asset Management, which has $45 billion in assets under management, is buying bitcoin.

GoldenTree specializes in investments in credit, in everything from high-yield and leveraged loans to distressed debt. The news that GoldenTree is actively acquiring bitcoin is absolutely massive, and marks just the logical step forward for creditors during a period of coordinated debt monetization by global central banks.

Let’s use a quote from Ray Dalio’s “Principles For Navigating Big Debt Crises:”

“Investing during a hyperinflation has a few basic principles: get short the currency, do whatever you can to get your money out of the country, buy commodities, and invest in commodity industries (like gold, coal, and metals)."

"Buying equities is a mixed bag: investing in the stock market becomes a losing proposition as inflation transitions to hyperinflation. Instead of there being a high correlation between the exchange rate and the price of shares, there is an increasing divergence between share prices and the exchange rate."

"So, during this time gold becomes the preferred asset to hold, shares are a disaster even though they rise in local currency, and bonds are wiped out.”

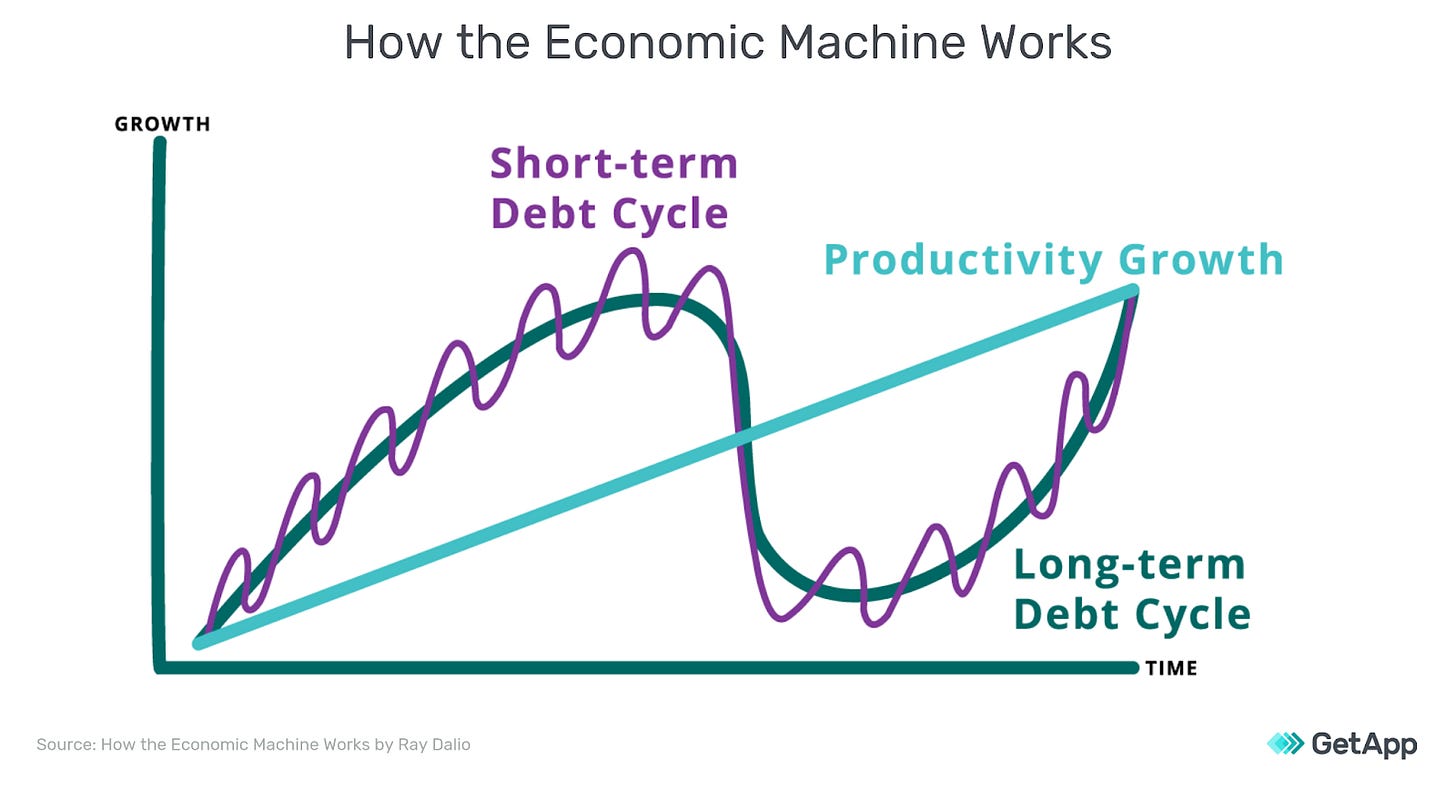

The thing that many people fail to realize is the economic environment we are living through is nothing entirely new. Yes, it is occurring on a global scale in a world that has never been more interconnected, but on a basic level, this has all transpired before.

A local (or global) economic system reaches the end of the long-term debt cycle, and the steps that come next are entirely logical from the lens of a policy maker. Thus, it is extremely important to understand how to protect yourself, and what you are even protecting yourself from in the first place.

Covered more extensively in “The Conclusion Of The Long-Term Debt Cycle & The Rise Of Bitcoin,” there are four levers that policymakers and central banks can pull to attempt to ease debt burdens:

1) Austerity (i.e., spending less)

2) Debt defaults/restructurings

3) Transfers of money and credit from the “haves” to the “have nots”

4) The central bank “printing money” and making purchases (or providing guarantees)

The first three options are not happening, while the last is occurring on a massive scale, globally.

Below are two charts provided by Dalio for the archetypal deflationary debt crises, with the monetary expansions as a percentage of Gross Domestic Product. and the nominal interest rate for short-term debt, and beneath it, the gold price indexed to the local currency.

In today’s environment, the entire global economic system is facing the same problem — over-indebtedness.

Policy makers are currently attempting to fix a solvency problem with liquidity, which doesn’t fix the underlying issue at hand.

Instead, that excess liquidity is going to find its way into assets that are insulated from the decision making of policy makers and bankers alike.

When investing in an inflation and (potentially) an eventual hyperinflation, you win by holding hard assets that maintain their purchasing power because of their distinct production cost. Ideally, you want to hold the asset or commodity that is able to have its supply diluted the least, which historically was always gold.

This would make sense especially for credit investors who are not short the local currency, which during an inflationary period is the advantageous thing to do, but instead, they are long the underlying currency (in this case the dollar).

Now, in the digital age, more investors and asset managers are coming to understand that the best way to insulate your wealth from the great monetary inflation, is bitcoin.

GoldenTree is yet another domino to fall.