The Daily Dive #033 - Heavy Bitcoin Accumulation By Large Pockets

Unfavorable Crypto Regulations Included In Congressional Bill

Over the last 24 hours, it has begun to circulate around Twitter that unfavorable regulations for the Bitcoin and crypto industry have been added to the bipartisan infrastructure bill at the last minute. While nothing is confirmed, if passed, the implications would be felt by many if not all industry players.

The Deep Dive will cover this in more depth later on when more information is known. Here is some of the language from the reported bill.

For now, we’ll cover some of the recent on-chain accumulation trends.

Big Money Making Moves

On-chain data has started to show that large-pocketed investors have begun to aggressively accumulate bitcoin.

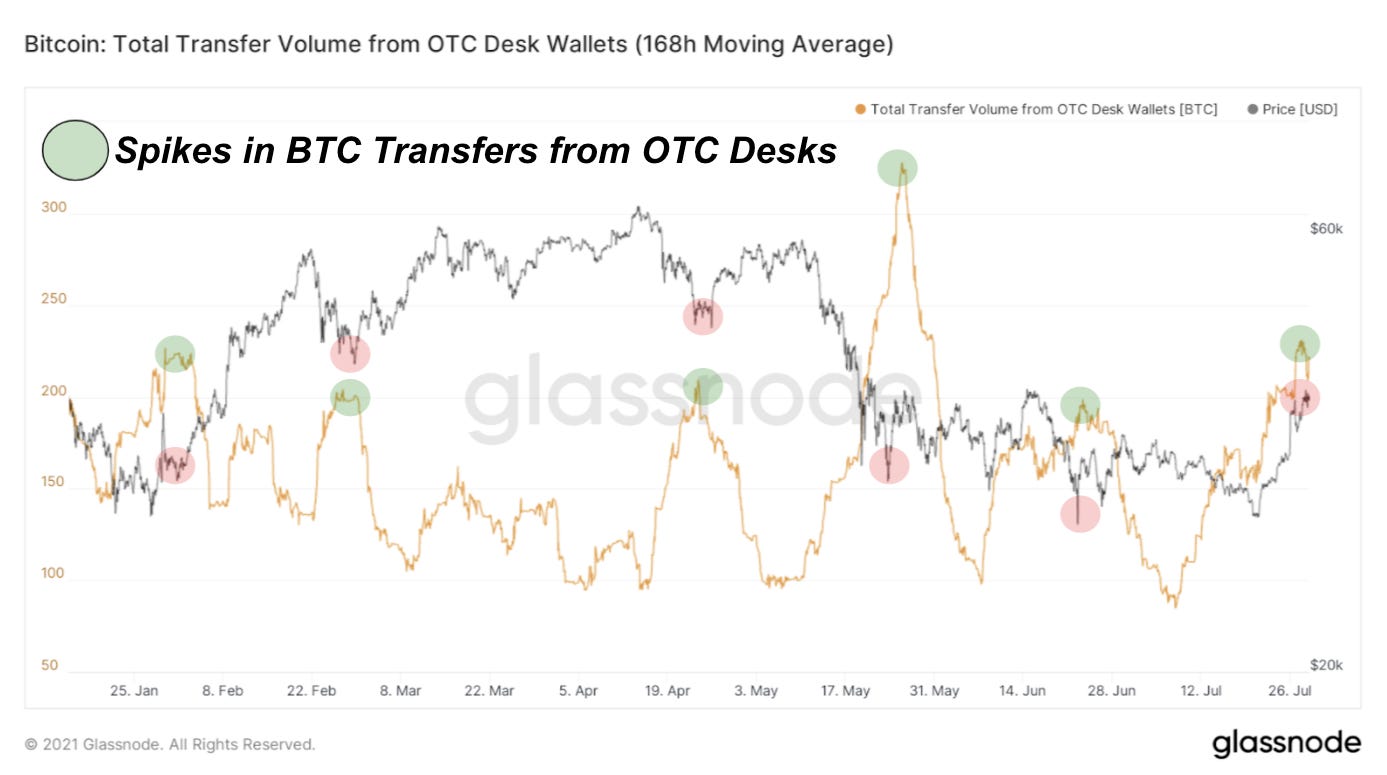

OTC Desk Outflows

Looking at the seven-day moving average of OTC Desk Outflows, over the course of 2021 there has been a pretty strong correlation between spikes in outflows and local bitcoin bottoms. This can be attributed to the fact that institutions and big money do not like buying an asset that is being heavily bid, as these players may even be able to move the market themselves if they are impatient.

Thus, when the price falls meaningfully, these players rush in to accumulate at a discount. That is exactly what we have seen over the last week, and the price has responded with eight straight days of higher closes.

Exchange Balances

Disclaimer: With exchange balance data, it is possible that that is an internal move that is mislabeled and subject to further change.

Once again, it is possible over the short term that the data is a mislabeled internal transfer, but it is very likely that this is not the case.

If correct, more than 60,000 BTC has been transferred off exchanges over the last 24 hours. A truly staggering amount, this would mean that massive institutional buyers are in the water and actively accumulating.

The daily net outflow from exchanges would be by far the largest seen since the start of 2020, and you would have to go all the way back to May of 2016 to see one of larger size.

Aggregate Bitcoin Balance On Exchanges

The overall assessment that larger market players have been aggressively accumulating can also be seen by looking at the total supply of bitcoin held in wallets with a balance of 1,000-10,000 bitcoin.

Over the last two months, this cohort of wallets has increased their bitcoin holdings by 115,701 BTC. This accumulation trend by whales continues the dominant trend witnessed in 2020, that subsided as bitcoin crossed the $40,000 level in early February.

Now, following a 50% pullback and ensuing consolidation, these players look to be on the bid and accumulating once again.