The Daily Dive #027 - The B Word Virtual Conference

This afternoon, The B Word virtual conference put on by Ark Invest occurred with presentations from Nic Carter, Lyn Alden, and many more, followed by a panel with Jack Dorsey, Cathie Wood, and Elon Musk, moderated by Steve Lee following afterwards.

Today’s Daily Dive will highlight some of the comments made during the conference along with using some charts for visuals and providing some commentary.

Highlights from the call with Elon Musk, Cathie Wood, Jack Dorsey and Steve Lee:

Elon Musk:

“Money is just an information system for labor allocation.”

“I own Bitcoin, Tesla owns Bitcoin, SpaceX owns Bitcoin.”

“Government is just a corporation… it's the biggest corporation of all and it has a monopoly on violence.”

Jack Dorsey:

“You don’t have to trust anyone, you can verify with open source code.”

“[Bitcoin is] not controlled by any bank, state, or corporation.”

“A lot of our monetary policies and systems cause so much distraction and cost.”

“Bitcoin incentivizes renewable energy.”

“My role through the companies I run is to push for more decentralization.”

My hope is that [Bitcoin] creates world peace by fixing a fundamental level of society.”

Cathie Wood:

“Money has powerful network effect qualities.”

“Bitcoin is a hedge not only against inflation but also deflation (counter-party risk).”

Broadly speaking the conference was a success, and it can be inferred that there were deep institutional pockets watching closely throughout.

“[Bitcoin is] not controlled by any bank, state, or corporation.” - Dorsey

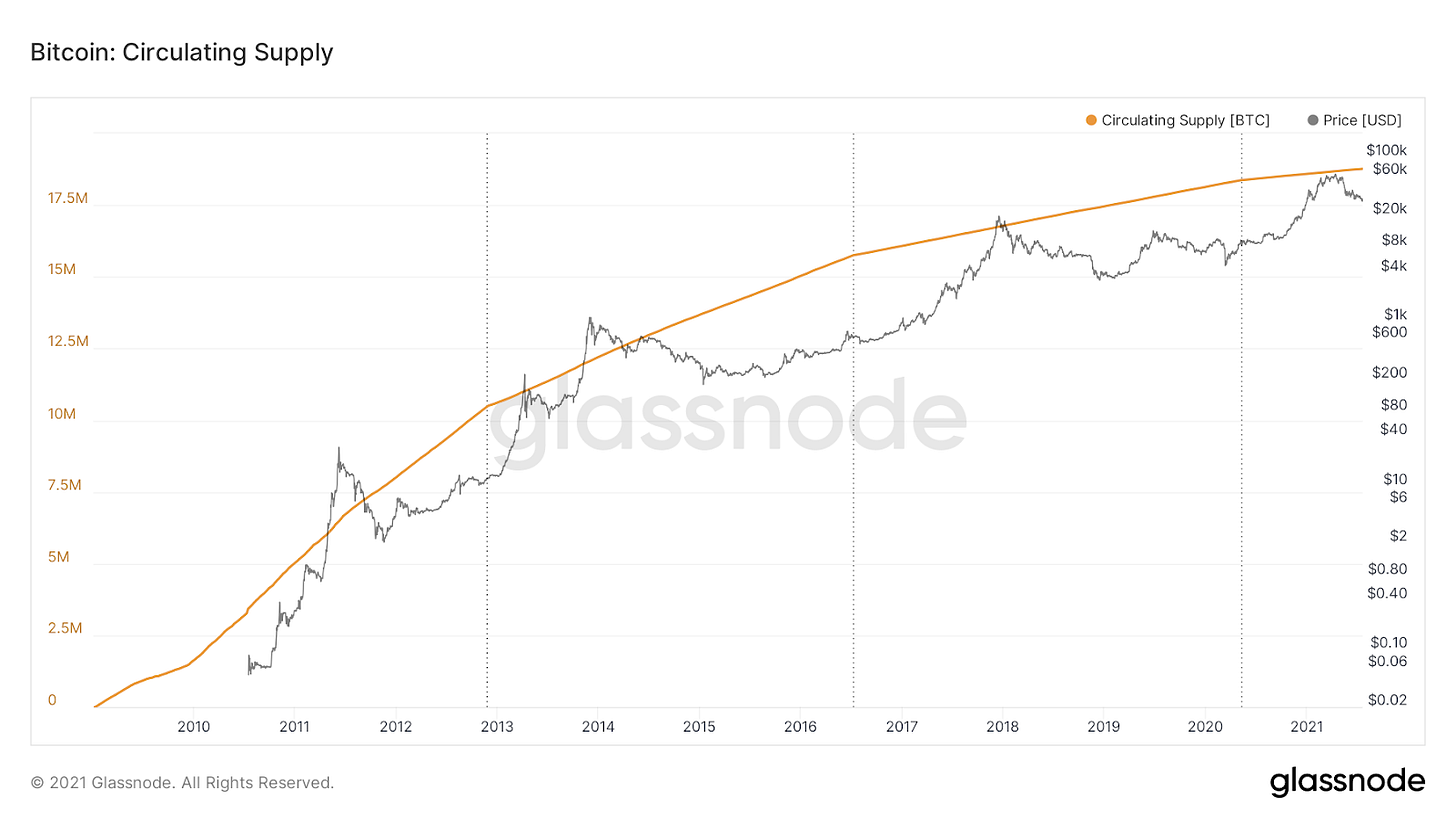

Bitcoin has a terminal inflation rate of zero, but the distribution of bitcoin occurs in asymptotic fashion, with the final satoshi estimated to enter circulation in the year 2140. Compared to the current fiat monetary system, where commercial banks store reserves at the central bank, and create money through the act of credit expansion, bitcoin is far superior.

A particular quote from the notorious Satoshi Nakamoto sticks out:

“Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts.” - Satoshi Nakamoto

Don’t trust, verify. That is the Bitcoin ethos. Whether you are Elon Musk, Jack Dorsey, Michael Saylor or someone residing in a developing nation, you play by the same rules when using Bitcoin.

“You don’t have to trust anyone, you can verify with open source code.” - Dorsey

The biggest value proposition of bitcoin is that no individual or entity can manipulate or dilute the monetary supply, as full nodes enforce consensus rules on the network. Anyone is able to run a node on the network with a simple laptop computer.

“Money is just an information system for labor allocation.” - Musk

Most simply, money is an information system. As brilliantly stated in Aaron Segal’s Bitcoin Information Theory:

“In a free market society, the greatest network of information by far is price, which itself is, at its core, an intersubjective agreement of value. Money is the abstraction of that value.”

Thus, when the money supply is manipulated through expansionary monetary policy, the information that money is attempting to convey becomes distorted.

“A lot of our monetary policies and systems cause so much distraction and cost.” - Dorsey

Bitcoin is such a massive idea that many struggle to come to terms with the ramifications for society at large. At the very least, bitcoin is viewed (in the western world) as a “portfolio diversifier,” or a “hedge against inflation,” or “Gold 2.0.”

However, those statements, while most definitely holding merit, fail to encapsulate the sheer magnitude of what Bitcoin means for humanity. The human race, for the first time ever has a flawless ledger of accounting for the communication of economic preferences and resources.

Imagine a world where resources cannot be arbitrarily stolen and redistributed/redirected with the stroke of a pen. That is the current reality of the fiat system today, but the world that Bitcoin has brought about makes that a thing of the past.

With the B Word conference earlier today, some of these ideas were explicitly covered, and some were not, but the points remain.

Institutional capital was watching, and gradually, then suddenly, these institutions are going to come to realize what many bitcoiners have before them.

That bitcoin is an idea whose time has come. These institutions will all eventually have to ask the trillion dollar question:

What is the value of an incorruptible monetary network that bridges the digital and physical realm through computer code and the laws of thermodynamics?