The Daily Dive #025 - Treasury Market Signals Trouble

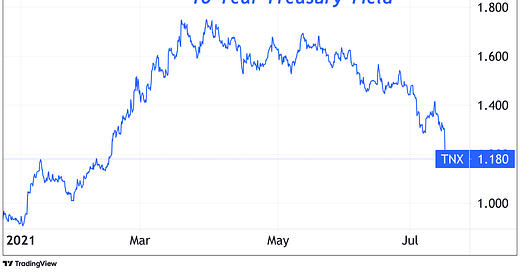

The treasury market is spelling trouble in the broader financial system. Yields on U.S. treasury bonds continued to fall today, with the 10-year yield hitting 1.18%, as legacy markets have begun to risk off as the reflation trade from earlier in the year has lost significant steam.

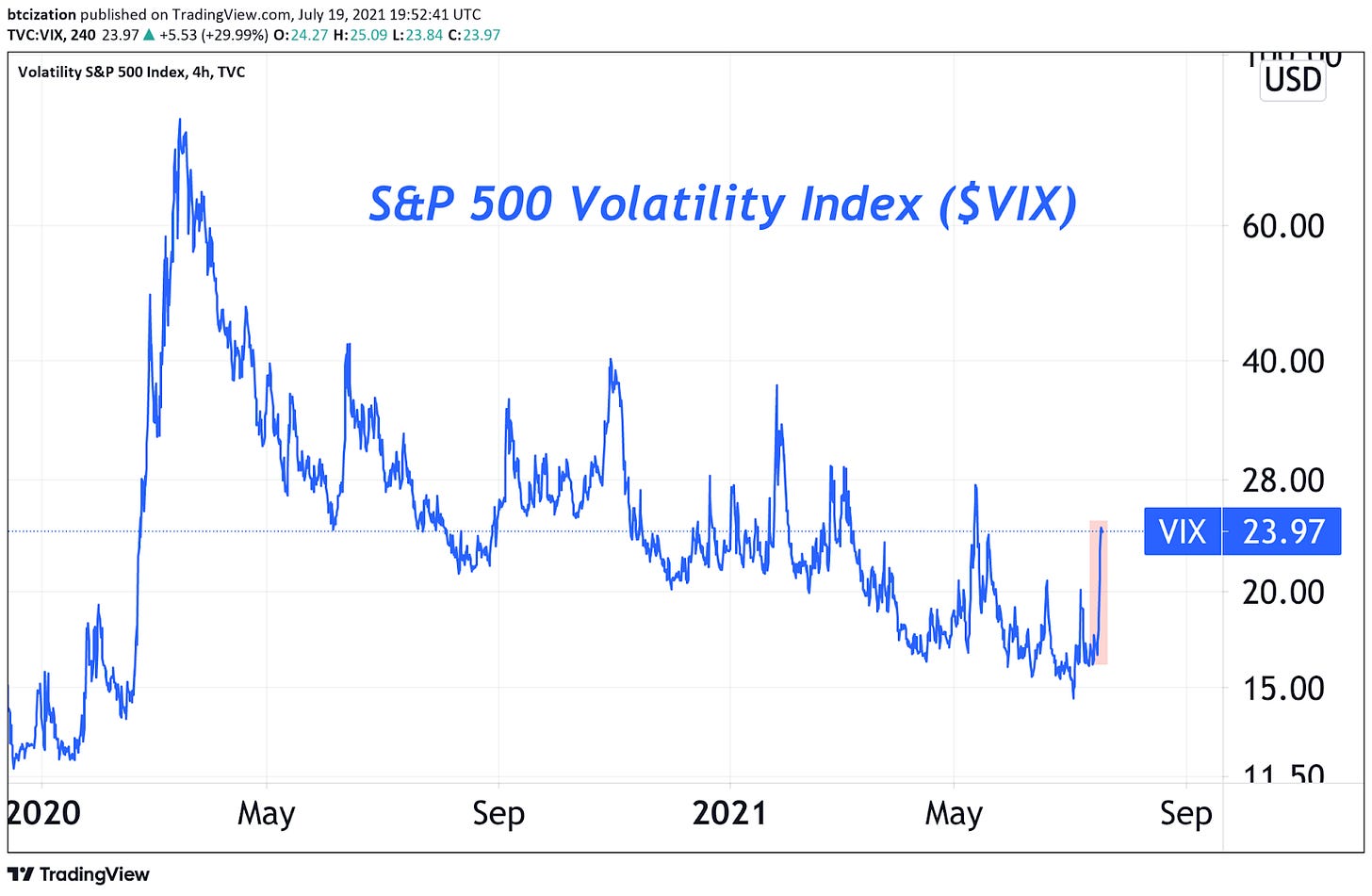

The S&P 500 Volatility Index ($VIX) spiked as equities sold off sharply.

As covered in the “Daily Dive #018 - Impending Deflationary Bust,” due to the massive amount of leverage in the incumbent financial markets, a deflationary bust is not only very possible but even imminent (although the timeline cannot be known).

The Fed and other global central banks have to continue to toe the line between financial asset hyperinflation or a deflationary bust and ensuing depression. If equity markets continue to fall, expect the talks of central banks “thinking about” tapering asset purchases to halt completely.

The only game in town for financial markets to remain “stable” is for real yields to continue to be pushed further into negative territory (i.e., inflation picking up with yields being suppressed). This process, which is known otherwise as financial repression, is the only way out of a debt trap.

More debt monetization is coming. There are very few places to hide.

Tomorrow’s Daily Dive will cover the latest on-chain updates and insights.