The Daily Dive #024 - An Explosive Dichotomy Emerges

In today’s newsletter, we will look into the notable dichotomy that has emerged over the recent month/s in the derivatives market and with illiquid bitcoin supply, and what the trend/s could mean.

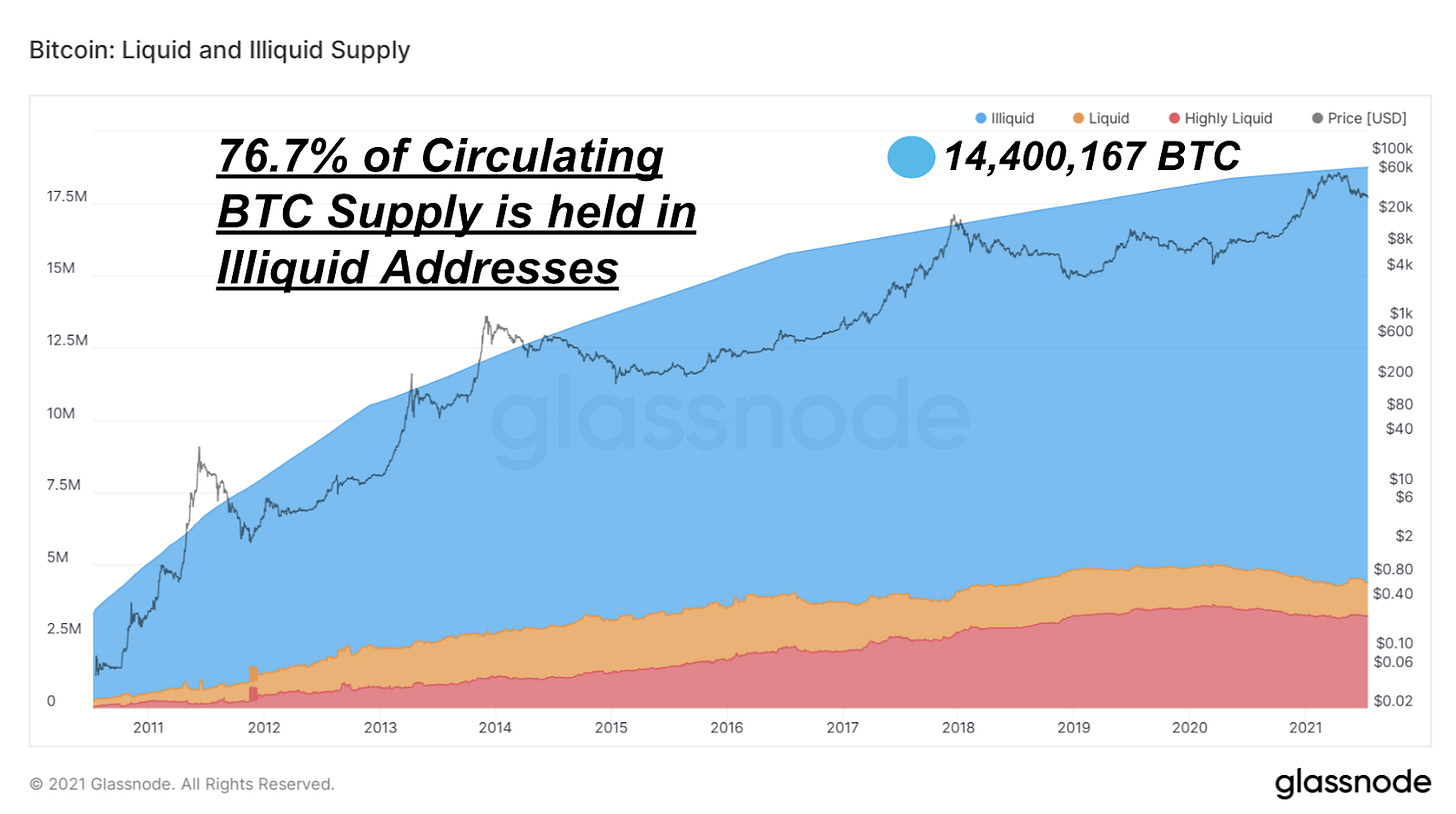

Illiquid Supply Change

May brought about the largest change in previously illiquid supply since January of 2018, as short term investors relentlessly sold their positions, most of which was at a steep loss. The 30 days leading up to May 20th saw 231,333 bitcoin move from previously illiquid addresses back into the liquid bitcoin supply.

For more information on how liquid and illiquid supply is measured, check out this article.

However over the last 30 days, 164,107 bitcoin have moved back into illiquid addresses, as convicted bitcoiners around the world continue to relentlessly accumulate, with twice the effectiveness per dollar compared to April.

Currently there are an aggregate 14,400,167 bitcoin held in illiquid addresses, about 76.7% of the circulating supply.

Perpetual Futures Funding

Following the COVID crash of 2020, bitcoin traders turned notably bearish for the months of March and April. This was at a time (highlighted in the beginning of the newsletter) where bitcoin was moving into illiquid supply (strong hands) at a feverish pace.

This divergence during the extended consolidation period last summer led to an explosive breakout after the market had realized: nearly all of the bears and large sellers in the market had already sold.

Now, we are witnessing the same trend beginning to unfold. Perpetual futures funding is negative and the contango yields that were extremely elevated for much of the early months of 2020 are now suppressed and very near 0%.

Derivative and futures traders are bearish. Bitcoin stackers and hodlers are bullish. An explosive dichotomy in the market is beginning to emerge.