The Daily Dive #019 - Bitcoin Capital Inflows At A Standstill

In previous editions of the Daily Dive, we have shown the Market Value to Realized Value Ratio (MVRV Ratio) to quantify the relative value of bitcoin. In today’s edition, we will dig a little bit deeper into what is actually happening and show how, at least for the time being, capital inflows into the Bitcoin Network are at a standstill.

Below is the often cited MVRV Ratio metric.

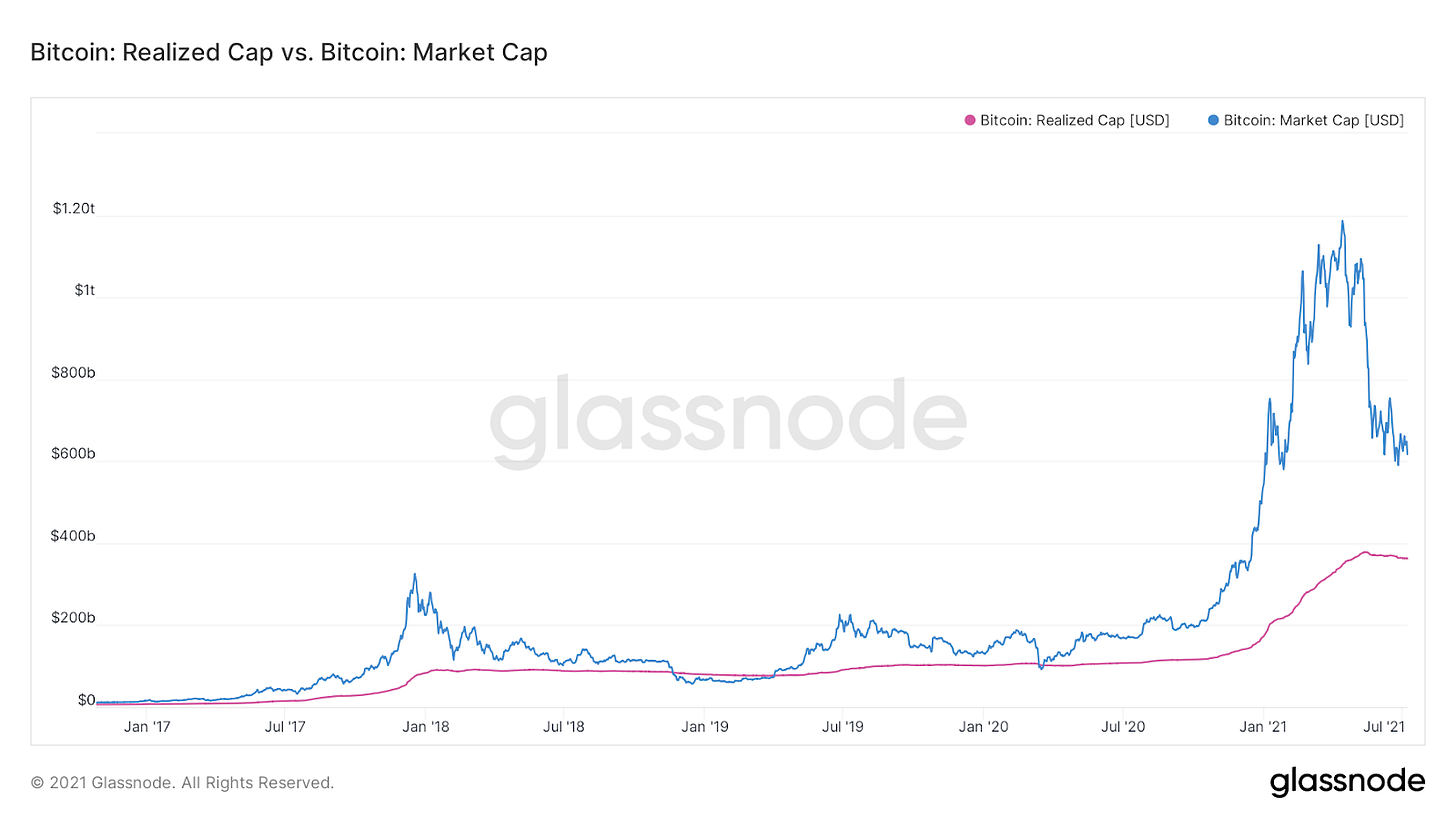

For additional visual context, here are the two components of the metric, charted together. While it is known that linear charts are not the most optimal for viewing the growth of bitcoin, due to the exponential rate of growth and adoption that has occurred on the network over the last decade, the linear scale is great at demonstrating the sheer scale of capital inflows that has occurred since 2020.

Like any asset, the price of bitcoin is set by the marginal buyer and seller. Thus, looking at market price or the total market capitalization of bitcoin may not give the most accurate representation of the capital inflows into the network.

By looking at the realized capitalization of the network, you quantify at which price point every coin (technically: UTXO) moved, giving a more accurate and representative look into how much new capital moved onto the network.

From May 13, 2020 to May 13, 2021, the realized capitalization of bitcoin increased by $273 billion, in what was by far the most explosive growth phase in aggregate dollar terms ever for the network.

For context, the realized market capitalization of bitcoin at the exact top of the market was $73 billion.

However, since May 13, 2021, realized capitalization has actually decreased by $15 billion, as 2021 investors currently underwater on their positions have sold their holdings and capitulated, while older holders for the most part have refused to sell over the course of the last two months.

New capital has been hesitant to enter positions since April, with regulatory headwinds coming from China, and the narrative of corporate treasury adoption having not played out as many had thought (so far).

Oddly enough, some of the most ecstatic buyers at $64,000 are not interested in allocating to the same asset at a 50% discount. The hype and noise has passed, and only the relentless sat stackers and hodlers of last resort remain. This is precisely why bitcoin will never “die”.