The Daily Dive #018 - Impending Deflationary Bust?

Starting in the middle of May, yields on U.S. treasury bonds have started to fall in quite a noticeable way. Yields on the 30-year treasury have fallen to 1.91% from 2.40% on May 13, and yields on the 10-year treasury have fallen to 1.28% from 1.69% during the same period.

So what is going on, and why are investors rushing in to secure a nominal return of around 2% annually over long periods of time?

Is it possible that we are at the start of a significant market downturn?

Possible? Yes. Probable? No one can know.

All that can be known is that the problems that have plagued the U.S. financial system - and more broadly the global economy - for the past two decades have not only not been resolved, but are worse than ever before.

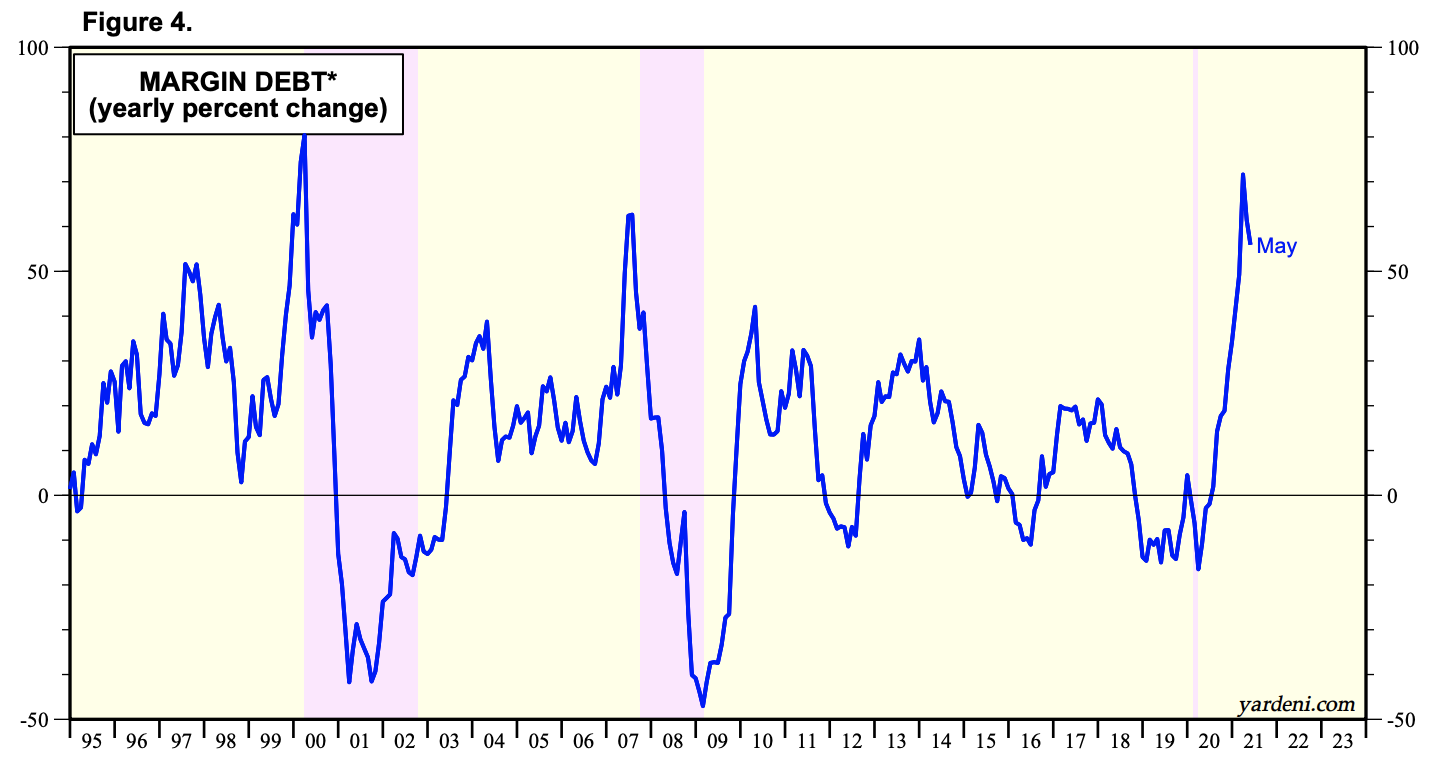

The stock market is absolutely soaring, but what is the driving force behind the rally? Well, debt of course.

Yields are falling because investors may be starting to fear for the worst, that a deflationary bust could soon come about, as contagion strikes the credit markets and equities sell off in a major way.

Investors do not buy U.S. Treasury bonds because of their lucrative yield. Investors flock to U.S. Treasuries because the probability of a U.S. government default is extremely minuscule.

The U.S. Dollar Index (DXY) has started to bid, and investors may be starting to see the writing on the wall. A downturn in equities would lead to reflexive amounts of selling by investors who are margined long, and this would spread across global credit and equity markets, as the estimated $12.6 trillion in dollar-denominated debt owed by foreigners starts a global short squeeze for the greenback.

This potential scenario is similar to what occurred in March of 2020. While the broad market crash was exacerbated by the coronavirus and the ensuing economic lockdowns, a market meltdown and dollar squeeze may have been coming regardless.

This is the nature of human emotions and credit cycles.

Treasury yields, equity markets, and the DXY should all be watched closely by bitcoin investors, as market downturn could potentially present the opportunity to buy at generational lows, before the ensuing rebound that would follow, enabled by monetary and fiscal stimulus that would make the liquidity injections seen in 2020 look like a walk in the park.

Tomorrow’s Daily Dive will break down some of the latest bitcoin derivatives market and on-chain data.