The Daily Dive #014 - The Man Who Broke The Bank Of England Enters The Fold

Early this afternoon, June 30, it was revealed that Soros Fund Management, led by infamous billionaire investor George Soros, received an internal nod of approval to begin trading bitcoin.

The fund reportedly has around $27 billion under management, but the move is especially notable given the history of the billionaire fund manager.

The Man Who Broke The Bank of England

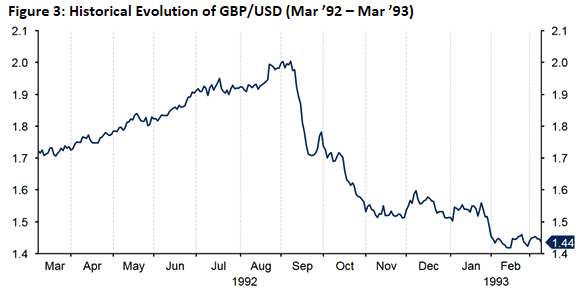

In September of 1992, George Soros famously “broke the Bank of England” on what became known as Black Wednesday, via a speculative attack on the British pound. What is a speculative attack, you ask?

A speculative attack is the act of borrowing in a weak currency to buy a strong currency. Seems simple enough, but there is more to the story. With fiat currency, lending actually creates money and, conversely, default or repayment destroys it.

So what did Soros do back in 1992?

To make a long story short: certain countries in the European Union had agreed to join the European Exchange Rate Mechanism (ERM). Introduced in 1979, the ERM was implemented to reduce exchange-rate volatility between currencies in the EU (remember: this was before the Euro was introduced). The agreement had countries agree to keep their currencies within an upper- and lower-bound against other member currencies.

Leading up to Black Wednesday, inflation in the U.K. was heating up and many traders, including Soros, came to the conclusion that the British pound was overvalued even at the lower bound of the ERM.

The result: Soros began quietly building up a massive short position in the pound. Soros then began to speak publicly about the inevitable fall of the pound outside the bounds of the ERM, encouraging other traders and speculators to short the pound as well.

The U.K. attempted to combat the speculative attack and bolster the value of the pound by raising interest rates and using foreign exchange reserves to buy the pound, but it wasn’t enough.

The day before Black Wednesday, Soros’ Quantum Fund upped its short position and continued to aggressively short borrowed pounds onto the market. The speculative attack was too large for the Bank of England to combat, and they later announced a departure from the European ERM.

Soros then covered his shorts, repaid the borrowed money using the devalued pound and reportedly netted more than $1 billion from the trade, in what is still known as one of the greatest trades in history.

Bitcoin

But what does this have to do with bitcoin, you may ask?

Everything.

As you most likely already know, Michael Saylor has very publicly encouraged the adoption of bitcoin as a treasury reserve asset over the last 10 months, and has borrowed billions of dollars to acquire bitcoin on the balance sheet of MicroStrategy. Michael Saylor is executing a speculative attack on the dollar.

Bitcoin is an asset on the balance sheet of the holder, and a liability to nobody else. Fiat on the other hand, is quite literally created through lending. So what is the rational action to take if you believe that the cost of capital is mis-priced as a trader/investor/speculator? It’s to acquire the strong currency by borrowing and shorting the weak currency.

In an environment where interest rates are pegged at or near 0% by global central banks, and bonds of almost any rating and duration are returning a negative real yield, holding fiat currency or a debt security denominated in said currency is extremely unattractive.

The beauty of bitcoin is that units of the asset are not created through lending, but rather through a proof-of-work (PoW) algorithm. There will only ever be 21,000,000 bitcoin, and there can theoretically be an infinite amount of dollars (or any fiat currency).

Investors like Soros are coming to understand this reality, and they do not play nice. Once the likes of Soros and other investors with massive amounts of capital come to terms with the absolute scarcity of bitcoin, we can expect the mother of all speculative attacks.

The magnitude of the trades cannot be known, but when (not if) they happen, expect tens of billions of dollars to be borrowed at nearly no cost to be used to acquire as much bitcoin as possible.

The likes of Soros do not care for feelings or the status quo. That was demonstrated on Black Wednesday.

Trades will be made based on circumstance and, more importantly, math. There is nothing more precise mathematically than 21,000,000 bitcoin, and in a world of central banks gone mad and unchecked government spending necessitating zero-interest-rate policy, using a speculative attack to acquire bitcoin is the rational choice.

Soros has entered the game, and he’ll play to win.

The second speculative attack by Soros is coming. It’s not a matter of if, but when.