The Daily Dive #013 - The Fallacy Of Taper Talk

“The monetary policy goals of the Federal Reserve are to foster economic conditions that achieve both stable prices and maximum sustainable employment.”

In the Federal Reserve's mandate, there are two stated goals for their monetary policy:

Stable prices

Maximum employment

With these two stated goals, the Fed is implicitly telling the market that any taper talk is complete nonsense, and here is why:

The entire economic system is built upon credit, and to maintain full employment and stable prices (i.e., “2% inflation targeting”), credit cannot be allowed to contract.

Let’s dig into some recent trends in the real estate market for context:

Median prices for single family homes have increased 14.6% year over year, fueled by record low mortgage rates over the last 18 months.

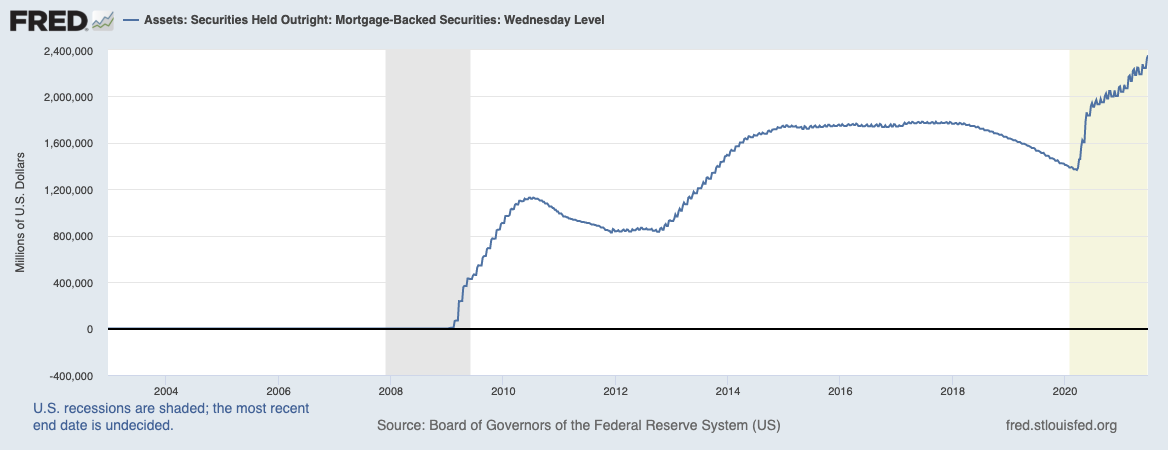

But what happens if the Fed tapers? What happens if the Fed stops buying mortgage backed securities at a clip of $40 billion per month?

The Fed taking the punchbowl away from markets would mean bad news for risk assets, real estate included. It is important to remember that real estate is among the most leveraged asset classes in the market, as it is commonplace to buy with only a 20% down payment (or even less).

If the Fed tapered and real estate prices declined, what would that mean for the broader economy? Taking a look back at the 2008 Great Recession can provide an answer.

Real estate prices started to decline in 2006, and in 2008 prices fell below mortgage value. In simple terms that means the liabilities owed by homeowners was worth more than the home value itself (i.e., negative home equity).

While this Daily Dive is not suggesting that a Fed taper would immediately lead to a similar outcome to 2008, it is just highlighting the underlying trend. More debt, higher real estate prices, and repeat. Credit, broadly speaking, cannot be allowed to contract otherwise homeowners everywhere would go bankrupt.

With the mass defaults and bankruptcies, the unemployment rate skyrocketed, as the liquidity crises and the turn of the credit cycle in financial markets spilled into the real economy.

The point being made here is that the Fed’s dual mandate of “stable prices” and “maximum employment” is built upon the reality that tapering over any medium/long term frame of time is impossible.

During the Great Recession, as a result of the credit unwind in the banking system, the Consumer Price Index actually turned negative year over year as a deflationary bust began to take hold.

That was the Fed’s notice to step in with ZIRP (zero interest rate policy) and QE (quantitative easing).

TLDR: The Fed’s taper talk is completely at odds with their dual mandate, and any jawboning about a taper should be taken with a grain of salt.

QE Infinity, MMT forever. That is the entire game at this point. Don’t let talking heads convince you otherwise.

Bitcoin is insurance on the entire legacy system.

The system is on fire, and the cost of insurance just got cut in half.

Don’t overthink it.