The Daily Dive #012 - Historically Slow Average Bitcoin Block Time

Over the weekend, the trend of falling hash rate on the Bitcoin network that has been observed over the last month accelerated in a historic manner. On Sunday, the average block time exceeded 23 minutes, the highest average block time in a day in over a decade, with the only other occurrences of slower average daily block intervals occurring before bitcoin even had a market price, back in 2009.

However it should be noted that looking at one-day sample sizes of hash rate and mean block interval times can be misleading due to the probabilistic nature of bitcoin mining; variance is to be expected.

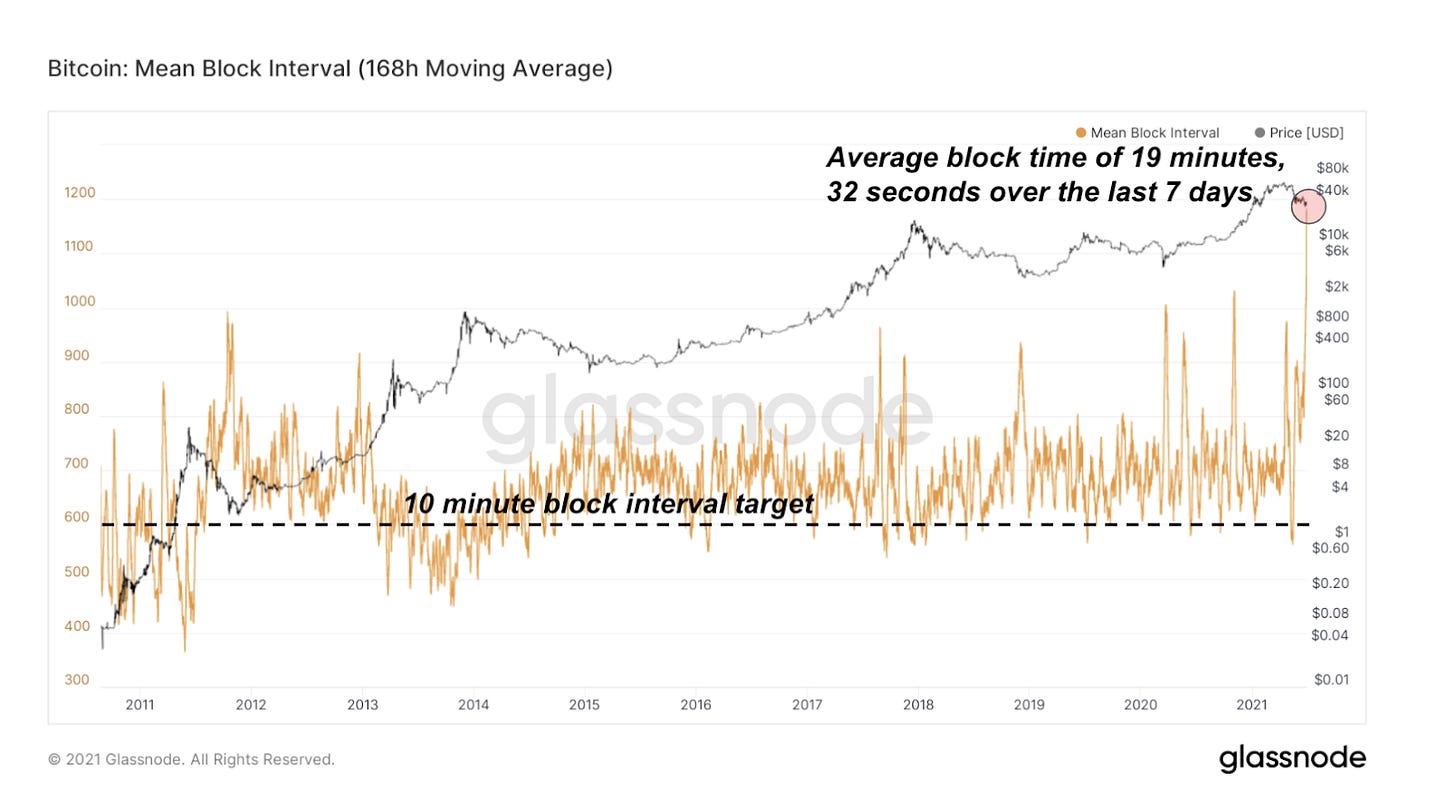

Using the trailing seven days (168-hour moving average), the average time between blocks was 19 minutes and 32 seconds, almost double the 10-minute target interval.

The next miner difficulty adjustment is now estimated to come in at -25.8% on July 2, which would be the largest downwards difficulty adjustment in the history of the Bitcoin network.

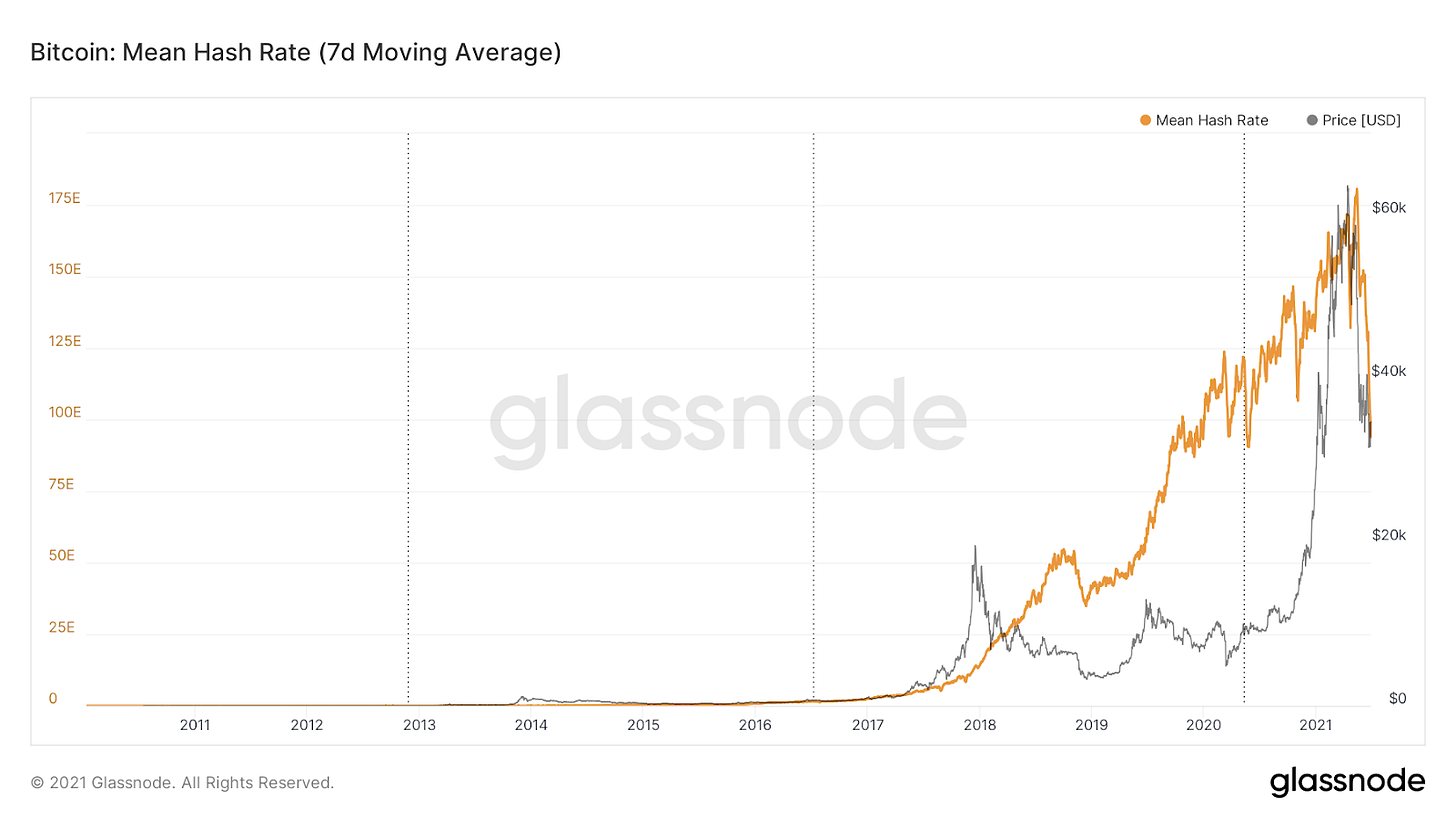

While the historic decline in hash rate is a massive story, perspective remains important. The Bitcoin network has been growing in exponential fashion over the last decade, both in price and in security (hash rate).

Sharp declines in both price and hash rate should be viewed in logarithmic terms if one is aiming to assess the long-term trend of the network.

Below is the bitcoin price and hash rate charted together first in linear terms, followed by a second chart in logarithmic terms.

Final word:

China is not banning bitcoin, they are banning themselves from the Bitcoin network.