The Daily Dive #010 - It’s The Liquidity, Stupid

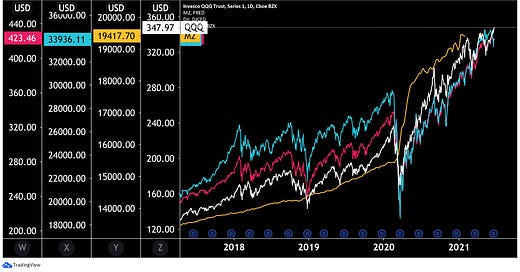

Earlier today, the Nasdaq hit a record high, with the index up 67.5% since the start of 2020, and up a whopping 147% from the March 2020 bottom.

Casual onlookers may question what has made companies inside the index 67.5% more valuable over the last 18 months, or what has caused the mass belief in “stocks only go up!”

In short, the answer is simple. It’s the liquidity, stupid!

While that may come off as quite blunt and oversimplified for what many would ascribe a very complex and nuanced answer, any such explanations for the massive increases in the prices of bonds, equities, and real estate over the last 18 months should be approached with Occam’s Razor.

By observing another similar chart, of global liquidity and the S&P 500 index from Holger Zschaepitz, it becomes clear that equity markets predominantly are not soaring as a result of improved business outlook or a massive increase in earnings, but rather are quite simply a proxy of global liquidity, which has risen at record-breaking pace as a result of central bank quantitative easing programs globally.

It is important to keep the long view in mind, even with bitcoin in the midst of an over 50% retracement from the all-time high set in the middle of April 2021.

The performance of every asset class is a function of central bank liquidity, and in an environment of unprecedented credit expansion, bitcoin is the only asset that is 100% monetary premium, 0% anything else.

The supply of bitcoin cannot be diluted or “managed” by a team of central planners, and new supply of the monetary asset is created through the proof-of-work mechanism built into the protocol.

Contrast this to new units of fiat currency, which are “created” through commercial bank lending.

In this unprecedented monetary environment, where all assets are rising in tandem, it’s vital to remember:

It’s the liquidity, stupid.

Protect yourself with bitcoin.