The Daily Dive #007: Miner Capitulation Placing Pressure on BTC

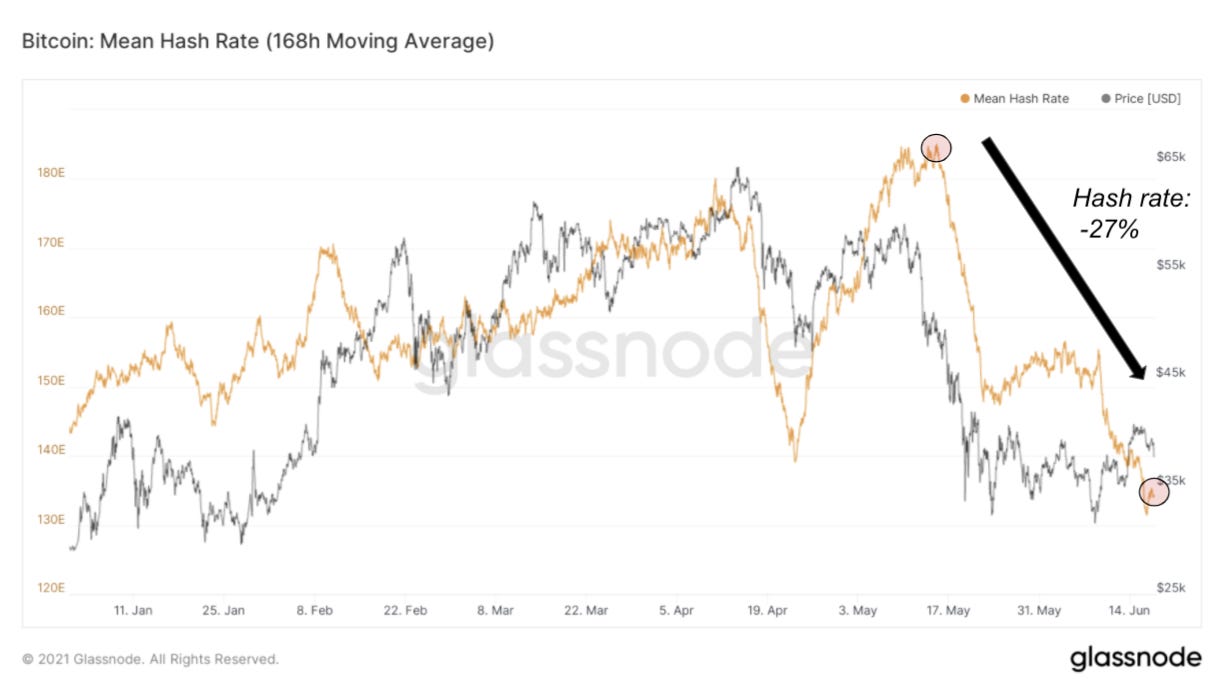

Hash Rate Decline

For those that are unfamiliar with how hash rate is calculated: the Bitcoin network targets ten minute block times, and has a difficulty adjustment every 2016 blocks (about every two weeks). If over a 2016 block period, blocks are coming in at 5% faster rate than the ten minute average target, then difficulty will adjust upwards, and vice versa.

Thus, when the hash rate is dropping, it means that blocks are coming in slower than the 10 minute target, which means that miners have turned off their operations (for any number of reasons).

The hash rate of the Bitcoin network has declined by approximately 27% since May 15, as a confluence of a mining ban in provinces in China as well as a large decrease in the price of bitcoin has led to many operations temporarily turning off their machines.

There are bitcoin miners all over the world with wide ranging break-even costs as a result of cost of energy, as well as miner efficiency. When mining no longer becomes economical due to break-even costs, they simply turn off their machines until conditions become favorable again (or the machines are reallocated to a different jurisdiction with a cheaper energy source entirely).

As displayed below, total miner revenue has decreased from a peak of $68,018,448/day on May 10th to $31,119,504/day today (using 168h MA).

With a decrease of over 50% in revenue in a little more than a month's time, miner profitability has come under serious stress, and this is undoubtedly placing downward pressure on the price of bitcoin.

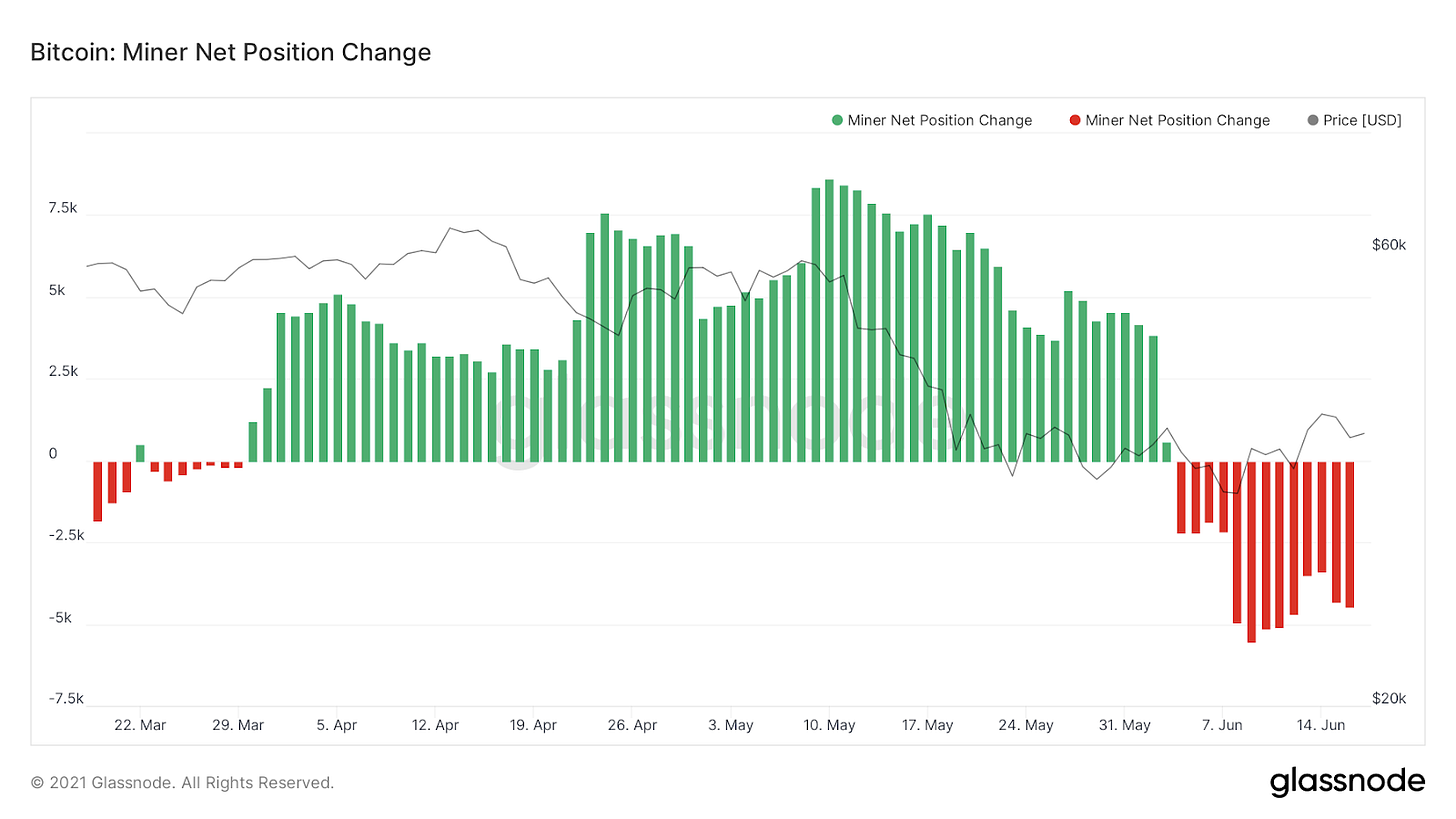

Over the previous 30 days, bitcoin in miner addresses has declined by 4,473 bitcoin, in large likelihood due to the decrease in miner revenue over the same period.

Bitcoin Hash Ribbons

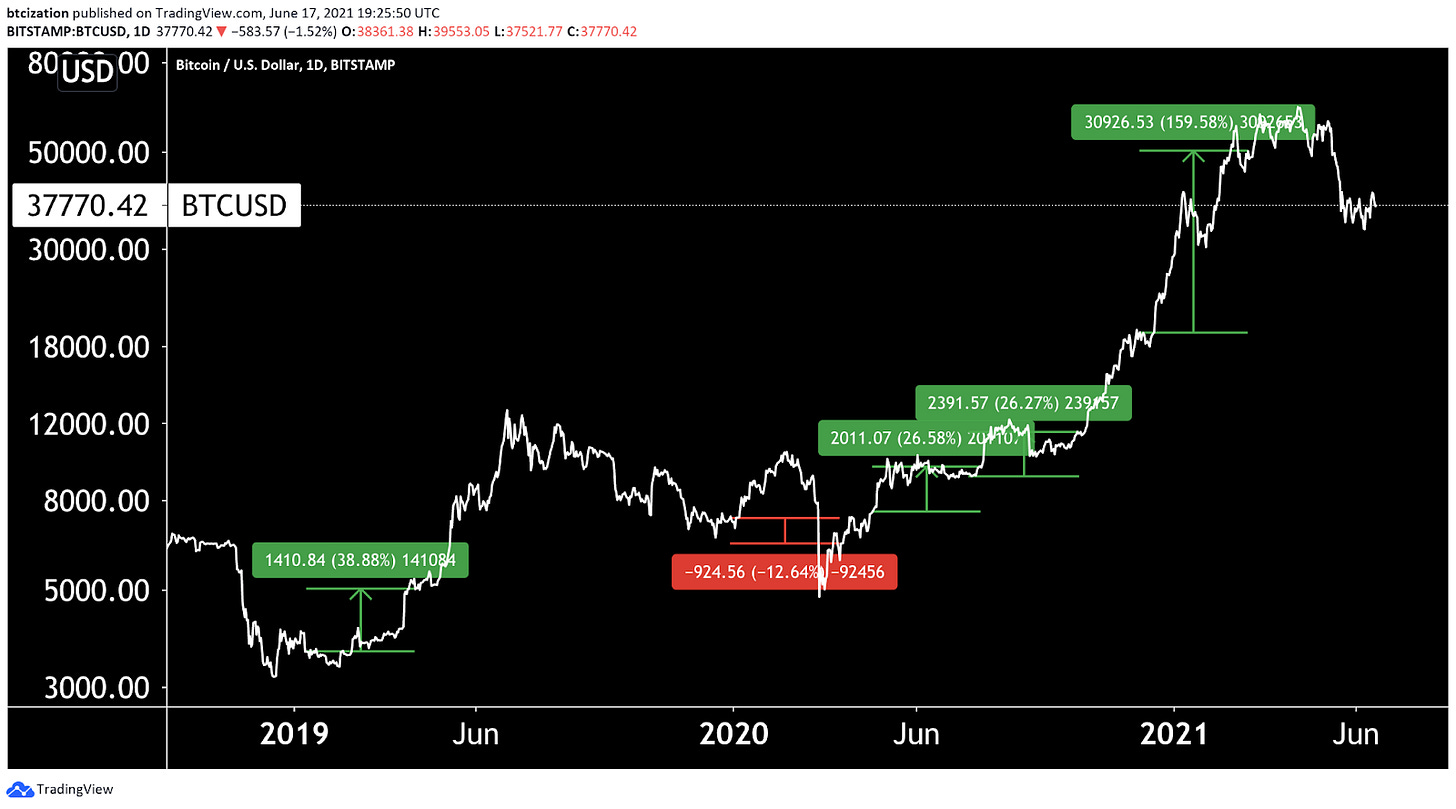

Hash ribbons is an indicator founded by Charles Edwards which uses moving averages of bitcoin’s hash rate to show when miners are capitulating.

The hash ribbon indicator uses the 30 day and 60 day moving average of hash rate to indicate when miner capitulation occurs, and assumes that due to the large pressure on miner profitability, a local bottom is likely to have occurred due to miners being the market’s only natural seller.

Throughout the indicator’s history, buying after hash ribbons flashed a buy signal yielded fantastic results, with the latest five occurrences and the following three month returns charted below.

While the three months following the buy signal presented in December of 2019 netted a negative return, the COVID-19 black swan event should be acknowledged here.

Impending Hash Ribbons Buy Signal

Bitcoin had a -5.3% difficulty adjustment recently, and currently, with 1493 blocks until the next retarget (at the time of writing), bitcoin is on track for another -8.6% difficulty adjustment.

This is the beauty of bitcoin. When prices decrease, or it is uneconomical for a vast number of miners to secure the network, the network automatically adjusts upwards or downwards, raising or lowering the cost to mine, and keeping the supply issuance inelastic in the process.

Following the (probable) downwards difficulty adjustment that is expected to be coming in the next week or so, hash rate will return to the network, and miner profit margins will improve. This should ease the downwards sell pressure on the market, and the notorious hash ribbons indicator will flash a buy signal.

Could this time be different? Sure, but we are of the belief that this is an extremely bullish development to watch.

We will be keeping a close eye on this over the coming week/s,

Happy Thursday everyone,

Cheers

excellent!