The Daily Dive #006 - QE Infinity + MMT Forever

In yesterday’s Daily Dive we said today’s release would cover some updates involving on-chain analytics, but in light of the Federal Open Market Committee (FOMC) meeting today, we’ll will save the bulk of that for tomorrow’s Daily Dive and the Weekly Recap on Friday.

Here are some of the “highlights” of today’s meeting:

POWELL: INFLATION COULD TURN OUT TO BE HIGHER AND MORE PERSISTENT THAN WE EXPECT

FOMC: FED MAINTAINS $80 BILLION TREASURY BUYING, $40 BILLION MBS BUYING PER MONTH

FOMC: FED WILL CONTINUE BOND BUYING UNTIL SUBSTANTIAL FURTHER PROGRESS ON GOALS

POWELL: EVEN AFTER LIFTOFF, POLICY WILL REMAIN HIGHLY ACCOMMODATIVE

POWELL: DOTS ARE NOT A GREAT FORECASTER OF FUTURE RATE MOVES

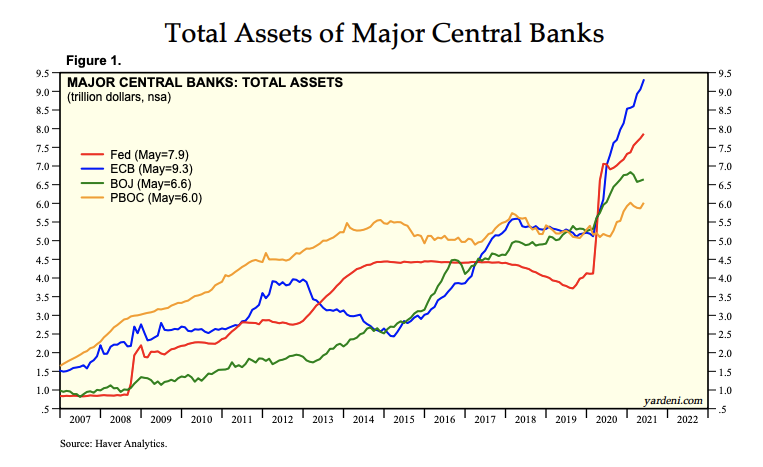

Powell’s comments on inflation were telling, but somewhat expected. There is nothing that could be said to escape the reality of the situation that the Federal Reserve (along with other global central banks) have found themselves in.

Total U.S. debt/GDP is at a ridiculous 383%, and the only ways out of a debt crisis are the following:

Austerity/default (not feasible)

Outgrow the debt (near impossible)

Financial repression (being attempted)

The Fed is stuck between a rock and a hard place. Total debt/GDP is 383%, the stock market is currently 233% of GDP and real yields are negative nearly across the board (meaning: the price of money is negative).

If rates are raised, debt servicing costs explode and the present value of assets fall, creating a cascading effect of debt liquidations and plummeting asset prices.

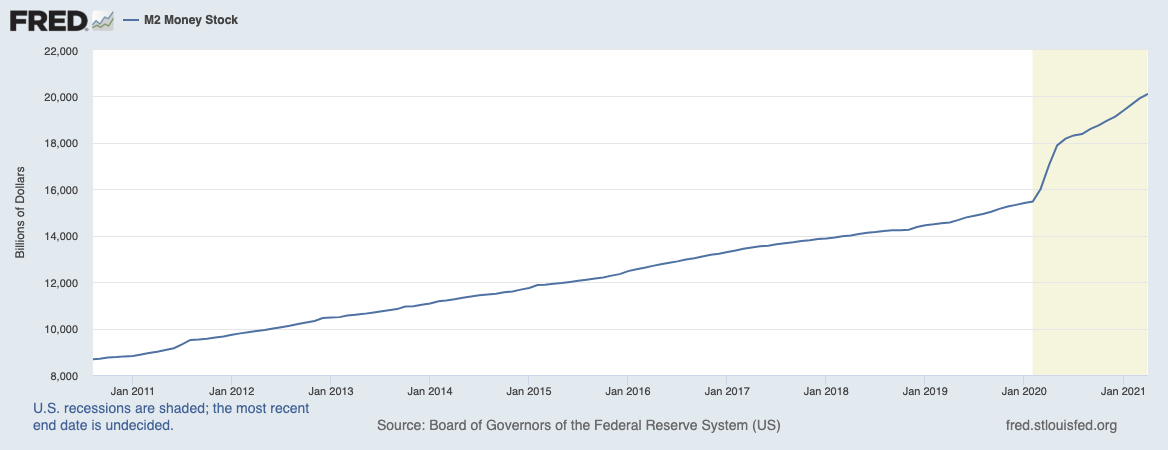

In a fiat monetary system, where dollars are created through credit expansion and destroyed through repayment or default, during a credit contraction with debt/GDP at 383%, there is so much leverage in the system that everything collapses all the way down.

This is the central banking dilemma:

Either a) crash the markets and send the global economy into the biggest depression the world has ever witnessed or b) keep the music playing as markets continue to get drunk on the reality of artificially easy credit.

Jerome Powell has to go on stage and act like the Fed has a hand to play, when the reality is they have no choice. The talks of tapering asset purchases and easy credit is pure fantasy, and while it very well may be attempted in the future, global credit and equity markets would collapse and the Fed would be right there like always to prop everything up.

The purpose of this Daily Dive is not to simply harp on the Fed’s actions or any actor in the system, by no means.

The purpose is to articulate why there is no alternative to Bitcoin.

It is extremely important to understand:

Bitcoin isn't a hedge against CPI "inflation" but rather a monetary safe haven against perpetual credit expansion, eventual credit contraction and the counterparty risk that comes with a deflationary bust.

That’s how the entire fiat regime comes to an end, with an inevitable credit contraction and bond market collapse and with the central banks monetizing nearly all global debt.

This isn’t opinion, but mathematics.

There is no alternative to bitcoin because there is no other vehicle or asset to park value in over the long term that provides the assurances provided by the Bitcoin network.

With bitcoin, your value is immutably secured with the world’s strongest and most decentralized computing network and with the assurances of a perfectly inelastic supply issuance and absolute scarcity.

With fiat, you are stuck watching central bankers virtue signal about how much money they will or won’t print next year.