The Daily Dive #004 - Tudor Jones Re-Emphasizes Bitcoin Endorsement

Weekend Recap

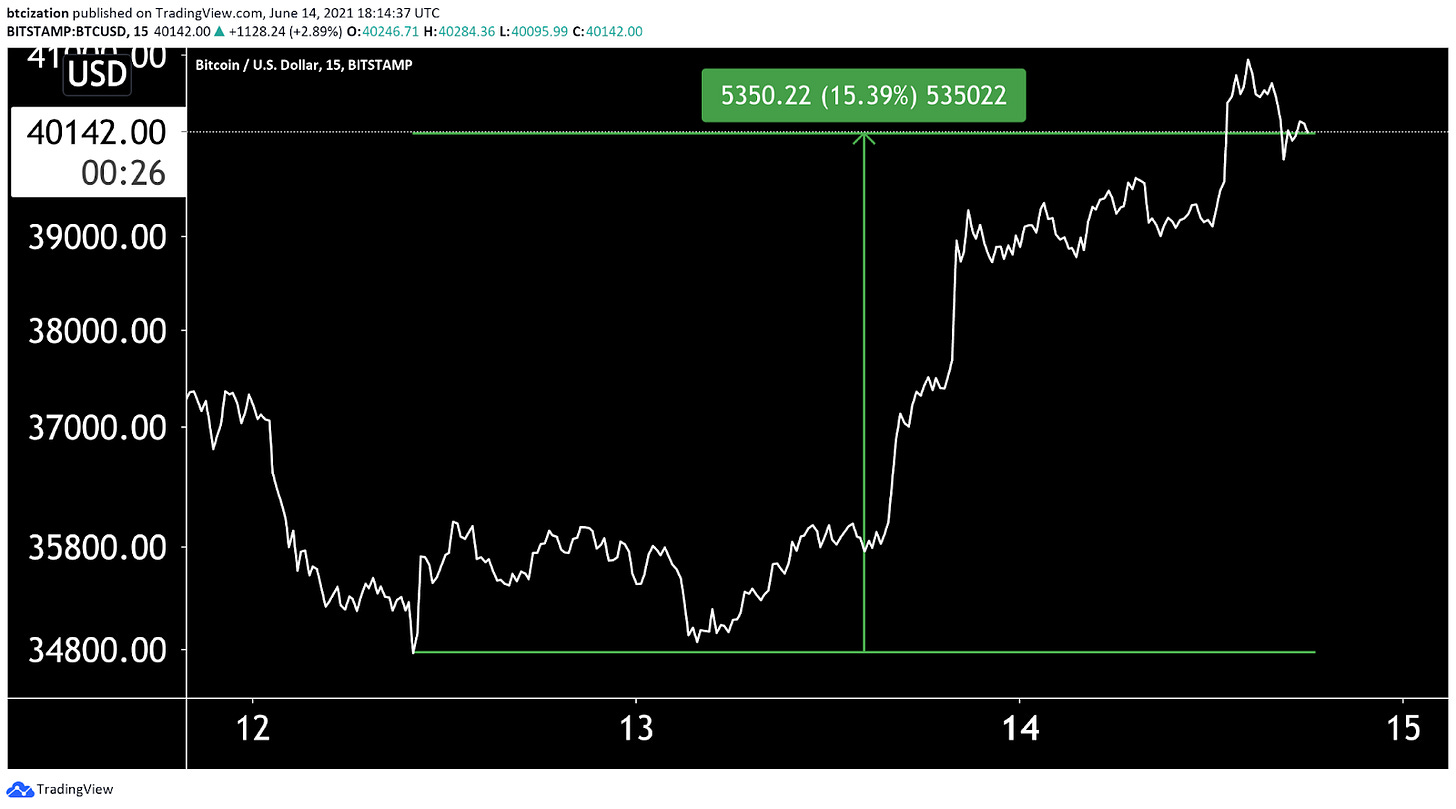

The price of bitcoin has popped more than 15% off its weekend lows, a promising sign for bulls as the rally looked to be spot driven, as open interest in derivative markets and funding on perpetual swaps stayed stagnant for the weekend.

Bitcoin traded from $35k to $39k on Sunday with funding for perpetual futures contracts staying negative, a sign of a spot led rally.

Open interest across all bitcoin futures platforms have seen a decrease from the $31k bottom six days ago, a promising sign for a sustained rally past 40k in the coming days/weeks.

MicroStrategy Begins $500 million BTC Accumulation

After a week of anticipation, it was confirmed that Michael Saylor and MicroStrategy officially secured $500 million of capital from a debt raise last week, with the proceeds going directly towards more bitcoin as per the company’s treasury reserve policy.

It will be interesting to see the average purchase price for MicroStrategy's latest bitcoin haul in a week or two.

Legendary Trader Paul Tudor Jones Doubles Down on BTC bet

“At the end of the day, the best profit-maximizing strategy is to own the fastest horse. Just own the best performer and not get wed to an intellectual side that might leave you weeping in the performance dust because you thought you were smarter than the market. If I am forced to forecast, my bet is it will be Bitcoin… [Bitcoin is] the quintessence of scarcity premium. It is literally the only large tradeable asset in the world that has a known fixed maximum supply.” - Paul Tudor Jones, The Great Monetary Inflation

The biggest news event this Monday morning was Paul Tudor Jones making an appearance on CNBC to discuss current market conditions. The legendary macro trader/investor discussed actions taken by the Federal Reserve, inflation, and notably his increased confidence and allocation to bitcoin.

In May of 2020, shortly before the bitcoin halving, PTJ published a report titled The Great Monetary Inflation where he outlined the unprecedented monetary expansion that was taking place across the world, and compared a variety of asset classes that he viewed as ideal for “seeking refuge” against inflation.

The inflation hedge assets/trades that were proposed were:

“Gold, long 2-year notes and short 30-year bonds, NASDAQ, Bitcoin US cyclicals (long)/US defensive (short), AUDJPY, TIPS (Treasury Inflation-Protected Securities, GSCI (Goldman Sachs Commodity Index), and the JPM Emerging Market Currency Index.”

Tudor Jones went into depth on his stance for why Bitcoin was an ideal hedge against the record debt monetization. The price of Bitcoin at the time of the report being published was under $9k, and since has increased in value by 300%+, with plenty of volatility along the way.

Tudor Jones’ re-endorsement this morning was significant, with a notably bullish stance on bitcoin, stating,

"The only thing that I know for certain is I want to have 5% in gold, 5% in bitcoin, 5% in cash, 5% in commodities."

Investors/traders closely follow what the likes of someone like Paul Tudor Jones has to say, and more importantly, how their portfolio is positioned.

To further support PTJ’s support for a 5% BTC allocation, here are three different portfolios:

Portfolio #1: 60% Equities, 40% Bonds - 5-year CAGR: 9.82%

Portfolio #2: Dalio All Season, 30% equities, 55% bonds, 7.5% commodities, 7.5% gold - 5-year CAGR: 7.58%

Portfolio #3: 60% Equity, 35% Bonds, 5% BTC - 5-year CAGR: 16.99%

The math doesn't lie: bitcoin in a portfolio not only improves performance but the asset’s uncorrelated performance to traditional assets actually reduces risk in a portfolio, contrary to mainstream belief.

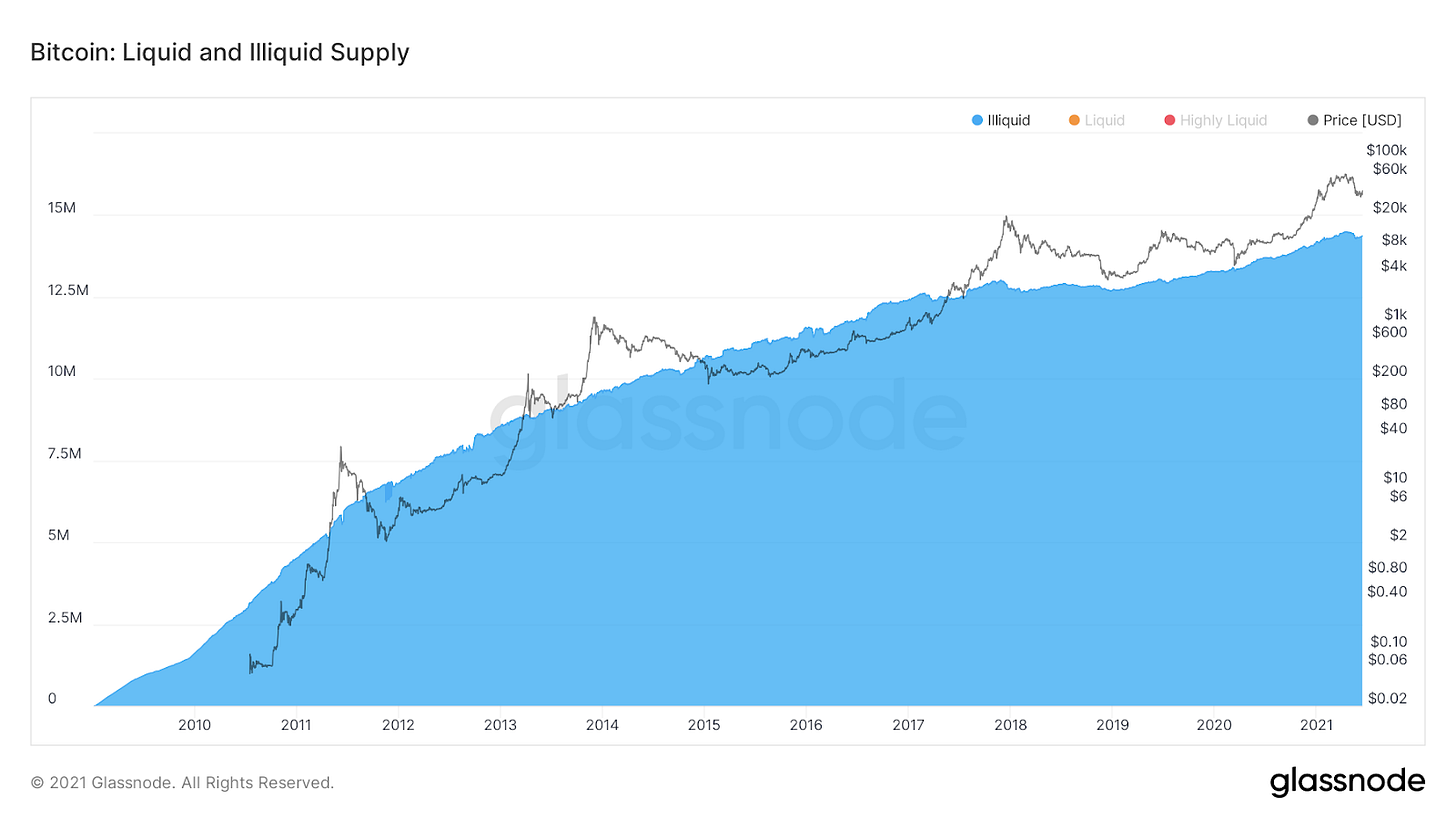

More asset allocators will begin to take small bitcoin positions due this reality. Bitcoin will have to explode as a result, given the asset’s relatively minuscule macro liquidity compared to other asset classes, and the limited amount of bitcoin actually up for sale, with Glassnode data suggesting that 76.6% of the bitcoin supply is currently “illiquid” and not available to the market.