The Daily Dive #003 - Highest CPI Inflation Reading in 13 Years

There were some notable announcements in regards to the incumbent financial system that hold significance in regards to bitcoin.

Basel Committee Proposal

The Basel Committee for Banking Supervision, the global body for bank regulation standards, released a consultation early this morning that, if put into effect, would impose capital requirements for bitcoin.

Given the recent demand by commercial banks to get involved in the bitcoin and cryptocurrency space, the regulatory framework proposed by the Basel Committee is both a positive and a negative for bitcoin.

In a positive light, it gives much needed regulatory clarity to the banking sector that notably is among the most regulated and bureaucratic sectors in the economy. With regulatory clarity for commercial and investment banks, allocations into bitcoin can start to be made, not only on behalf of the banks clients but also on the balance sheets of the banks themselves.

The negative is that the regulatory proposal put forward by the Basel Committee is extremely onerous, with a risk weight of 1,250% for bitcoin, proposing that banks set aside enough capital to cover any bitcoin losses in full.

While a positive start for bitcoin (to be recognized as a legitimate asset class in the banking system), it will be challenging for banks to make any significant allocation while capital requirements and risk weightings remain elevated.

CPI Print

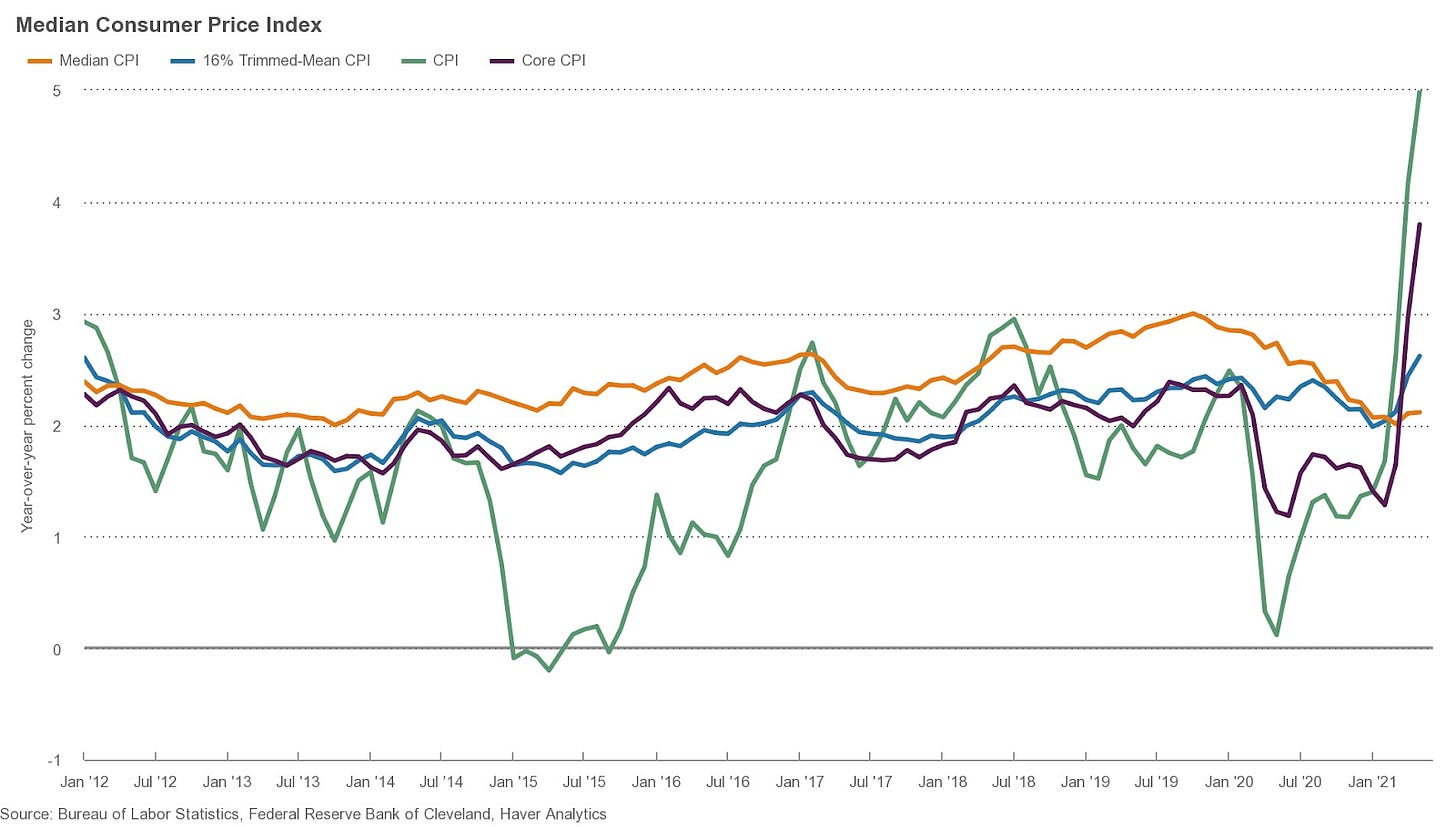

The data from the consumer price index was reported this morning, coming in at 5% year over year.

The CPI print, the highest reading in 13 years, was expected and a goal that the Federal Reserve had actually set out to achieve, when last August a notable policy shift was made towards average inflation targeting.

The Fed’s reasoning was that CPI inflation had lagged over the last decade, and that it would be healthy for inflation to rise meaningfully above 2% over the short/medium term to reach “2% average inflation”.

There are a few things that need to be addressed with this framing:

Inflation is a spectrum, and cannot be properly “indexed”, as no one has homogenous wants, needs, spending patterns, or geographical locations. Inflation is a vector.

Using the consumer price index as a measure of inflation is disingenuous at best, and deceitful at worst. Inflation has not showed up in the CPI index for a decade, but where has inflation shown up? Asset prices.

Why? Quantitative Easing and monetary expansion on a global scale coupled with zero interest rate policy, juicing the present value of every asset on the planet, as bond yields were artificially bid as a result of central bank intervention.

But remember, “there is no inflation”.

Real Yields

So what does this mean for capital markets? In short: The largest fixed income bubble of all time.

Real yields on the 10-year treasury bond after today’s CPI reading are coming in at -3.40%, meaning that the “risk free rate” that the entire global economic foundation is built upon, is negative.

The entire global economy is built on the implicit assumption that the cost of capital is negative. That is reality.

What does that mean bond investors globally, with their ~$300 trillion of fixed income assets?

You will (probably) be repaid in nominal terms, but in the process your purchasing power will be wiped out. As Greg Foss would say, “it is just math.”

Global debt to GDP is around 400%. Using a rough estimate that the average bond coupon (read: interest rate) is 3%, that means that global GDP must grow at 12% just to keep up with the organic growth of the debt load.

That is not feasible. So what has to happen?

Debt loads must be eroded away in real terms, meaning that while nominal interest rates will remain positive, but in real terms, after being adjusted for inflation, bonds are a contract that is guaranteed to lose you money.

This is the playbook currently being run by global central banks at the moment. Given that the global financial system is built upon fiat currencies with no peg, a default is not possible.

Whereas in the past with a peg to gold, the peg could be broken or devalued, this time the currency is pure fiat, entirely built upon credit creation, meaning that a credit contraction is not able to take place without a systemic collapse.

TLDR: Print Print Print!!

On-Chain Update

Long-Term Holders Feverishly Accumulating

Taking a look at the long-term holder net position change, it is clear that bitcoin holders with a long term time horizon and constructed thesis are taking advantage of the price pullback, on their way to acquiring a net +376,517 bitcoin over the previous 30-day period.

To put it simply, stack sats, or someone else will. During sharp corrections, as short term speculators and un-convicted new entrants will sometimes stop buying altogether, and even more costly, will sell at a loss.

OTC Desk Outflows Spike

An interesting development occurring over the past few days is the spike in transfer volume from OTC desks following the passage of the bitcoin bill in El Salvador to officially make bitcoin legal tender in the nation.

The OTC desk outflows are a solid indicator of institutional interest in the asset, and the steep pickup of outflows from OTC desks shows that the event was viewed in a positive light by institutional allocators, echoing the signal given by the price action following the news.

Make sure to catch our weekly report being released tomorrow for a recap of the previous 7-days.