The Bitcoin Market Surge: Unraveling the Mystery of 'Mr. 100' and Sovereign Buyers

A Deep Dive into Record-Breaking ETF Volumes, Mysterious Large-Scale Purchases, and the Pre-Recession Trade Dynamics

In today’s post, I pull on a few strings from around the bitcoin industry. I start with updating volumes and inflows for the ETFs, then move onto the mysterious “Mr. 100”, a buyer snapping up bitcoin in 100-btc chunks. Lastly, I’ll finish up with a quick macro update. Let’s get started.

Bitcoin Products Everywhere Hit Record Volume

Bitcoin product volumes are off the charts. The total trading volume during yesterday’s market melt-up was $7.69 billion, nearly doubling the record from launch day of $4.66 billion. Grayscale’s GBTC volume was lower, while the New 9 were much higher. Blackrock’s IBIT alone had $3.35 billion in volume.

Source: @JSeyff

Net inflows for the ETFs also continue to increase. The net flows (orange line below) ended the day yesterday with $673M, breaking the launch day record of $655M.

Bitcoin Futures ETFs and leveraged ETFs joined the party as well. Proshares Bitcoin Strategy ETF (BITO) had its second highest daily volume of $72M, only behind the spot launch day. The 2x Leveraged ETF (BITX) nearly doubled their record volume from launch day.

It is not just a US phenomenon either. Yesterday, the Canadian spot bitcoin ETFs (BTCC and EBIT) both had the highest volumes in 18 months. Same thing for Bitcoin Tracker Euro (XBT) in Sweden, it saw the highest daily volume since June of 2021. Hong Kong’s CSOP Bitcoin Futures ETF (3068.HK) has seen daily average volume triple.

Source: Reuters

We know the ETF demand is off the charts, but is there another source of demand building under the surface?

Mr. 100 and Mr. Snowden

The account @HODL15Captial on Twitter has been following a mysterious buyer they’ve nicknamed, “Mr. 100.” You can follow the address here yourself. The address has been active since November 2022, right before the FTX collapse. Its first big purchase was 10,000 btc at $20k on 4 Nov 2022. FTX collapsed four days later on 8 Nov 2022.

This address is making consistent buys of 100 BTC in early hours New York time. HODL15Capital speculates it is an Asian or Middle East entity due to the timings of their buys. The first buys occur each date roughly around midnight New York time and continuing until around 9 am ET, when they become more sporadic. This doesn’t match well with Japan or South Korea because midnight ET would be 2 pm in Seoul. However, it does match quite well with the Middle East. Midnight in New York is 8 am in Doha, and 9 am in Dubai.

Source: @HODL15Capital

There are already several governments buying and mining bitcoin. Of course, we know El Salvador, but also the Kingdom of Bhutan is mining bitcoin. Ethiopia, UAE, Saudi Arabia and North Korea are all mining or setting up mining facilities in their countries. During the ETF approval process and associated hype, there were rumors of the Qatar sovereign wealth fund deciding to get involved in size. Bitcoin legend and billionaire Max Keiser, back in December 2023, tweeted he had one word for you, “Qatar. Rumors are getting very loud on this. Their SWF rumored to be looking to buy [$0.5] trillion.”

Another interesting wrinkle to this saga is that Blackrock CEO Larry Fink visited the Middle East in April 2023, meeting with the Qatari Finance Minister. He travels often to the region, but there is a chance that this visit sparked the rush for a Bitcoin ETF. By June 15, they have an application filed.

Something big is going on here. We have no corroboration from Snowden on what country he’s thinking of, or from Qatar that they are currently buying, but I think it is interesting that a big buyer that matches the Doha time zone has been buying like crazy, and that Larry Fink files an application for a Bitcoin ETF immediately after his visit. On top of that there are rumors swirling in the Bitcoin industry amongst highly connected individuals, like Max Keiser and BTC Inc. CEO David Bailey, that sovereign wealth funds are now involved. Lastly, the icing on the cake is Edward Snowden saying nation state involvement in bitcoin will “be revealed this year.” Not that they will start stacking this year, but it will be revealed that they have been stacking.

It is interesting that attention on this address coincided with a tweet from Edward Snowden saying he expects a major sovereign to reveal they are buying bitcoin this year. Feel free to speculate in the comments below!

Source: @Snowden

Beyond individual buyers and ETF trends, broader macroeconomic conditions also play a crucial role in the Bitcoin market dynamics.

Macro Update

Long-time readers will know that over the past 6 months, I’ve been discussing what I call the Pre-Recession Trade or Pre-Recession Environment. This period is characterized by deteriorating economic activity and a broad pivot to safer, more liquid assets. People and businesses will tighten their belts, cease hiring or expanding and instead plow any extra capital into savings, retirement or paying down debt.

For months now, I’ve been calling for higher stocks, especially those which benefit from passive retirement inflows, sluggish commodities because global economic activity is slowing, rising bond prices/falling yields, and rising safe haven assets like bitcoin. This is important because most analysts equate rising stocks and bonds with a healthy economy, when in fact, it is a signal that things are deteriorating.

Let’s take a look at how things have gone over the last month or so since our last macro update. First up is the S&P 500. It has performed almost exactly as forecast. Many think a rising stock market like this precludes an impending recession, but it is the narrowing of the stock market rally, with most gains coming from a handful of stocks, like the Mag 7 that signals economic weakness.

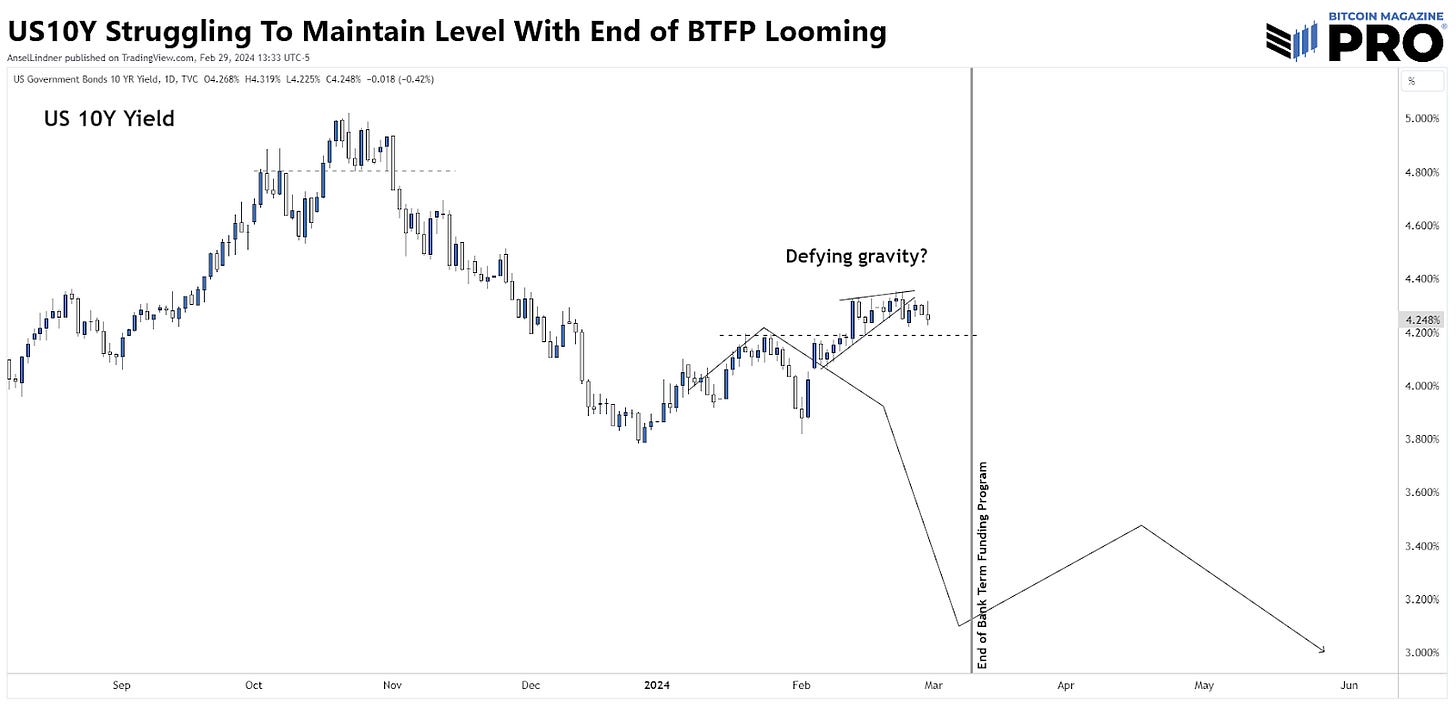

On the US 10Y yield, I left my arrow path on the chart for transparency. Yields have not fallen according to my forecast, but as we enter March and the Bank Term Funding Program (BTFP) wraps up on 11 March, there is a possibility that banks return to stressed status and yields will fall down to that forecast. Recent candles look weak and might break down out of this pattern soon. Remember, this is because entities are rotating into safe and liquid assets.

Oil is my commodity proxy. It is in everything and supply/demand characteristics for oil can tell us a lot about the underlying economy. As you can see on the chart, there has been general weakness in price over the last couple of years, despite 5 million barrels per day (MMB/D) of production cuts from OPEC+ and war in the Middle East. Oil is not in any danger of breaking to significantly higher levels. Recent candle patterns could lead to a temporary break higher soon.

Conclusion

Can the US avoid recession? It is looking increasingly unlikely. Japan, the UK and the EU are all in official recessions, and by my estimation China is, too. Being a globally connected economy and financial system, it is only a matter of time until contagion will come to the US. The pre-recession environment is intact which should benefit bitcoin in coming months as a safe haven and exciting new asset class. I expect more volatility around the end of Q1 in March corresponding with seasonal patterns and the end of the BTFP.

In light of the recent developments within the Bitcoin market, including unprecedented ETF volumes and enigmatic activity of "Mr. 100," investors should closely monitor these indicators for potential market movements. The unique buying patterns and the speculated involvement of sovereign wealth funds could signify a massive underlying shift in the market beyond simple spot ETF adoption. With macroeconomic signs pointing towards a pre-recession environment, characterized by a pivot towards more liquid and secure investments, individuals should evaluate their portfolios in light of these broader economic indicators.

All that said, stay humble and stack sats. Nothing goes up in a straight line and we shouldn’t be surprised with periods of consolidation or even correction during the coming bull market.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! If you enjoyed this article, please consider liking and sharing it. This will enable us to reach and inform a larger audience.

easy read

The US is irrelevant when it comes to crypto. Asia, and more specifically Hong Kong will lead the way. The US is run by little people with miniature minds.