T-Mobile Parent Company Announces Mining Plan as US Stocks Bounce

US-based mining stocks hit new all-time high as industry recovers from halving. Telecommunications giant Deutsche Telekom plans to begin mining itself.

The Bitcoin mining industry has seen several big boons with record stock prices for US-based miners, and T-Mobile owner Deutsche Telekom has announced plans to enter the industry.

Since the most recent halving in April, the Bitcoin mining industry has faced a variety of new challenges. Various firms in the business had ample warning and opportunity to prepare themselves for mining rewards to get cut in half overnight, but there is only so much preventative effort to be done when the core function of a company is impacted so suddenly. In the immediate aftermath of the halving, prices underwent a slow and steady decline over several weeks, and all the leading companies began working on various ways to revolutionize the business. Measures like this include acquisitions and reorganization in general, upgrading equipment, alternate revenue streams, and several others.

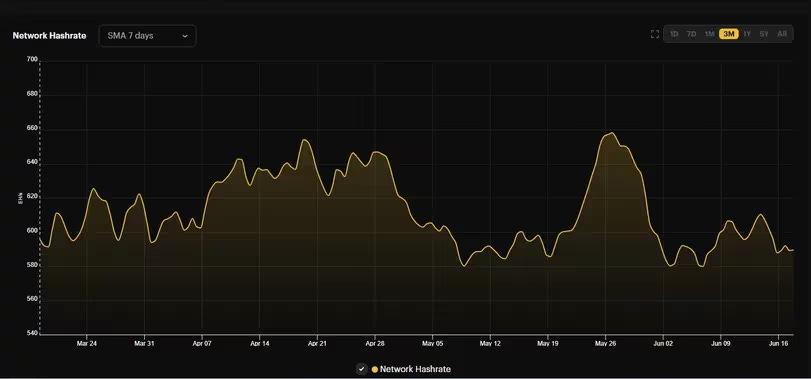

It’s no wonder that alternate revenue streams in particular were such a hot issue among leading mining firms, as data revealed that mining revenues dropped by a whopping 46.14% in May compared to April. Decreased profits were directly linked to a declining hash rate over the same period, with a brief spike in network capacity immediately followed by another huge drop. On top of the profitability concerns created by the halving, contributing factors have also emerged from sources totally unrelated to Bitcoin’s blockchain activity or any of its price actions. Specifically, it has been observed in past years that the US mining sector usually faces a hash rate dip during summer heat waves, as issues like equipment overheating pale in comparison to the increased electricity prices from residential and business consumption.

These economic conditions led Charles Edwards, founder of Capriole Investments, to declare in early June that the industry as a whole had entered a phase of miner capitulation. As Edwards explained, miner capitulations “sync with the shuttering of miner operations, bankruptcies, and takeovers... Bitcoin halving means that old, inefficient mining hardware becomes obsolete and no longer profitable to run. These mining rigs will typically then be phased out over several weeks following the halving, resulting in falling hash rates''. He did describe these market conditions as an overall positive sign for Bitcoin’s recovery, but optimistic conclusions did not immediately materialize.

Despite some of the worrying implications of this lowered activity and profitability, there have indeed been a series of silver linings for the industry, and some of these are finally starting to materialize. For one, the seasonal decline in all US-based firms, big or small, has reduced the large firms’ ability to corner the market. In an environment where new hardware innovations are rolling out at an impressive rate, this depressed period is giving smaller miners the chance to remain operational. By mid-June, it was confirmed from on-chain data that mining difficulty had finally dropped. The drop in difficulty is also an integral part of the halving cycle, as the industry reaches a new phase when remaining participants end up with larger percentages of an overall smaller pie.

These factors were directly acknowledged in a report from JPMorgan on June 17th, where the bank stated that the aggregate market cap of 14 leading miner stocks hit an all-time record of $22.8 billion. While “inefficient private operators scaled back operations post-halving," as the report claimed, the hash rate from these 14 industry leaders “accounted for ~23.8% of the global network hashrate," an increase of 1% from the previous month. Collectively, these leading stocks outperformed Bitcoin in the observed period, and the US share of the global hash rate had increased for two consecutive months. In other words, as far as the US market is concerned, there has been nothing but good news after a particularly tumultuous period.

Just because the US market has seen its leading firms take over more of the global share, however, it does not follow that other regional markets have not also seen gains. In a bombshell announcement on June 15th, the German-based Deutsche Telekom declared its intentions to begin mining Bitcoin itself. A telecommunications giant with nearly $300 million in total assets, Deutsche Telekom is most recognized in the US for being T-Mobile’s parent company. Although the firm has already been embracing Bitcoin on a small scale, running Bitcoin nodes since 2023 as well as Lightning Nodes, their announcement at a Prague-based Bitcoin conference to “engage in ‘digital monetary photosynthesis’” brings Deutsche Telekom’s commitment to a whole new level.

In essence, the intention to begin mining signals that this industry giant considers Bitcoin to be fully part of the new Internet. The employee who made this speech was Dirk Röder, Deutsche Telekom’s Head of Web3 Infrastructure and Solutions, and some of his department’s previous initiatives put the Bitcoin decision in proper context. Specifically, in the effort to keep this telecommunications company at the cutting edge of Internet development, it’s been a Polygon validator for a year now and has been partnered with a decentralized AI company since February. In other words, the company has a documented history of keeping on top of growing trends for some time. The firm has even gone so far as to experiment with running nodes in a handful of other cryptoassets, but none seem to have as much attention as Bitcoin. For Deutsche Telekom to take this next step, then, it shows that Bitcoin has jumped up once again in their estimation.

Since the approval of the Bitcoin ETF in early 2024, the community has been no stranger to increasingly gigantic financial institutions making investments in Bitcoin. Indeed, even before that, firms like MicroStrategy also made strong commitments to Bitcoin with their own major purchases. Deutsche Telekom’s decision here is very different from those examples. Their direct investment is not in buying Bitcoin like it was a profitable stock, but actually in developing the physical infrastructure to take a piece of the action themselves. The company is not primarily a financier that hopes to subtly influence their bets to fruition; it’s engaged in inventing new technologies and actually rolling them out. T-Mobile is one of the largest cell phone carriers in the US, and it has exclusive rights to thousands of cell towers. The company’s decision to back Bitcoin in this way is completely different from its previous corporate backers, and it should be celebrated by the whole community.

It’s difficult to say for sure that Bitcoin’s price is likely to keep rising just because this one industry is showing positive signs, but plenty of mining firms are certainly showing real signs of optimism. Just to name some examples, the firms Marathon, Riot Platforms, and CleanSpark announced plans to start a political lobbying nonprofit. Marathon has entered a new partnership to offer mining services marketed to individual miners, and Riot’s stock has risen after an attempted corporate merger. None of these are actions of a beleaguered and struggling industry, but of one that feels confident and future-looking. And as far as smaller miners are concerned, fees from Runes transactions are quickly turning into a new revenue source. The wave of miner capitulation after the halving has undoubtedly had lasting influences on the mining industry, but this includes positive changes as well. As far as the future is concerned, Bitcoin seems ready to climb higher.

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support!